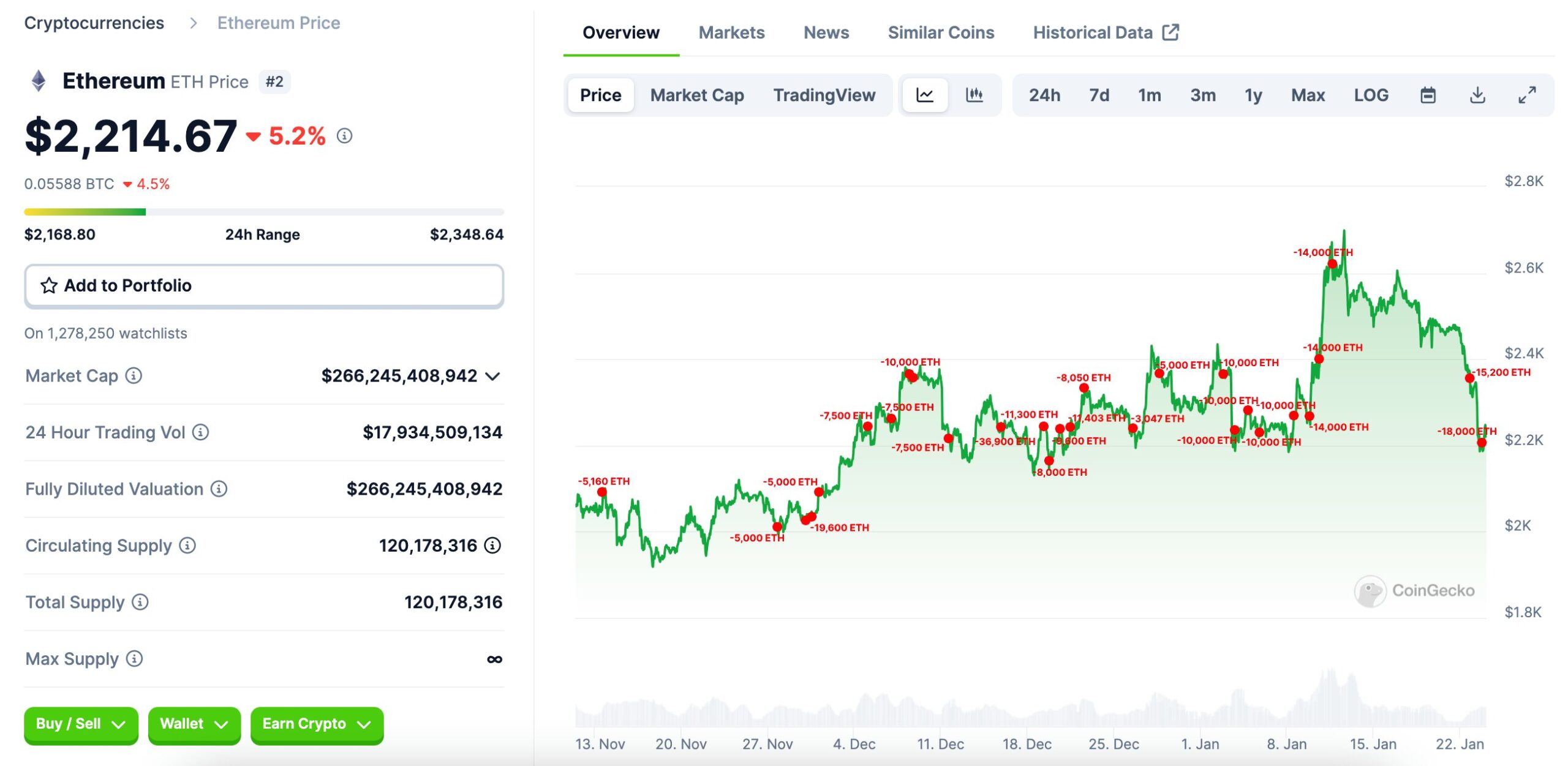

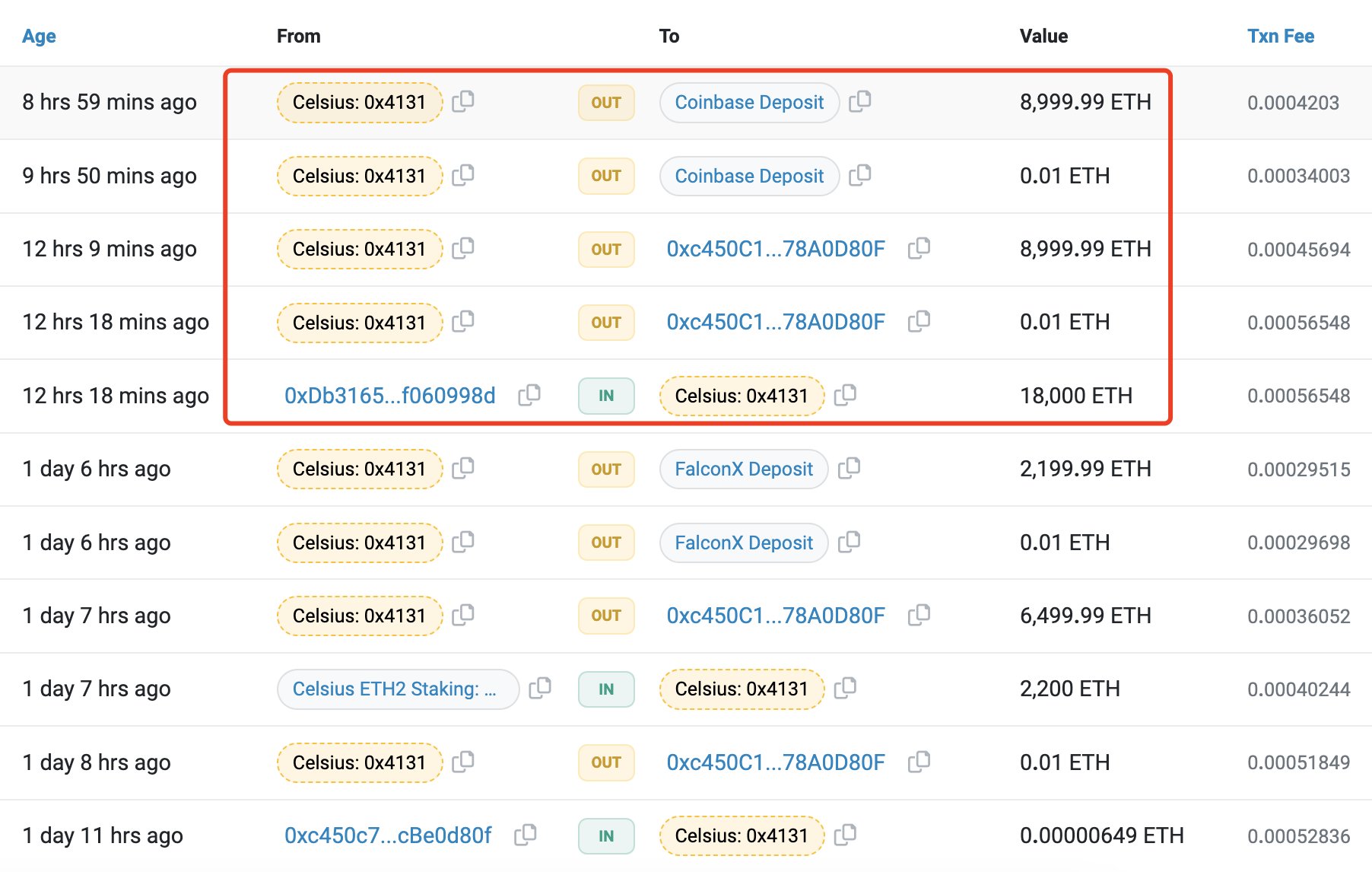

In a recent development, the Celsius wallet deposited 18,000 ETH worth $40 million into Coinbase, marking a notable transaction in the last 12 hours. This move follows a series of strategic investments by Celsius on various platforms, showcasing a calculated approach to managing Ethereum assets.

Strategic Deposits Across Platforms: Unpacking Celsius’s Tactics

Celsius has been in the news for transferring 280,760 ETH to platforms such as Coinbase, FalconX, and OKX since November 13, with the figure now exceeding $621 million.

The distribution of Ethereum assets across multiple platforms necessitates addressing the market position of Celsius as a bankrupt company. Accordingly, as part of the recovery plan, Celsius is making calculated moves to address creditor obligations and navigate the complexities of bankruptcy proceedings.

Current Ethereum Assets

As of the latest update, Celsius holds a significant Ethereum portfolio worth $1.2 billion, comprising 540,029 ETH. The consistent and strategic deposit transactions by Celsius align with broader trends observed in the cryptocurrency market, where institutional players strategically manage assets to effectively influence market dynamics.

The decision to deposit cryptocurrency Ethereum into leading platforms reflects Celsius’s commitment to optimizing liquidity, capitalizing on various trading opportunities, and potentially participating in yield-generating strategies available on these platforms.

Implications of These Moves for Investors

For investors and market enthusiasts, monitoring the movements of organizations like Celsius provides valuable insights into market dynamics and potential trends. Understanding how institutional players strategically utilize assets can inform investment decisions and shed light on emerging opportunities in the crypto space.

In conclusion, Celsius’s recent deposit of 18,000 ETH to Coinbase and cumulative strategic deposits across various platforms underscore a conscious and calculated approach to managing Ethereum assets.

With a significant Ethereum portfolio exceeding 540,000 ETH and valued at $1.2 billion, Celsius positions itself as a notable player in the crypto world despite bankruptcy. As the cryptocurrency market continues to evolve, the actions of institutional entities like Celsius provide valuable insights into strategic considerations affecting crypto asset management.

Türkçe

Türkçe Español

Español