For a long time, there was censorship that cryptocurrencies faced on major social media companies, and this is changing. Efforts to ensnare victims with scam crypto ads had brought about strict measures. Days ago, Google took a significant step back, and Meta companies are following suit.

Facebook, Instagram, and Bitcoin

Two of the world’s most active user platforms are loosening their restrictions on crypto currency ads. Facebook and Instagram will allow crypto-themed works in a limited way with spot Bitcoin ETF ads. With mainstream acceptance growing and the SEC officially approving spot Bitcoin ETFs, the way has been paved for this development.

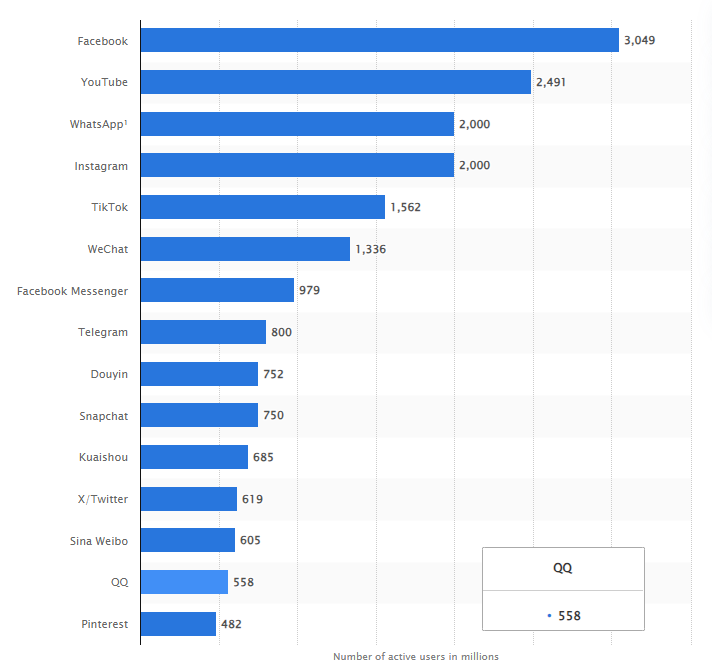

Meta has decided to update its policy to allow Bitcoin ETF ads in the US. The new policies will clear the way for Bitcoin ETF ads on both platforms. Thus, these two platforms, reaching approximately 2 billion active users monthly, will do their part to facilitate the rapid growth of spot Bitcoin ETFs.

ETF Store President Nate Geraci emphasized the importance of Facebook’s older demographic characteristics. According to him, both platforms, and especially Facebook, have significant advantages in explaining cryptocurrencies to an older demographic that is not familiar with investing in them.

“Facebook and Instagram may soon allow spot Bitcoin ETF ads… There’s no bigger boomer honey pot than Facebook.”

Crypto Currency Ads

Google has started to allow ads for a limited number of crypto products, including spot Bitcoin ETF products. This permission, which covers traditional company-backed, approved, and legal investment products, also positively contributes to the legitimization process of Bitcoin. Although the SEC says we do not approve Bitcoin, what we approve are ETFs, the institution’s approval has legitimized BTC.

Spot Bitcoin ETFs, which have already gained significant popularity in the investment markets, saw massive net inflows in less than a month since they started trading. BlackRock’s IBIT and Fidelity’s FBTC witnessed inflows of $2.6 billion and $2.2 billion, respectively.

IBIT and FBTC crossed the $1 billion threshold in assets under management very quickly. They even etched their names in history as the fastest 5 ETFs to reach this threshold. All this indicates that Spot Bitcoin ETFs could grow even more in the coming months.

Türkçe

Türkçe Español

Español