After the approval of the United States’ first spot Bitcoin ETF, the overall cryptocurrency market, led by Bitcoin (BTC), fell sharply. Following the approval, the price of the largest cryptocurrency dropped from $49,000 to $38,500. This pullback triggered declines of up to and over 40% in many altcoins. The crypto data platform Santiment reported that since then, an important indicator for Bitcoin and altcoins has given a bullish signal.

Stablecoins’ Market Value Continues to Rise Steadily

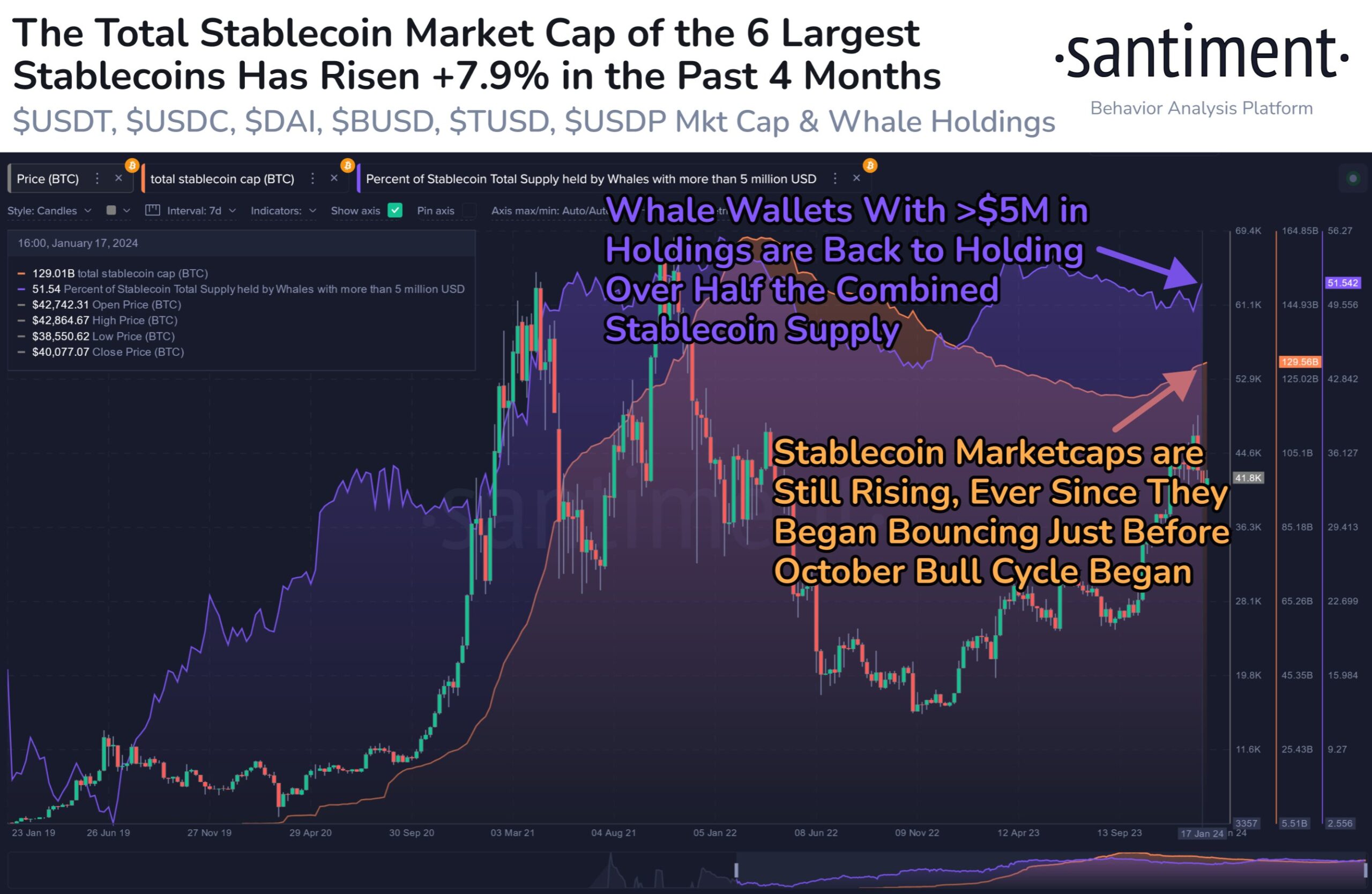

The leading crypto data platform Santiment reported a significant increase in the market value of stablecoins, an important indicator for the cryptocurrency market. The crypto data platform noted that since the end of September 2023, the market value of stablecoins in the cryptocurrency market has been encouragingly increasing.

Santiment highlighted that the total market value of leading stablecoins such as Tether (USDT), USD Coin (USDC), Dai (DAI), Binance USD (BUSD), True USD (TUSD), and USDP Stablecoin (USDP) has increased by $9.42 billion over the last four months, which is typically a necessary component for a bull market.

Looking at the data platform’s graph, the market value of stablecoins has been on an upward trend since June 2019, reaching $124 billion during the record-breaking year of 2021 for BTC and altcoins, and peaking at around $165 billion in 2022. The market value of stablecoins is currently around $130 billion.

The Increase in Market Value of Stablecoins and the Cryptocurrency Market

The increase in the market value of stablecoins against Bitcoin and altcoins can be interpreted in several ways. Stablecoins are cryptocurrencies that typically try to maintain their prices by pegging to a fiat currency (for example, the US dollar) or an asset class (for example, gold). Therefore, increases in the market value of stablecoins can reflect a rise in user demand for such assets to maintain price stability.

Cryptocurrency markets are prone to volatility, so investors and users may prefer stablecoins, which tend to maintain their value more steadily. This situation can lead to an increase in demand for stablecoins pegged to a specific asset class. Essentially, the increase in market value of stablecoins indicates that investors may be preparing to move into Bitcoin and altcoins, which, as Santiment points out, is a bullish signal and could mean an imminent flow from stablecoins into the cryptocurrency market.