Bitcoin has once again surpassed the $43,000 mark, buoyed by significant optimistic developments. What are these developments? Firstly, after the approval of ETFs, the billions of dollars in sales that occurred in the spot markets have been exhausted. The efforts of whales to convert their profits into cash had dragged individual investors into concern, leading to substantial losses.

Was It a “Sell the News” Event?

Whale sales were the foundation of the downturn on January 12, and even though the ETF approval was not a typical “sell the news” event, it was forced into one. Spot Bitcoin ETFs, despite sales of GBTC, hosted net inflows and led to increased demand for BTC. This supported the view that, under normal circumstances, ETF approval should trigger a long-term gradual rise rather than a “sell the news” event.

However, that did not happen; the feared scenario came to pass as whales made billions of dollars in sales, creating an artificial “sell the news” situation. The scenario everyone was prepared for was thus implemented.

Another detail confirming the situation was the intense demand below $40,000. If this had been a normal “sell the news” event, investors would not have been so bold below $40,000, and the price would have needed to drop to $30,000 or close to those lows.

Investors’ mid and long-term optimism remained strong despite the downturn triggered by speculative sales.

Why Is Bitcoin Rising?

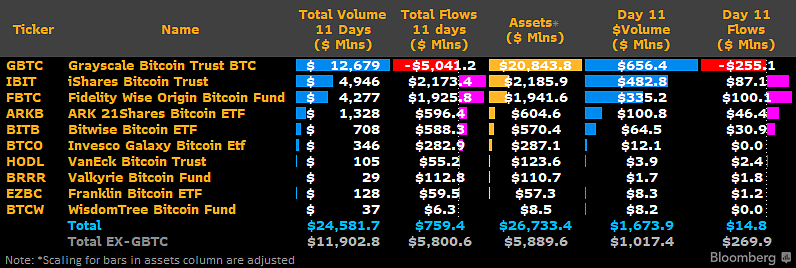

The largest cryptocurrency by market cap has reached $43,000, coming off a promising weekly close, with the slowdown of outflows from the Grayscale Bitcoin Trust. According to data valid at the time of writing, these outflows totaled $360 million for the day. This was positively received in the crypto markets as it was a decrease from previous outflows.

Meanwhile, according to asset manager BlackRock‘s data, the iShares Bitcoin Trust has accumulated a full $2 billion worth of BTC since its launch. As you can see above, despite nearly $5 billion in GBTC outflows, there was a net inflow of over $750 million.

The numbers have caused a stir on social media, with popular investor Rajat Soni highlighting the scale of the implicit buying volume compared to Bitcoin’s daily emission.

“Currently, only 900 BTC are issued each day. Just Blackrock clients alone are buying 2-5 times the total daily BTC production.”

This perspective confirms the mid and long-term optimism discussed in the first part of the article.

Türkçe

Türkçe Español

Español