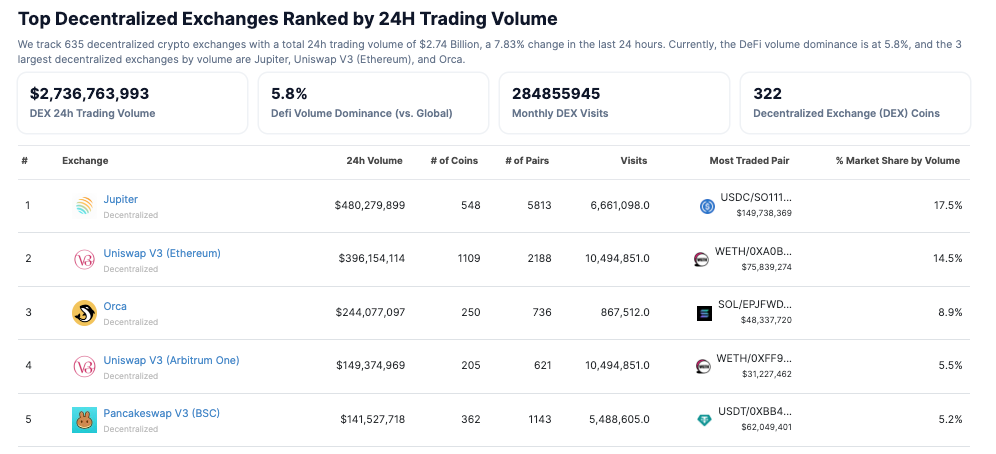

The crypto market’s blockchain ecosystems are witnessing notable developments. In the Solana ecosystem, the decentralized exchange Jupiter’s trading volumes have soared to the top of the charts with $480 million in the last 24 hours, amid the frenzy of a new memecoin airdrop event and increasing stablecoin swaps.

Volume Madness on Jupiter

According to CoinGecko data, Jupiter’s trading volumes from both V2 and V3 protocols surpassed those of Ethereum-based volumes on Uniswap by $10 million, with these protocols’ total trading volume amounting to only $470 million in the last 24 hours.

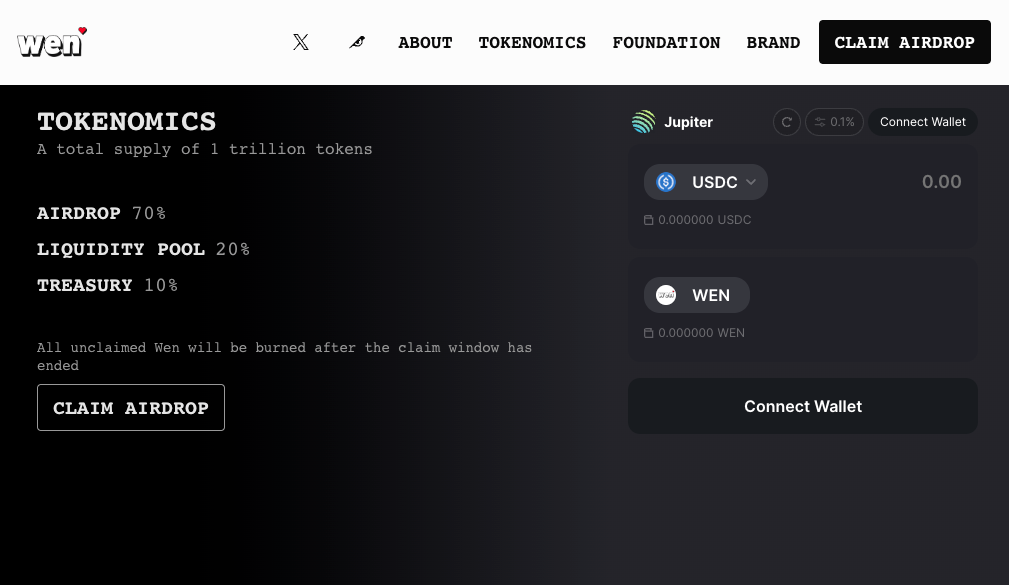

More than $50 million of Jupiter’s total daily trading volume came from investors trading a memecoin called “Wen,” which can be claimed by any Solana user who has interacted with Jupiter in the last six months, as well as owners of Solana’s Saga phone.

The memecoin was designed by Jupiter developers as a trial run ahead of the highly anticipated airdrop event of the exchange’s native token JUP, planned for release on January 31. However, a significant portion of the volumes seen on Jupiter in recent days was trading of Solana’s Circle’s USD Coin and Tether, which made up $191 million of the total daily volume.

Airdrop Winds Continue to Blow

According to data from the decentralized exchange Aevo, the pre-market trading JUP token is currently trading at around $0.61. The estimated total value of the JUP airdrop event, with 1 billion tokens, could exceed $600 million at current prices.

The market excitement surrounding WEN and JUP comes amid a series of airdrop events recently announced by various projects in the crypto ecosystem. On January 25th, Ethereum scaling solution AltLayer announced a $100 million airdrop to its users.

Meanwhile, the multi-layer rollup distributor Dymension is planning to launch its mainnet in the coming days and will distribute approximately 70 million DYM tokens, worth about $210 million at pre-market prices, to eligible users.

Türkçe

Türkçe Español

Español