The leading cryptocurrency lost $43,000 after the Fed’s recent actions and is struggling to reclaim it as this article is being prepared. Market volatility is expected to increase with the employment data coming tomorrow. So, what do experts think about the current outlook? What are the expectations for cryptocurrencies, especially for BTC?

Bitcoin (BTC) Predictions

Bulls are struggling to regain momentum after a nearly 20% drop from the two-year high of $49,000. However, sellers do not seem to have lost much of their motivation for deeper lows. Material Indicators, from account X, shared the following in their latest market update;

“Monthly charts do not mean that the price will make a lower low this month, but as long as new #TradingSignals are not invalidated, it shows that the price will not make a new high this month. However, I would be surprised if Bitcoin does not test its bottom support near $38,500 before the end of the month.”

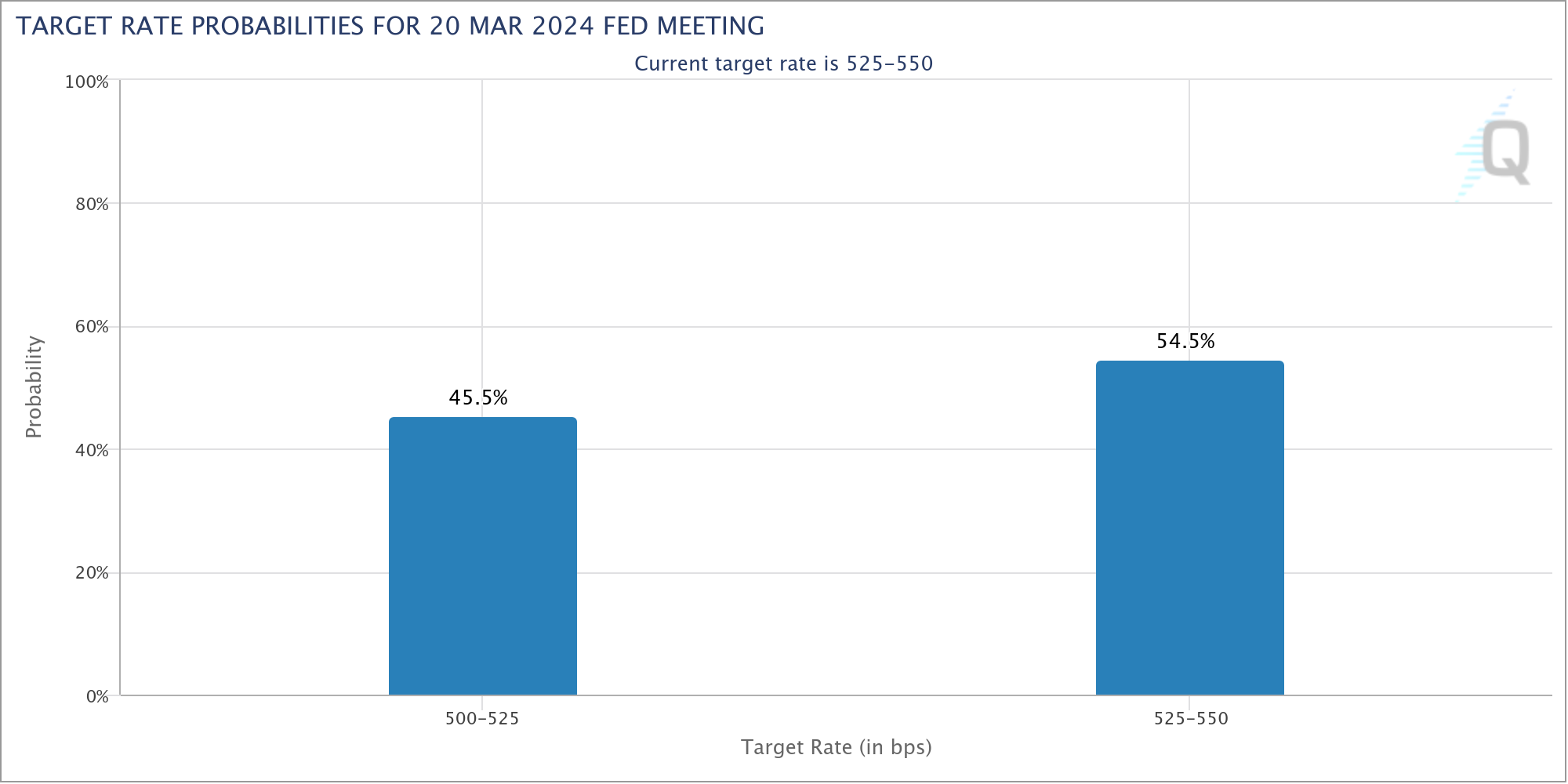

The US Fed is fighting to cut off predictions of interest rate cuts for the first half of the year. Therefore, data coming throughout February will be more significant for the markets. Surprise figures could move prices.

“In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not think it would be appropriate to lower the target range until it is more confident that inflation is sustainably moving towards 2%.”

Cryptocurrency Commentary

On the first day of February, the Grayscale Bitcoin Trust (GBTC) saw an outflow of 6,200 BTC. The outflow is noteworthy but still considered reasonable following a peak of 25,000 in a single day. The size of GBTC outflows will significantly determine the overall performance of cryptocurrencies. The company, still holding over $20 billion in BTC, could bring a massive oversupply in the event of sudden sales.

According to data from sources like Bloomberg Intelligence, US spot Bitcoin ETFs saw approximately $200 million in net inflows on January 31st. James Seyffart, however, argues that these figures are impressive when considered in the context of ETFs overall.

Therefore, in February, investors will keep one eye on macro data and the other on GBTC outflows.

Türkçe

Türkçe Español

Español