Investors had envisioned a very different January, yet in the world of cryptocurrency, the unexpected often occurs. The king of cryptocurrencies is now struggling to maintain the $40,000 level after approaching the $50,000 threshold. However, it has not yet secured support in this region.

Is It Time to Buy Bitcoin (BTC)?

Although the price approached the key support level of $40,400, it failed to reclaim the region today, and BTC is once again looking towards lower levels. Outflows from Grayscale Bitcoin Trust (GBTC) were around 13,000 BTC throughout the day, making it difficult for the overall market sentiment to turn positive amidst this weakness.

While inflows into other ETFs might balance the situation, over $20 billion in Grayscale assets could create an irreparable hole this year. A significant portion of GBTC investors are angry with the company, and the annual management fee being the highest among all alternatives is fueling the exodus from GBTC.

Popular crypto trader Daan Crypto Trades believes that after some time, the situation will stabilize and the panic will subside.

“The good part is, this will eventually slow down and exhaust itself, but it will take a few more weeks for the majority to leave.”

Bloomberg Intelligence analyst James Seyffart wrote:

“Good news: GBTC outflows are on a downtrend. Bad news: Inflows into other ETFs have weakened. This leaves us with a TOTAL RULING NET FLOW of +$824 million. Also noteworthy is ARKB and BITB passing half a billion. For a normal launch in the first month, this is a record-breaking success.”

In summary, it might be sensible to watch whether this negativity will trigger a deeper bottom. A rise is expected once the panic subsides weeks later.

A Lifeline for Bitcoin

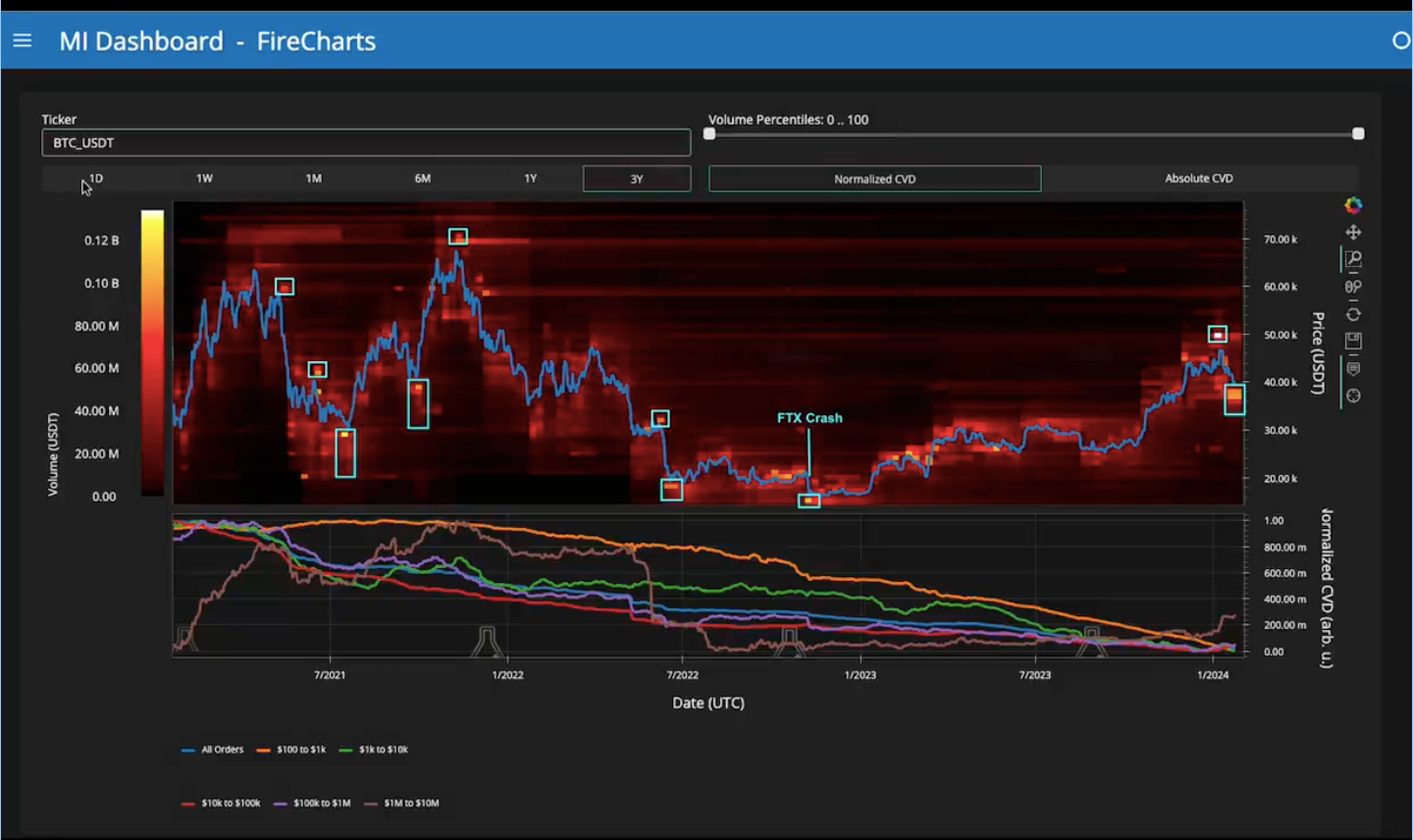

Material Indicators, which analyzes the state of the order book for Binance, the world’s largest cryptocurrency exchange by trading volume, pointed out a lifeline that could save the bulls from a deeper fall. Monitoring liquidity in exchange order books often opens the door to consistent predictions.

“When we have large liquidity blocks close to the price, the price tends to either reverse – and this works in both directions, the same with resistance – or consolidate here. However, we are looking at a significant bid liquidity block just below the price.”

Türkçe

Türkçe Español

Español