The market value of the largest cryptocurrency, Bitcoin (BTC), has fallen below the $41,000 level in the early hours today, influenced by recent strong selling pressure. This situation is particularly a result of significant outflows following the conversion of Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF.

Bitcoin’s Price Could Drop to $34,000

Prominent cryptocurrency analyst Ali Martinez has pointed out that Bitcoin’s price has been moving within a parallel channel. According to Martinez, Bitcoin’s price has turned downward after failing to surpass the $48,000 level, which corresponds to the upper boundary of the channel.

The analyst predicts a pullback for Bitcoin, foreseeing a drop to the $34,000 level, which is the lower boundary of the parallel channel. Martinez anticipates that after this decline, Bitcoin will revisit the upper boundary set at $57,000 and recover. This observation provides valuable insights into Bitcoin’s potential price trajectory and offers a strong context for the established parallel channel’s key support and resistance levels.

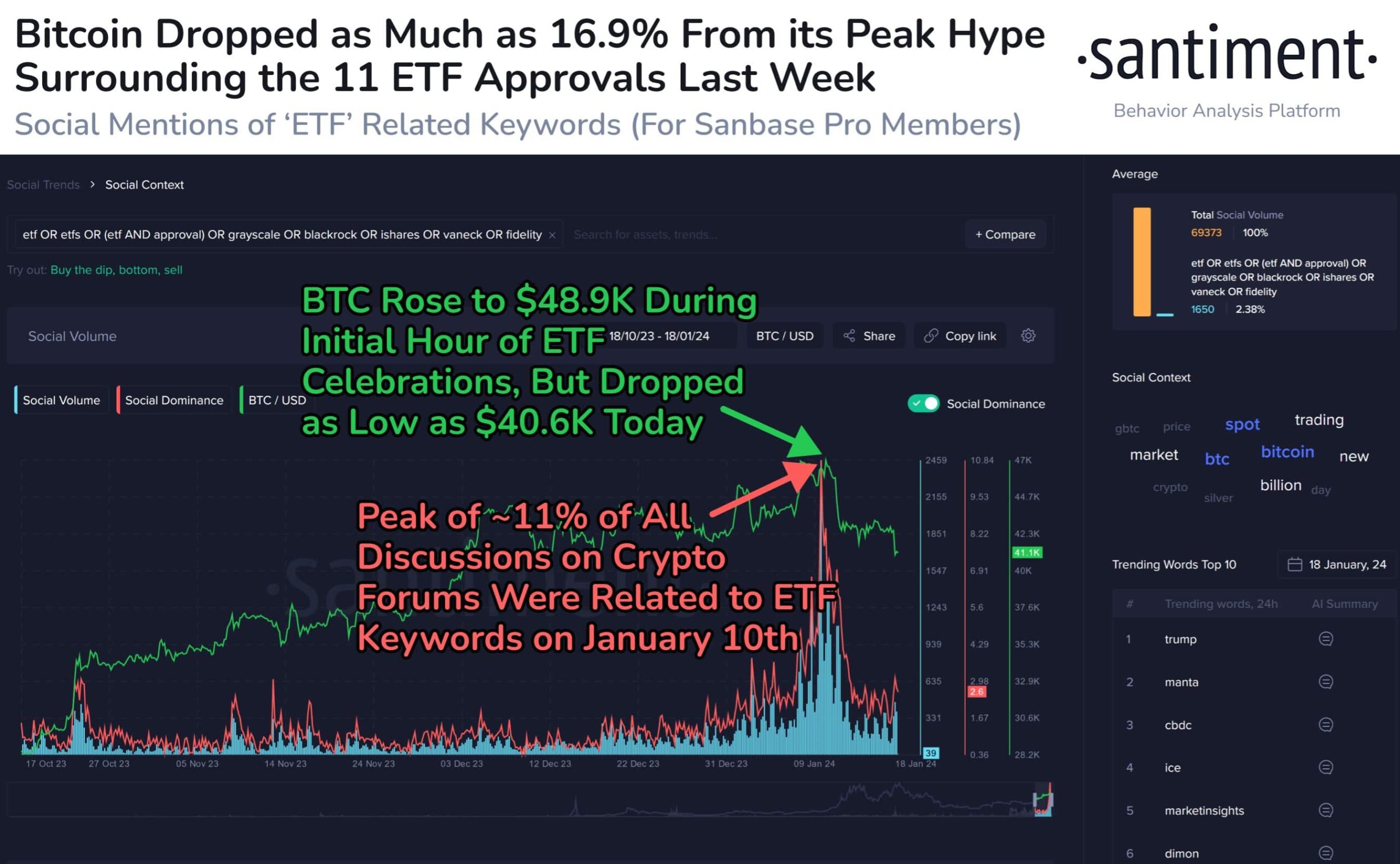

On-chain data provider Santiment reports that investors continue to maintain their optimism about the long-term implications of the approval of the first 11 spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) on January 10th. However, Santiment also highlights that the FOMO surrounding the ETF approval could have contributed to the crypto market reaching its peak, suggesting a notable shift in investment sentiment could occur.

Experts argue that the much-anticipated spot ETF approval has already been priced in, and as a result, Bitcoin’s price has fallen. Following a 16.9% drop from its highest market value the previous week to $40,600, Santiment added that the positive narrative surrounding ETFs could change.

There is a keen interest in tracking the usage of words like “hype,” “scam,” or “disaster” to determine whether the crowd’s sentiment has turned negative following the approval of the ETFs. Santiment warns that FUD and novice investors could be the trigger for a strong sell-off if a downward trend emerges after the “hype” that caused the price increase from October to December 2023.

Bitcoin Expected to Experience Months of Stagnation

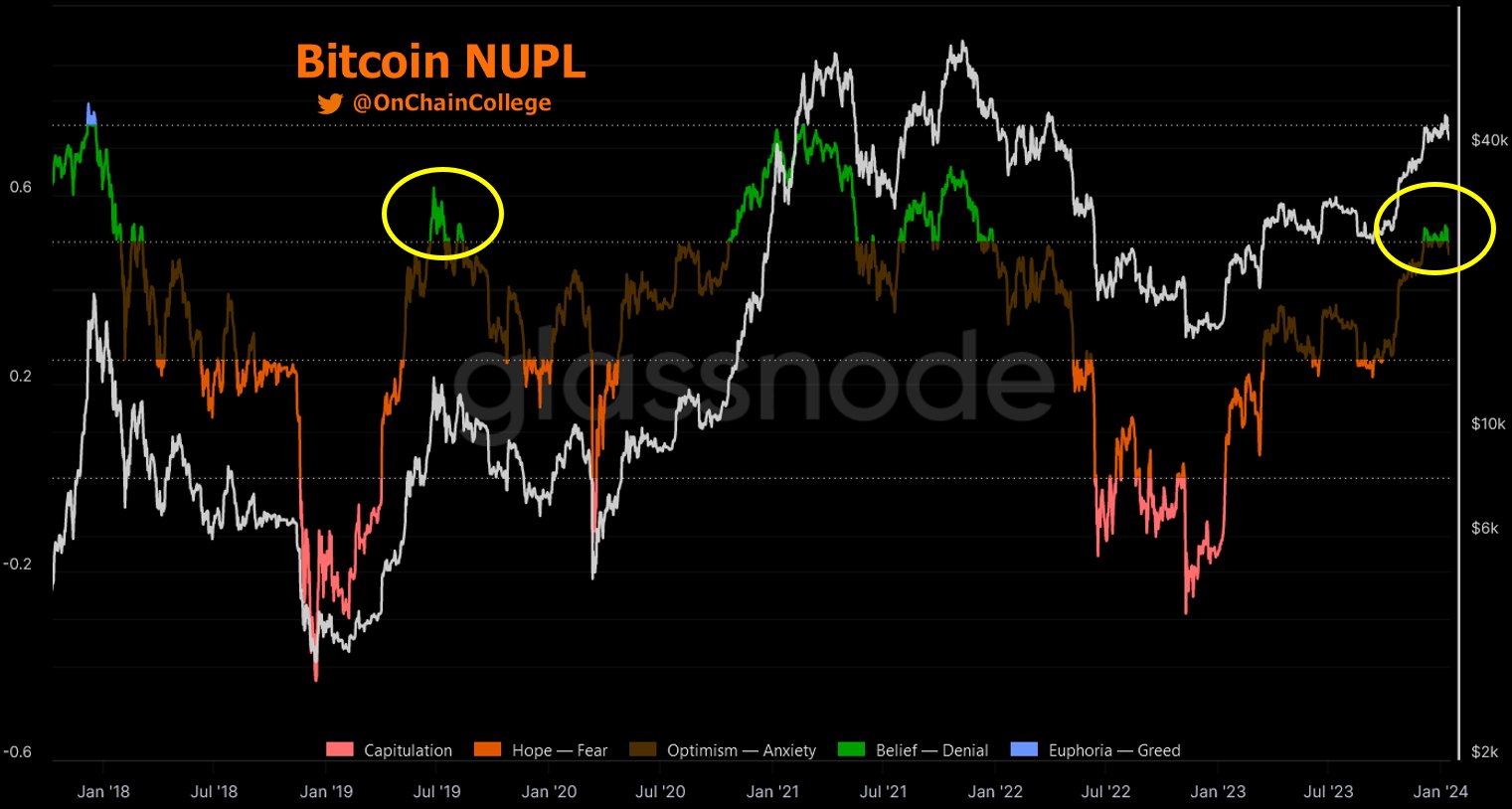

Meanwhile, on-chain data provider College has suggested in a recent analysis that Bitcoin’s price could undergo a significant correction or stagnation lasting several months. According to College’s analysis, such a trend does not indicate a bear market but could pave the way for a strong bull run as the crypto market transitions to stronger hands.

Currently, attention in the market conditions is focused around Bitcoin’s short-term cost base near $37,800. Historically, this level has served as support during bull markets and resistance during bear markets, playing a significant role in shaping market dynamics.

Türkçe

Türkçe Español

Español