Last year, LINK was at the forefront of igniting the crypto markets, and now, renowned market analyst Michaël van de Poppe has also shared his views. According to the analyst, there seems to be an overly optimistic sentiment specifically for LINK.

Will LINK’s Price Rise?

Michaël van de Poppe, a leading analyst in the world of cryptocurrency, indicates that an altcoin project within the top 20 is ready to climb the ranks in terms of market volume.

van de Poppe told his followers on social media platform X that Chainlink (LINK), a decentralized network, could rise by about 90% from its current price level.

Chainlink is still stuck in a range, but it’s likely to break upwards. Why?

It brought liquidity down to $12.20. Multiple resistance tests. The BTC pair is bottoming out. ETH is starting to wake up. We could see levels of $25-30 in the coming months.

Looking at the chart, LINK has tested the crucial resistance level of $16.54, which has been of vital importance since November, four times so far and may soon convert this resistance into support with an upcoming price movement.

At the time of writing, Chainlink (LINK) is trading right at the mentioned level of $16.74.

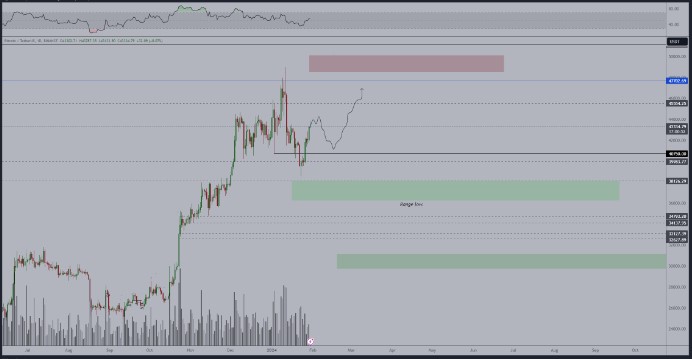

The analyst also draws attention to April, predicting that Bitcoin (BTC) could visit a higher price level before the halving in April, which will cut miners’ rewards in half. Moreover, he forecasts that altcoins will perform better than Bitcoin, the pioneer of crypto, during this period.

Bitcoin has moved liquidity above the high level and will likely consolidate. Overall, a new test of the $48,000-$50,000 levels seems likely, and altcoins will perform significantly better during this time.

While making a longer-term prediction for Bitcoin, Poppe suggests that BTC could reach an all-time high in 2025 after breaking out of its current trading range post-2024 halving.

This scenario is still valid for Bitcoin.

Upon examining Poppe’s chart, it is predicted that Bitcoin could reach $68,000 in the first half of 2025. He also mentions that Bitcoin could visit $50,000 before the halving date and then drop to $39,129 before making an upward move.

Bitcoin is trading at $42,400, down 1.85% over the last 24 hours, which is still far from the $49,000 level seen last month.