The cryptocurrency market continues to witness notable developments. Nearly 1 billion dollars worth of Bitcoin option contracts are set to expire this February 2. Moreover, the markets continue to recover from the post-ETF launch slump, but could the options expiry activity in the futures market drive prices up over the weekend? We examine with key data and analyst comments.

Noteworthy Data for Bitcoin

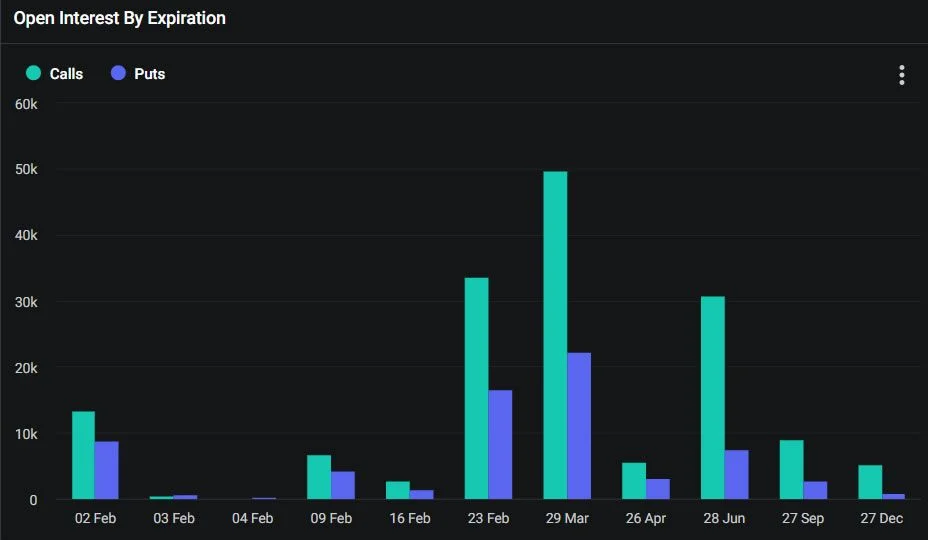

Approximately 22,000 Bitcoin option contracts will expire on February 2. This week’s expiry event is much smaller than the massive end-of-month event from last week, but it still represents nearly a billion dollars worth of activity. According to data analysis platform Greeks Live, the nominal value of these Bitcoin option contracts expiring on February 2 is 960 million dollars. The put/call ratio is 0.66, indicating a higher number of long or call contracts sold as short contracts.

The maximum pain point, or the price level where the most loss occurs, is 42,000 dollars. However, there is still a significant open interest at the 50,000 dollar strike price, with 14,191 call contracts. According to Deribit, the nominal value of these contracts is 610 million dollars. Additionally, there is a substantial open interest at the 45,000 dollar level, with 12,307 call contracts.

Greeks Live commented that the crypto market has been relatively flat this week, while stating that relative and partial volatility is on a downward trend for main terms:

“Bitcoin spot ETF products are starting to bring increased capital into the crypto market as grayscale sales slow down. The next big speculation is about the Bitcoin’s halving event, which has maintained its upward momentum this year.”

Ethereum Option Contracts

In addition to the expiring Bitcoin options, 230,000 Ethereum contracts are also set to expire on February 2. Their nominal value is 530 million dollars, and the put/call ratio is 0.33, meaning there are three times more long contract sellers. The maximum pain point for Ethereum options is the current spot market price level of 2,300 dollars.

While the total market value has reached 1.73 trillion dollars, the crypto markets have gained 2.3% in value in the last 24 hours. However, spot markets continue to remain within a horizontal channel formed over the last two months.

Bitcoin prices gained 2.6% in value during the Asian trading session on the morning of February 2, reclaiming the 43,000 dollar price level. The asset has not been able to rise above 44,000 dollars since the launch of the ETF product, so the expiration of the options is not likely to have much impact. The Ethereum price increased by 2% with the asset regaining the 2,300 dollar level, but it traded horizontally throughout the past week.

Türkçe

Türkçe Español

Español