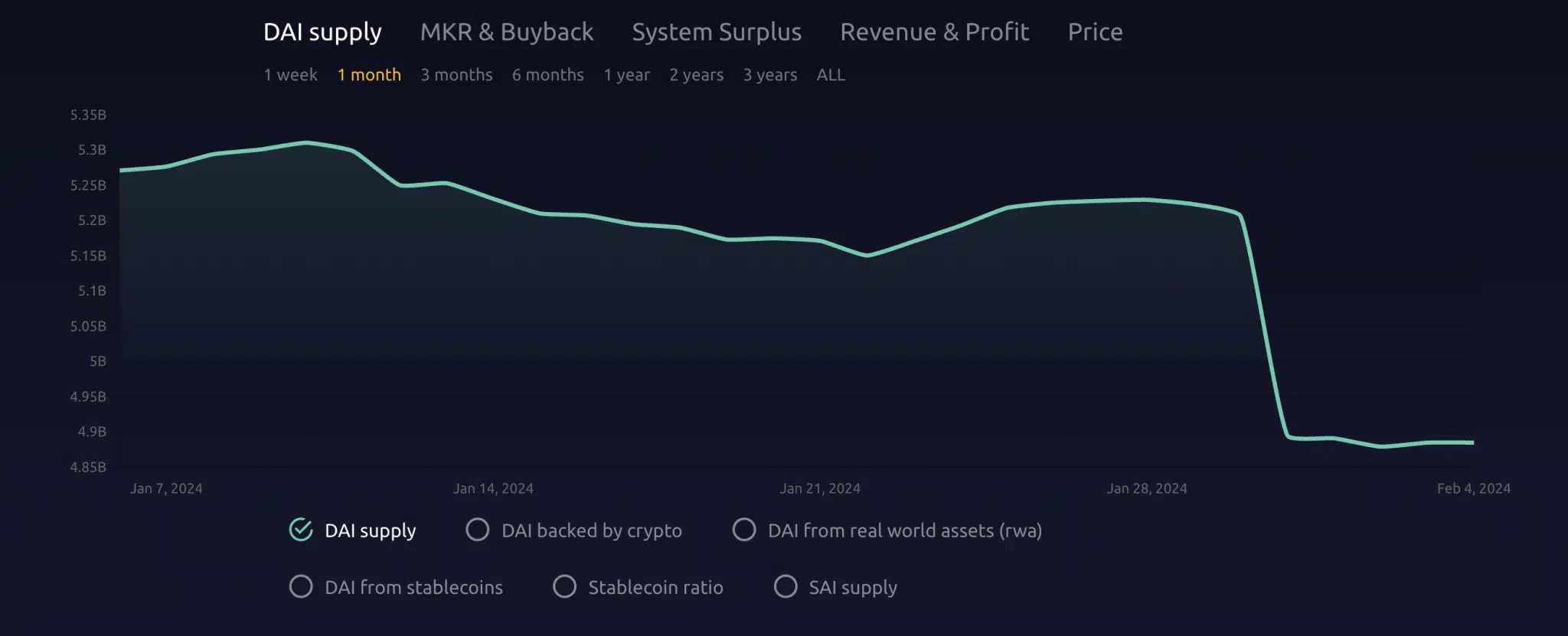

MakerBurn data indicates that the total supply of MakerDAO’s (MKR) decentralized stablecoin DAI has fallen to its lowest level since August 2023. The decrease in DAI supply stems from the protocol’s self-regulating market model known as Collateralized Debt Position (CDP).

MKR Supply Decreases

A significant portion of the cryptocurrency’s decline happened between January 30 and 31, when the DAI supply dropped by 6%. The stablecoin supply fell from 5.2 billion to 4 billion within 24 hours. According to CoinMarketCap data, at the time of writing, MakerDAO’s native token MKR was trading at $2,009.

Data from the Moving Average Convergence Divergence (MACD) indicator for MKR shows that bears regained market control on January 18. However, they failed to initiate a significant price drop. This is due to the altcoin continuing to benefit from a steady flow of demand. At the time of writing, the Relative Strength Index (RSI) was at 56.14 and trending upwards. This could indicate that even if a bear cycle has started, bulls continue to accumulate MKR tokens.

On-Chain Analysis of MKR

MKR market’s steady liquidity flow is confirmed by the Chaikin Money Flow (CMF), which was on an uptrend above the zero line at the time of writing. The rebounding CMF value of 0.03 could be a sign of strength in the market. It indicates that token accumulation has surpassed selling activity. However, while accumulation continues, the state of MKR’s oscillator suggests investors should remain cautious. The mentioned indicator measures the strength and direction of a token’s trend over a certain period.

This situation may show that the accumulation pressure is weak compared to the underlying bearish trend with a longer-term horizon. MakerDAO’s decentralized stablecoin DAI’s total supply has fallen to its lowest level since August 2023. The 6% drop in DAI supply is due to the Collateralized Debt Position (CDP) model. Yet, MKR is limiting the decline by encountering constant demand and bullish strength.

Türkçe

Türkçe Español

Español