Cryptocurrency markets’ largest stablecoin, Tether, has consistently made headlines. Recently, it has exerted significant effort to change its reputation, which has been marred by negative news, especially in the last year. It reduced its holdings of risky papers and took steps to increase transparency, including regular reserve attestation reports.

Tether News

The company today published its expected report for the last quarter of the previous year. Tether Holdings Limited announced a $2.85 billion profit in the report for the fourth quarter of 2023, conducted by the well-known auditing firm BDO.

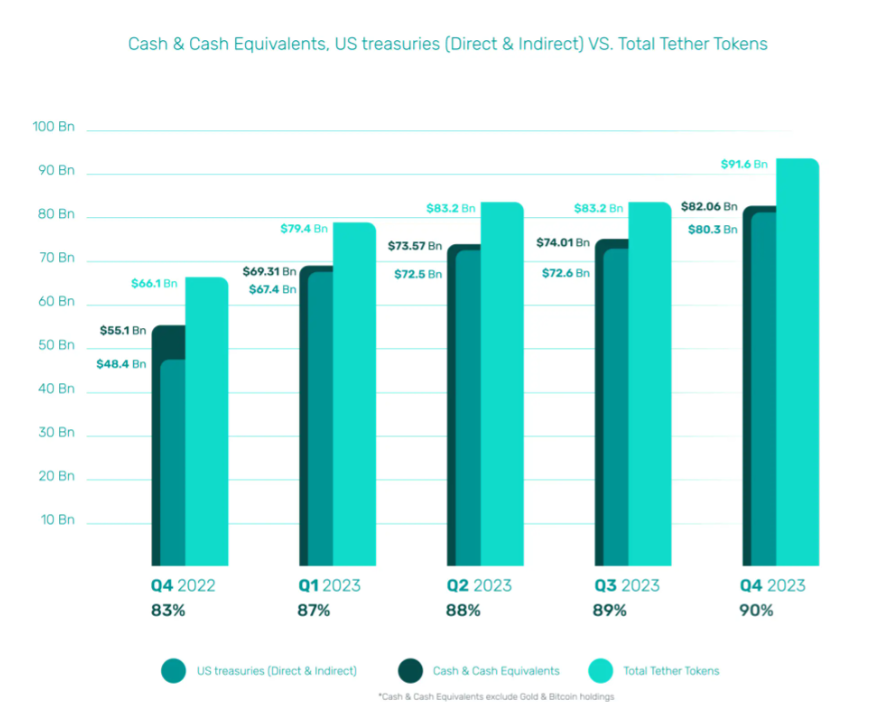

This attestation confirms the accuracy of Tether’s Consolidated Reserve Report (CRR) and provides a detailed breakdown of the assets held by the Group as of December 31, 2023. A significant portion of the record profit, $1 billion, is net operating income, primarily from interest income on US Treasury bonds.

The reserve surplus reached from $2.2 billion to $5.4 billion. The company holds more than enough assets to back the tokens it issued, as certified by BDO, with high liquidity.

Tether’s 2023 Earnings

The company’s total net profit for 2023 is $6.2 billion, with $4 billion of it coming from interest income on US Treasury bonds. Tether also continues to distribute a portion of its earnings to various assets, including Gold, Bitcoin, and other investments. It had previously announced that it would buy BTC with up to 15% of its profits.

“The Group has reached new record levels with $80.3 billion in both direct and indirect ownership of US Treasury bonds (indirect exposure includes overnight reverse repos collateralized by US Treasury bonds and money market funds investing in US Treasury bonds). In line with its commitment to transparency and stability, Tether has emphasized its commitment to maintaining liquidity in the stablecoin ecosystem by issuing tokens backed by an impressive 90% in Cash and Cash Equivalents.”

Tether CEO Paolo Ardoino wrote;

“Tether’s Q4 attestation underscores our commitment to transparency, stability, and responsible financial management. Reaching the highest reserve percentage in Cash and Cash Equivalents reflects our commitment to liquidity and stability. The significant net profit of $6.2 billion we achieved not only in the last quarter but throughout the year demonstrates our financial strength.”