While chaos and anxiety continue to dominate globally, US markets are still responding to the turmoil in Chinese stock shares. On the other hand, Bitcoin surpassed $43,500 during the February 5 Wall Street opening but then slightly retreated.

China’s Major Loss and Recession Concerns

According to information emerging this evening, Bitcoin surpassed $43,500, setting a new February BTC price record, and kept investors happy until a pullback occurred.

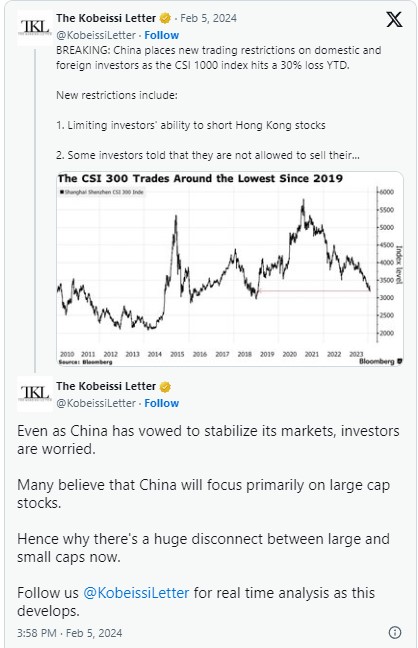

Bitcoin experienced volatile hours after the CSI 1000 index in China lost 8% in daily trading, which encouraged officials to impose more control over short selling.

The Kobeissi Letter, serving as a reliable source, questioned whether China is in a recession by pointing out the discrepancy and spread between large and small-cap stocks.

A statement on X (formerly known as Twitter) mentioned that the Chinese market officially lost 7 TRILLION dollars in value over the last 3 years.

The high volatility in Bitcoin also seems to have been aided by a significant increase in open interest reaching $775 million, according to data shared by J. A. Maartunn, known for his support on the famous analysis platform CryptoQuant.

On the other hand, the outflow transactions from Grayscale Bitcoin Trust (GBTC) seem to be slowing down since the day the ETF was approved. Although the selling trend continues, the sale of approximately 2,600 BTC was lower compared to previous days.

Critical Zone in Bitcoin

Material Indicators, co-founded by Keith Alan, conducted a detailed examination of the Bitcoin order book. Alan issued a price warning for BTC after his analysis. He noted that the spot price of Bitcoin is still experiencing a liquidity shortage, which could easily lead to a return to $42,000.

In his in-depth examination, Alan highlighted a more critical point, indicating that liquidity was at much lower levels and pointed to around $25,000.

Alan stated in his latest video:

This doesn’t mean the price will come here immediately or never, but it means there is currently sensitivity for this level. Is this a real sensitivity or just positioned here for a potential fuse? We will see, but I will be watching to see if more liquidity comes into this range because I think liquidity equals sensitivity.

Alan added that the top of the liquidity asking ladder was moving downwards, indicating that it could rise to $45,000 or higher in the short term.

Türkçe

Türkçe Español

Español