One of the largest altcoins by volume, Solana (SOL), has once again fallen below the $100 mark. This is not surprising as the fluctuation in BTC price triggers rapid sell-offs in altcoins due to the risk of deeper corrections. Investors prefer to remain cautious. So, what’s the situation on the Solana front?

Solana (SOL)

Between January 30 and February 1, the SOL Coin price experienced a 9.8% drop, moving below the resistance zone. Over a 30-day period, SOL Coin suffered a double-digit loss while cryptocurrencies like BNB and ETH were less volatile. SOL Coin is an asset with high volatility compared to other altcoins due to its quick recovery after each decline.

The ongoing risk of U.S. banks and the Fed’s interest rate policy have not eased their pressure on the market. Shares of New York Community Bancorp (NYCB), which acquired the collapsed crypto-friendly Signature Bank in 2023, fell nearly 40% in two days after reporting a loss of $260 million in the last quarter of 2023.

Experts like BitMEX co-founder Arthur Hayes are still worried about the risk of contagion and the possibility of continuing chain bankruptcies. If we recall March, we cannot say that the banking problems did not affect the crypto market.

SOL Coin Predictions

When the SOL Coin price reached $104, it surpassed a market value of $45 billion, overtaking BNB Coin in the rankings. This is psychologically significant. Despite the total locked value on the network being lower than BNB’s, SOL Coin stands out with its strong community and recent airdrop excitement.

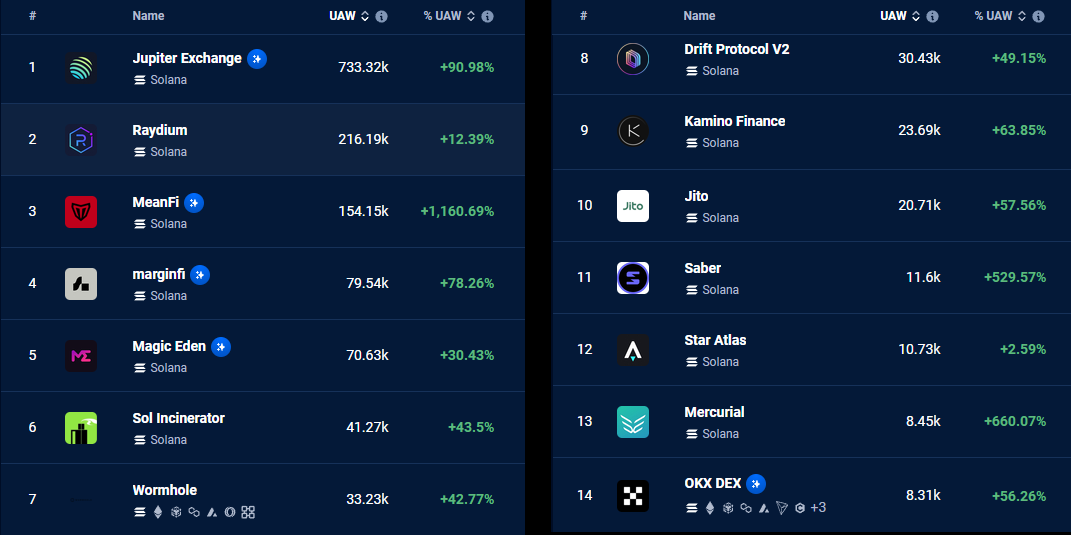

SOL Coin, which has recovered faster than rivals like AVAX, owes this to BONK and other ecosystem tokens. The Jupiter (JUP) airdrop reached a market value of $800 million, and the increased interest in the projects within its ecosystem explains the logic behind the rise in SOL Coin’s price.

Moreover, the network’s DeFi, NFT, yield protocols, liquid staking solutions, and games are also experiencing an increase in interest. SOL Coin is growing with the support of its ecosystem, which has revived after the FTX collapse.

However, when compared in terms of TVL, the $104 level seems to be the result of excessive demand. If SOL Coin maintains the excitement in its ecosystem, there is no problem, but as money constantly moves in crypto and interest shifts to different networks, investors may long for these days.

Türkçe

Türkçe Español

Español