Spot Bitcoin ETF approval’s impact on investors was difficult to foresee, with each day bringing new excitement. The limit for GBTC sales is over 500,000 BTC, and this is the underlying cause of the fear. Fortunately, while other issuers continue to demand BTC in a balancing act, Coinbase is transferring these assets from one wallet to another.

Crypto Currency Predictions

After the SEC reluctantly and manipulatively approved the ETF, Bitcoin’s price dropped by about 20%. Of course, this decline was multiplied in a significant portion of altcoins. BTC approached $38,000 on January 23, thankfully buyers acted at the right moment. So, what is the expectation for cryptocurrencies? What factors could sustain optimism?

Slowing GBTC Sales

The “sell the news” event of the converted BTC drop was actually triggered by a single sale of $5 billion. Market sentiment did not anticipate this turning into a sell-the-news event. Looking at today, the large outflows from Grayscale Bitcoin Trust (GBTC) are weakening. People are selling their GBTC shares because it has escaped the negative premium, it is profitable, and there are alternatives with lower management fees, including Alameda’s $1 billion in assets.

Two consecutive days of fund outflows from GBTC could increase optimism with the slowdown of this trend. Tomorrow’s data will be decisive for the market.

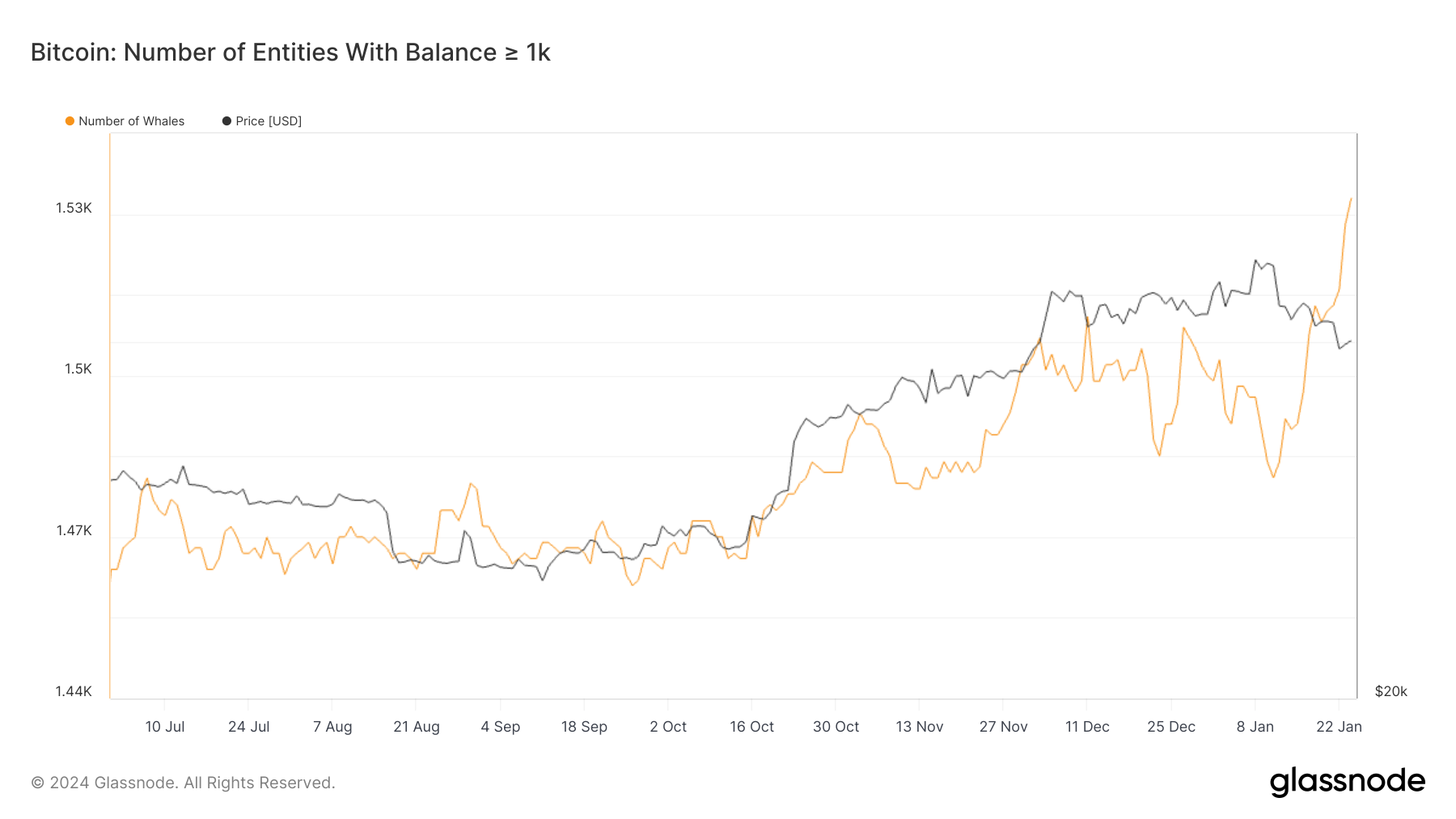

Whales Capitalize on the Downturn

The latest data compiled by Glassnode shows an interesting increase in activity among Bitcoin whales. The number of investors with over 1,000 BTC rose from 1,481 on January 11 to 1,533 on January 25, which is promising. This group continued to buy after the ETF approval, showing strong belief in a movement above $50,000.

From a technical standpoint, the RSI is moving away from the oversold region. This suggests that spot sales are easing and soon, with increasing demand, the price will start to rise. Buyers continue to hold their bids strong near $40,000. A few hours ago, we referred to the size of the demand block in the Binance order book as a “promising development.”

If BTC can sustain above $40,400, it may experience a rapid recovery up to $44,700. Perhaps this requires GBTC outflows to shrink significantly compared to other ETF entries? It’s hard to predict today’s price catalyst, but the upcoming PCE data, if below expectations, could be a good trigger.

Türkçe

Türkçe Español

Español