BTC is currently lingering around the $43,400 region, and there is ongoing activity in altcoins. The expected turnaround has not yet begun. The pressure from GBTC in spot Bitcoin ETFs has weakened compared to the early days, reducing investor fear. So, setting aside short-term negativity, what dollar targets do experts have for BTC in the very long term?

Why Will Bitcoin Rise?

Bitcoin maximalist Samson Mow expects the demand for BTC to rapidly increase in the long term, supported by spot Bitcoin ETFs. Despite ETFs being in their early days, Samson points to his BTC accumulation as an important signal for the long term.

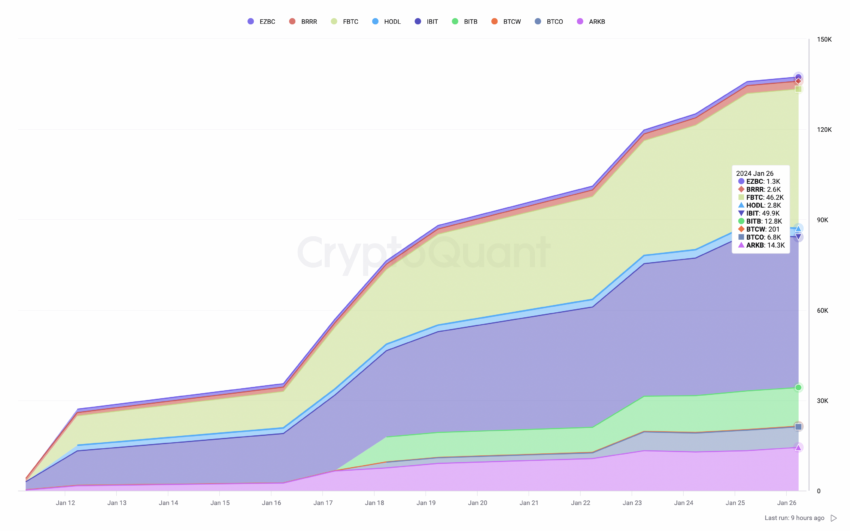

“The IBIT/FBTC purchase is approximately 9,000 BTC per day. Miners only issue 900 BTC per day. So, the demand from just 2 ETFs is 10 times the supply. The supply will halve in less than 3 months, meaning this demand will be 20 times the supply. And this demand is only from 2 ETFs.”

According to him, what investors forget is the fact that MicroStrategy (MSTR), Tether, and many other organizations should be added to this demand list. And of course, as demand increases like this, the limited supply ready for sale on exchanges will eventually be insufficient, starting to rapidly increase the price. Considering Satoshi Nakamoto’s dead BTCs and lost assets, a massive supply will likely never move or will remain immobile, further reducing the maximum supply of 21 million.

What Will Be the Price of Bitcoin?

Cathie Wood from ARK Invest underlines her determination at every opportunity for her Bitcoin price prediction of $1 million. Although she sees Bitcoin as a solid hedge against inflation, especially due to recent economic turmoil, she has yet to prove this during the current period.

However, she could be successful in the long term against the unlimited supply of fiat money. Wood says;

“The more uncertainty and volatility in global economies, the more our confidence in Bitcoin increases. One of the reasons is having experienced an inflationary fear. We think this is largely due to supply chain issues, and Bitcoin provides protection against inflation.”

Türkçe

Türkçe Español

Español