The largest cryptocurrency Bitcoin (BTC), sent shockwaves through the crypto market by surging to $38,500 following the approval of the first spot Bitcoin ETF in the U.S. After a sharp decline, the leading cryptocurrency recovered, climbing back above the $40,000 threshold. Crypto derivatives trader Gordon Grant stated that the recent increase in Bitcoin’s price could potentially be a result of the decrease in open interest at significant price levels in Bitcoin options.

Bitcoin Marches Toward $50,000

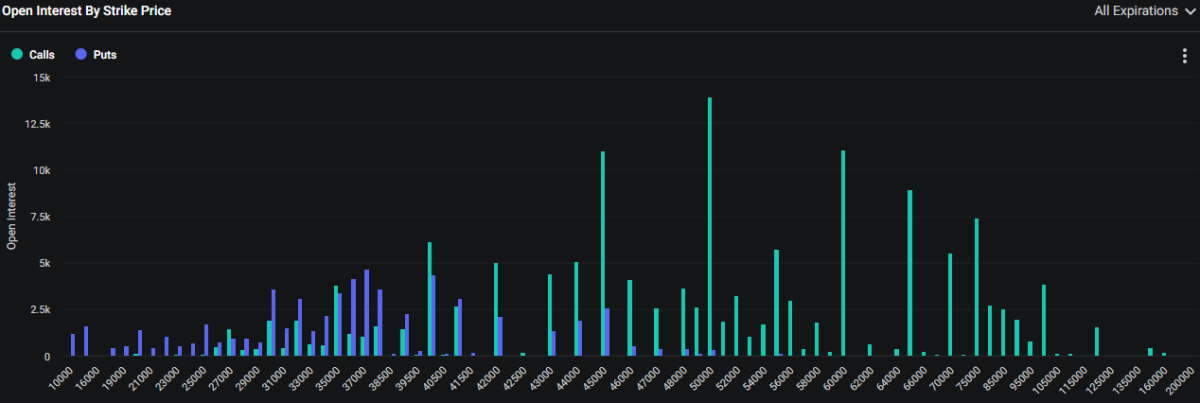

Crypto derivatives trader Gordon Grant, in an interview with The Block, said, “Open interest at the $40,000 level is quite limited. This could have been the trigger for the recent rise in Bitcoin; hedgers’ delta supply is relatively limited and suddenly lacked the optionality to support a large figure.” Grant noted that there was a significant drop in open interest for short-term Bitcoin derivatives, particularly options, following the expiration of options on January 26th.

Grant added that this situation is contrary to the process leading up to the expiration of options on January 26th, which could have constrained the price of the underlying asset following a short and sharp correction due to excessive local gamma. The total open interest in Bitcoin options at major central derivative exchanges was over $13 billion until the expiration date on January 26th, but the total open interest fell by more than $3 billion to $9.88 billion after the expiration.

According to data from crypto options giant Deribit, the open interest volume for Bitcoin for all upcoming expiration dates currently consists of calls at the $50,000 strike price, which corresponds to a bullish signal.

In option trading, a call option gives the holder the right to purchase the underlying asset at a certain price before or on the expiration date, without the obligation to buy. A large concentration of call options at the $50,000 level suggests that many investors may be anticipating Bitcoin’s price to rise above that level.

Many Were Mistaken: They Missed the Latest Rally

Contrary to many analysts’ expectations of a decline, Bitcoin’s price has remained above the $43,000 level in the last 48 hours. Although many analysts and market observers had predicted a drop to around $33,600, the largest cryptocurrency did not make such a move.

Last week, BitMEX co-founder and former CEO Arthur Hayes suggested that Bitcoin’s price would continue to fall. In a blog post, Hayes predicted a 30% correction for the largest cryptocurrency, which had reached about $49,000 immediately following the approval of multiple spot Bitcoin ETFs on January 10th. According to Hayes, this correction would push Bitcoin to the $33,600 level and eventually create a new support zone between $30,000 and $35,000, stating:

A 30% correction from the ETF approval’s peak of $49,000 corresponds to $33,600. Therefore, I believe Bitcoin will form support between $30,000 and $35,000.