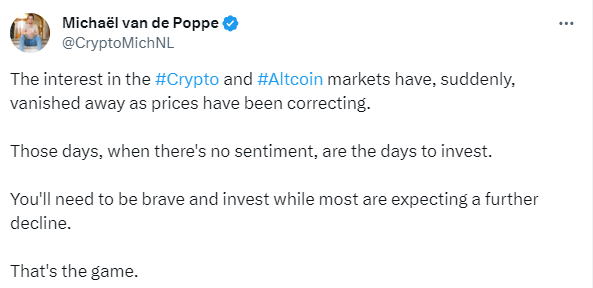

Bitcoin and altcoin markets are in a constantly evolving atmosphere, where experienced analyst Michael van de Poppe has shared his thoughts on the current shift in sentiment. According to the analyst, interest in these markets seems to have almost disappeared amidst corrective price movements. Van de Poppe claims that these moments, characterized by a lack of sentiment, can present unique opportunities for investors navigating uncertainties.

Embracing Investment Opportunities During Market Lulls

In times of reduced sentiment, Van de Poppe advocates for a strategic approach to investing. Contrary to the prevailing cautious atmosphere, he sees these moments as opportunities for those willing to evaluate them boldly. The absence of sentiment often comes with corrections and can create a window for knowledgeable investors to enter the market at potentially advantageous points.

Cryptocurrency space, known for its inherent volatility and sudden shifts in sentiment, prompts analyst Van de Poppe’s advice to encourage investors to be bold and consider investing even when the general market expects further declines. This contrarian approach can be expressed in accordance with an old investment rule: “Buy when there’s blood in the streets.” In other words, being bold when others are fearful can provide strategic advantages.

Strategies for Managing Uncertainties in Bitcoin and Cryptocurrencies

Van de Poppe’s views highlight the importance of flexibility and strategic decision-making against the complexity of the crypto markets. Market sentiment is temporary. However, opportunities in the cryptocurrency market can emerge for those who can look beyond momentary uncertainties. Being bold in the face of perceived declines requires understanding market dynamics and the ability to identify potential turning points.

While Michael van de Poppe notes that interest in crypto and altcoin markets suddenly vanishes during corrective phases, he calls on investors to embrace these challenges. Investing during such times requires strategic courage. The desire to counter prevailing emotions comes into play for potential gains. In the constantly fluctuating world of cryptocurrencies, these periods of uncertainty can be the most profitable opportunities for smart investors.

In conclusion, Michael van de Poppe’s perspective sheds light on the cyclical nature of the crypto markets and the potential benefits of a bold stance during market lulls. For those who can manage uncertainties with flexibility and strategic insight, these moments can represent more than a correction and could be turning points for profitable investments.

Türkçe

Türkçe Español

Español