Cryptocurrencies are ending a week of decline and the Fed week is beginning. Bitcoin is on the rise again. Although recovery seems to gain momentum after the weekly close, caution may be wise due to historically high volatility during Fed weeks.

Key Developments of the Week

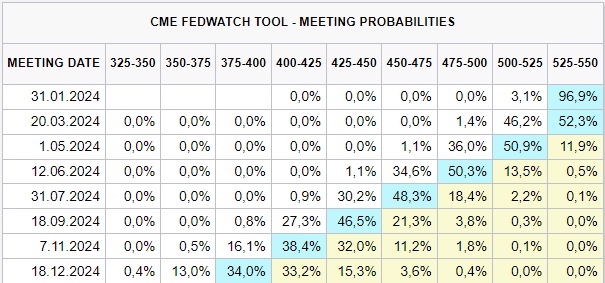

Expectations for the Fed to start cutting rates in March have dropped from around 80% to 50%. Recent US data suggests that the fight against inflation may not yield results as quickly as expected. Although PCE data is positive, headline and core inflation along with employment figures are concerning.

So, what developments will cause fluctuations in cryptocurrencies throughout the week?

Monday, January 30

- 18:00 US JOLTS Job Openings (Expectation: 8.73M Previous: 8.79M)

- OP Unlocking Event ($75.14 Million)

Tuesday, January 31

- 16:15 US ADP Employment Data (Expectation: 143K Previous: 164K)

- 22:00 US Fed Interest Rate Decision (Expectation: Steady)

- 22:30 US Fed Chairman Powell to Speak

- ETC Network Update

- SUI Unlocking Event ($5.68 Million)

Wednesday, February 1

- 16:30 US Unemployment Claims (Previous: 214K)

- 17:45 US Manufacturing PMI (Expectation: 50.3 Previous: 50.3)

- DYDX Unlocking Event ($93.3 Million)

Thursday, February 2

- 16:30 US Average Hourly Earnings (Expectation: 0.3% Previous: 0.4%)

- 16:30 US Non-Farm Employment (Expectation: 162K Previous: 216K)

- 16:30 US Unemployment Rate (Expectation/Previous: 3.7%)

Note: Earnings reports from companies like Microsoft, Meta, Google, and Apple on Wednesday and Friday could cause stock market fluctuations.

Will Cryptocurrencies Fall?

Wednesday’s Fed meeting is the week’s most critical event, and Powell‘s statements will be crucial. If Powell emphasizes a hawkish stance, it could significantly increase pressure on cryptocurrencies. On the other hand, we will see the latest data on employment and wage increases.

Weakening employment and wage growth are important for the fight against inflation. Powell will likely highlight this issue again, and if the data is contrary, we could see a negative trend in cryptocurrencies. The extent of META’s metaverse losses and the financial status of companies like Apple are of key importance. If the trillion-dollar giants’ earnings reports are positive, we might see a crypto rise fueled by optimism in the stock markets. The DYDX unlocking event is significant, but will prices unexpectedly rise while everyone expects a fall? If the unlocking event is not postponed, this seems unlikely.