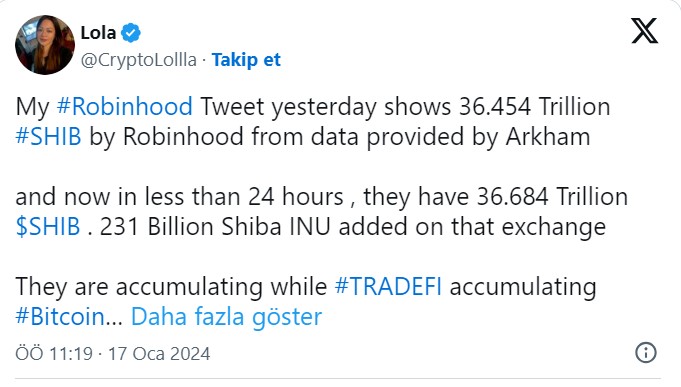

A prominent member of the Shiba Inu (SHIB) community recently highlighted that data from Arkham Intelligence indicates that the trading platform Robinhood (NASDAQ: HOOD) currently has 36.684 trillion SHIB tokens in its wallet.

SHIB Accumulation Process

The data obtained shows that the trading platform’s Shiba Inu wallet added another 231 billion tokens in a single day. It appears that investors on the platform are accumulating the meme-inspired cryptocurrency in their wallets. It may be useful to note that cryptocurrency exchange wallets do not represent the assets of the platform but rather the assets of its users.

Often, these large wallets can keep funds safe in storage while users trade on the platform. Cryptocurrency whales are accumulating the meme-inspired cryptocurrency. Shortly after the community-focused cryptocurrency project’s burn rate increased by more than 28,600%, resulting in the burning of 9.35 billion tokens, a whale sent a massive amount of 136.8 billion tokens to a newly created wallet earlier this week.

According to Lookonchain data, including a whale that accumulated 1.44 trillion tokens in just three days, a total of four whales accumulated 2.39 trillion tokens from cryptocurrency exchanges over the past month. Among those accumulating SHIB per service, TRON founder Justin Sun, who added 577 billion tokens to his wallet, is also mentioned during a period when Shiba Inu’s team announced a partnership with domain name company D3 Global, allowing users to acquire SHIB domain names, increasing the writing rate.

SHIB Partnership Process

The partnership makes Shiba Inu one of the first decentralized projects to pursue a top-level domain name through the Internet Corporation for Assigned Names and Numbers (ICANN) by partnering with D3. Last month, a surprising 8.6 billion SHIB tokens were sent to be permanently deleted within SHIB, causing a stir over the tokens.

This represented a significant increase of 160,598% over the previous day’s burn rate. The Shiba Inu community is burning tokens by moving them to addresses no one controls, removing them from circulation and effectively reducing the current market supply. Theoretically, if met with stronger demand, the price could rise.