Bitcoin price is once again above $41,000, and altcoins have gained over 5%. Following the ETF approval, BTC surpassed $49,000, but subsequent surprise sell-offs by billions of dollars prevented the price from climbing higher. This indicates that the increasing demand liquidity is seen as an opportunity by large investors. So, is it over?

Have GBTC Sales Ended?

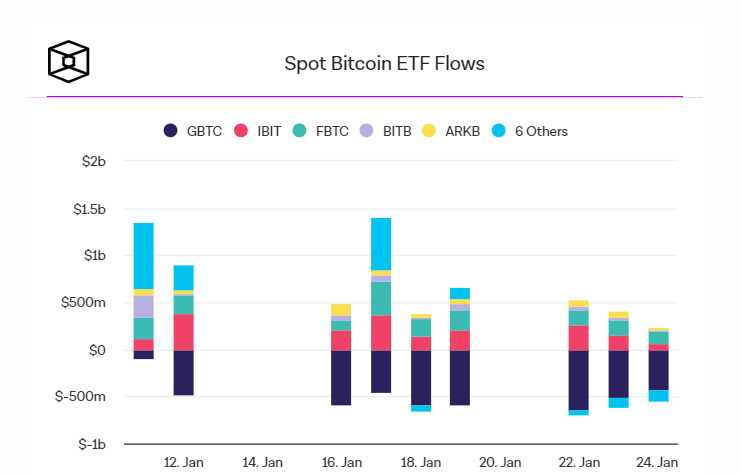

BitMEX Research data indicates a weakening in GBTC outflows. The expected outcome was indeed this: as soon as GBTC began trading at a neutral premium, significant sales were not surprising, and the initial sales were expected to be completed quickly. We are seeing this balance out over time. BitMEX data shows that there was a $394 million GBTC outflow yesterday, compared to $515 million on Tuesday.

With other ETF issuers continuing to attract demand, the balanced outflows are now on the verge of turning into bullish entries. Investors could drive prices even higher in the coming days by betting on this scenario.

BlackRock (IBIT), Fidelity (FBTC), Bitwise (BITB), Ark 21Shares (ARKB), Invesco (BTCO), VanEck (HODL), Valkyrie (BRRR), Franklin Templeton (EZBC), and WisdomTree (BTCW) have not yet experienced a net outflow day and their reserves have exceeded 113,000 BTC, making the positive scenario more dominant.

Since the first trading day, ETFs have seen an inflow of $5.53 billion while GBTC has hosted an outflow of $4.79 billion. This means there is still a positive outlook with a net inflow of nearly $744 million.

Will Cryptocurrencies Continue to Rise?

The recent rally has also unsettled dominant short positions in the futures market, with over $66 million in short positions liquidated. Last week, JPMorgan analysts predicted a market downturn if GBTC investors continued to take profits, but now see a rebalancing as an indication of a potential rise.

Chris Burniske reiterates his view that a new bottom between $30,000 and $36,000 could occur before a new ATH. Burniske continues to believe in the long-term trend’s strength but cautions about volatility. Macro risks form the basis of his concerns.

Türkçe

Türkçe Español

Español