Bitcoin ETF products have managed to surpass the trading volume of silver-based ETF products in the US within just a week. While significant statements from well-known figures in the cryptocurrency markets have been made on the subject, how this process will affect the price of Bitcoin in the future continues to be a matter of curiosity.

Notable Development in Bitcoin ETFs

Bitfinex Head of Derivatives Jag Kooner stated that the previously suppressed demand for Bitcoin is now emerging, attracting the attention of many investors in the US:

“Bitcoin ETF products have surpassed the size of silver ETF products in the US due to the significant market interest they have received.”

According to CC15Capital, silver was previously the second leading single commodity ETF in the US in terms of AUM. However, including the transformation of Grayscale’s GBTC service, spot Bitcoin ETF funds currently hold approximately 647,651 Bitcoin, which corresponds to an AUM of $27.5 billion. According to data from the blockchain data analysis platform Coinglass, Grayscale Bitcoin Trust ETF (GBTC) currently holds about 619,000 Bitcoin.

Interest in ETFs Expected to Continue

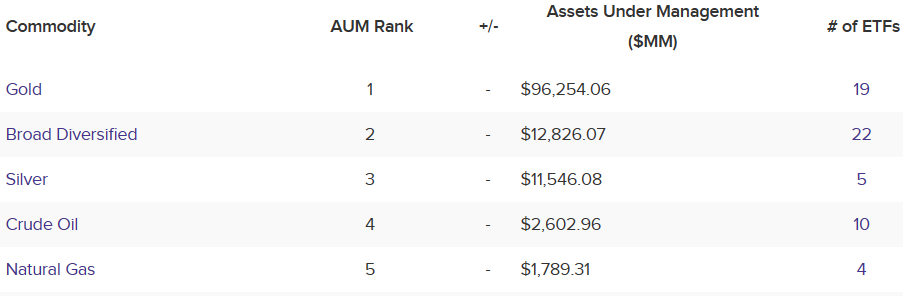

According to ETF Database, silver is in third place within the single commodity ETF asset class in terms of AUM, spread across five ETF products with approximately $11.5 billion. In contrast, US funds holding gold have a total AUM of $96.3 billion across 19 ETF products. Jag Kooner commented on the matter:

“The conversion of Grayscale’s existing GBTC product into an ETF overnight created the world’s largest Bitcoin ETF product. The transaction level reflects the suppressed demand for these products and is expected to lead to increased liquidity and stability in the market.”

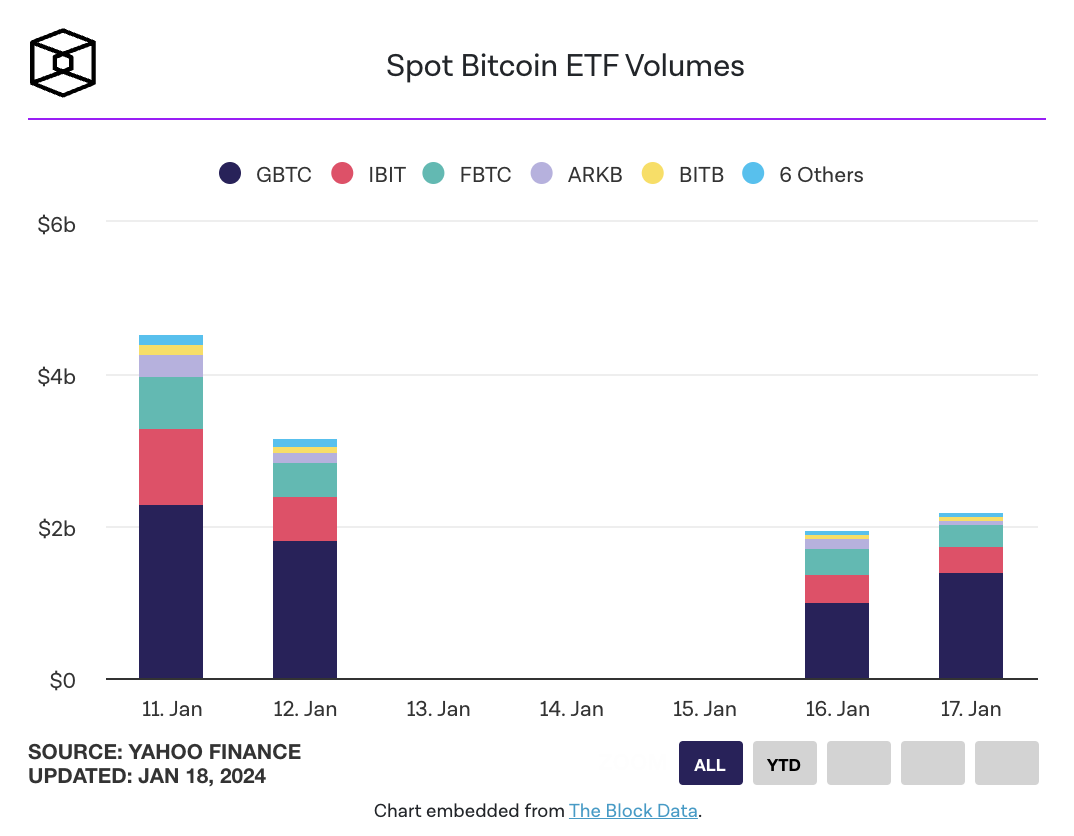

According to data provided by Yahoo Finance regarding spot Bitcoin ETF products, the cumulative trading volume for 11 funds exceeded $12 billion on January 18, which was the fifth day the new assets were traded. Kooner expects this strong interest to continue;

“ETF issuers have implemented competitive fee structures that include various discounted fees and fee waivers that could attract more investors and lead to more competitive pricing among ETF providers. While some in the investment community still see cryptocurrencies as risky, the growth of these ETFs could pave the way for more innovative crypto ETFs and new assets like Ethereum.”

Türkçe

Türkçe Español

Español