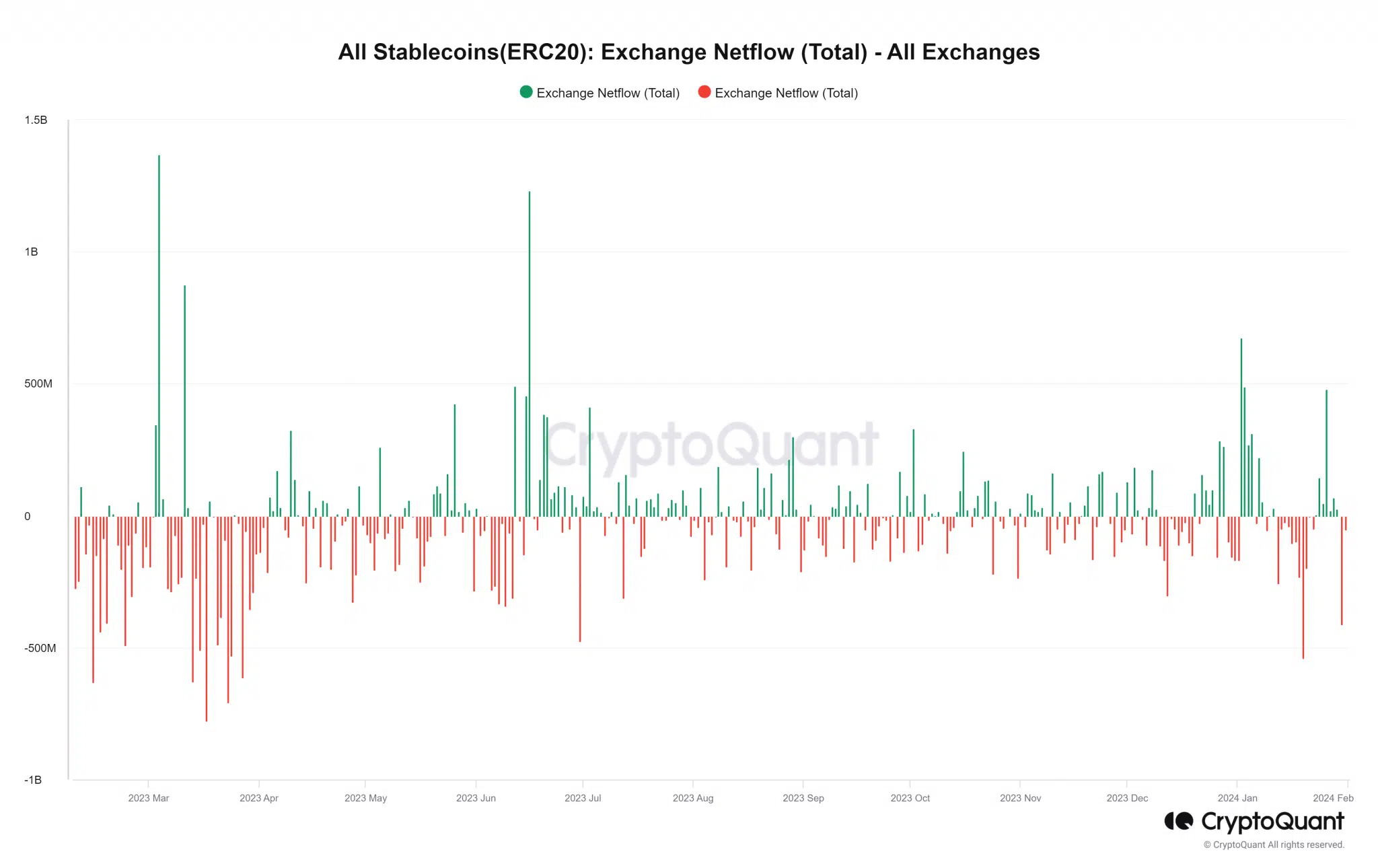

Stablecoins serve as valuable indicators for understanding the dynamics of the cryptocurrency industry. However, there has been a noticeable change in the market recently. According to IntoTheBlock data, there was a significant inflow of stablecoins to exchanges on January 26, which could indicate the highest volume of inflow observed.

Increase in Stablecoin Volume

CryptoQuant’s volume data analysis showed that January saw more daily volume increases compared to other months. On January 2, the inflow of stablecoins to exchanges exceeded $478 million, becoming the third-highest level of the month. The first two inflows were $673 million on January 2 and $489 million on January 3. However, the trend changed with the latest update, and more outflows were observed.

In particular, the total outflow on January 30 was around $412 million, which was the second-highest daily outflow recorded within the month. The highest outflow was $541 million on January 19. Similarly to the inflows, this daily outflow could represent one of the most significant outflows observed in months. Experts’ analysis of the last 24-hour trading volume, using data from the 21milyon.com website, showed that the total volume was approximately $49 billion.

Current State of Stablecoins

Furthermore, Tether (USDT) and USD Coin (USDC) accounted for approximately 90% of the recorded 24-hour volume. At the time of writing, USDT’s 24-hour trading volume was over $42 billion, while USDC’s volume was around $6 billion. Additionally, CryptoQuant also analyzed USDT flows, indicating a significant inflow of over $373 million on January 26.

However, the trend showed that outflows, observed at over $83.4 million, were dominant. The increase in stablecoin inflows to exchanges could indicate that analysts and investors are preparing to enter the market. It could also represent a desire to protect funds in a stable manner, especially during periods of uncertainty. This change in movement could be interpreted as a warning or preparation for potential market volatility. Moreover, the increase in the number of stablecoins entering the market could signify an increase in purchasing power and potential intentions to establish positions in the cryptocurrency space.