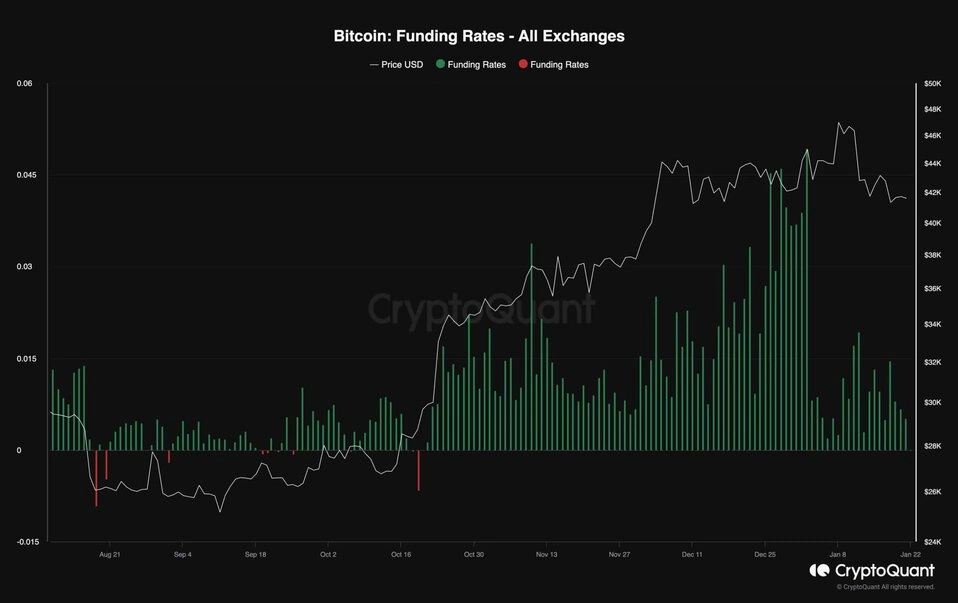

Bitcoin faced a significant rejection and a notable 17% drop in price despite positive developments like the approval of Bitcoin spot ETFs by the U.S. Securities and Exchange Commission.

Potential for a Bitcoin Rally

However, as the cryptocurrency approaches a critical support area, there is potential for a new upward movement. An examination of the daily chart shows that Bitcoin’s attempt to surpass the significant $48,000 resistance was rejected, leading to a 17% drop towards the critical support zone. This zone includes the mid-boundary of the rising channel and the important 200-day moving average at $39,000, serving as a strong support for Bitcoin buyers.

If the pullback continues, the cryptocurrency’s price is expected to find support around $39,000 and potentially trigger a new upward movement. Nevertheless, an unexpected break below the 200-day moving average could lead to a cascade, triggering a significant number of stop-loss orders and a prolonged squeeze event.

Bitcoin Price Analysis

In the 4-hour chart of the cryptocurrency, the rejection of the $48,000 resistance area continued, and a break below the lower boundary of the rising flag indicated the presence of sellers. However, after a strong break, a pullback towards the lower boundary of the flag is ongoing and could potentially complete a retracement.

In such a case, the pullback could pave the way for Bitcoin’s short-term downward movement to continue, targeting the $39,000 static support range. However, Bitcoin’s medium-term outlook could indicate consolidation within the critical price range bounded by the significant $48,000 resistance area and the decisive $39,000 support. Additionally, a successful exit from this region could shed light on the cryptocurrency’s next bullish trend. Consequently, there is a possibility that the price may continue its upward trend after completing the current correction phase.

Türkçe

Türkçe Español

Español