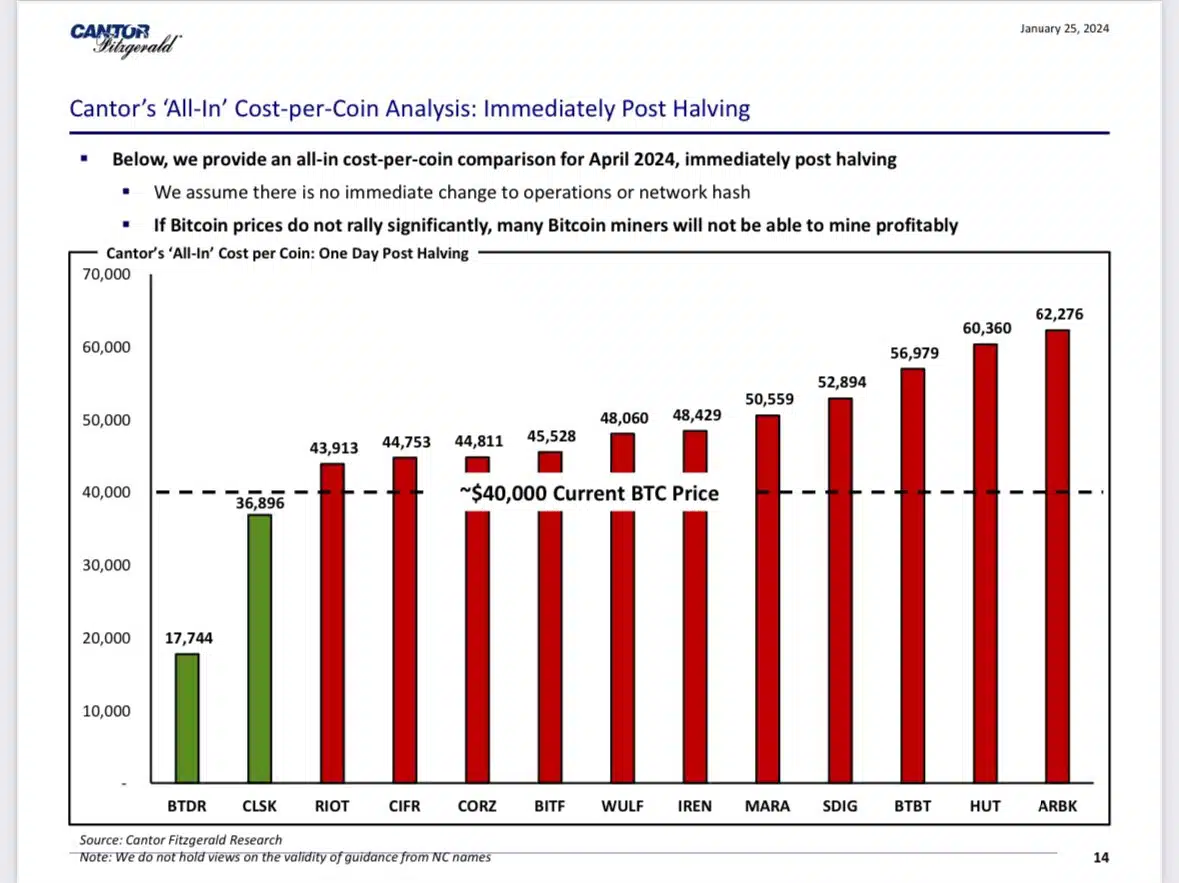

Leading financial services firm Cantor Fitzgerald shed light on the situation of eleven major Bitcoin (BTC) mining companies by examining the potential profitability challenges that may arise after the upcoming Bitcoin halving event in April 2024. This forthcoming halving, which predicts a 50% reduction in block rewards, has increased concerns about the profitability of mining giants.

Future Challenges: A Critical Review

Cantor Fitzgerald’s report highlighted specific concerns of leading Bitcoin miners such as Argo Blockchain, Hut 8 Mining, Marathon Digital, Riot Platforms, Core Scientific, and others. The main issue is that these companies may face costs of $40,000 with the halving.

This mismatch creates serious question marks about their sustainability if the Bitcoin price does not show a significant increase after the halving. It also endangers their ability to cover basic mining costs.

A Glimmer of Hope: Various Scenarios for Bitcoin Miners

Amidst concerns, Cantor Fitzgerald’s report indicates that some miners, such as Singapore-based Bitdeer and US-based CleanSpark, could maintain their profitability under current conditions. This assessment assumes that the Bitcoin price will remain at $40,000 and there will be no significant change in hash power. CleanSpark stands out as an example of a more favorable scenario for miners with estimated per-coin cost ratios below the current price.

This inequality highlights the complex relationship between Bitcoin miners’ revenues and the volatile nature of Bitcoin prices. Although the halving is promising for the long-term value of Bitcoin, it indicates the challenges of mining operations, especially for those with higher costs. If the Bitcoin price does not increase enough to balance the reduced block rewards and cover operational expenses, the operations could become unprofitable.

Strategic Moves: Managing Volatility with Financial Instruments

Bitcoin miners are taking strategic measures against these risks. According to Dan Rosen from Luxor, miners often turn to derivatives such as hash power-focused futures contracts and options related to Bitcoin. These financial instruments play a significant role in providing protection against the volatility of Bitcoin’s price and offer a safeguard against potential losses.

Market analysts and commentators are actively speculating about the potential impact of the halving on the Bitcoin price. Many expect a significant rise after the event. However, the outcome remains uncertain, and how the market reacts to the halving could significantly affect the profitability environment for Bitcoin mining operations.

This situation highlights the uncertainties and risks inherent in the nature of the cryptocurrency market. Organizations with a large influence on the value of digital assets, like Bitcoin miners, operate in an environment where strategic decisions and risk management are critical for sustainability and success.

Türkçe

Türkçe Español

Español