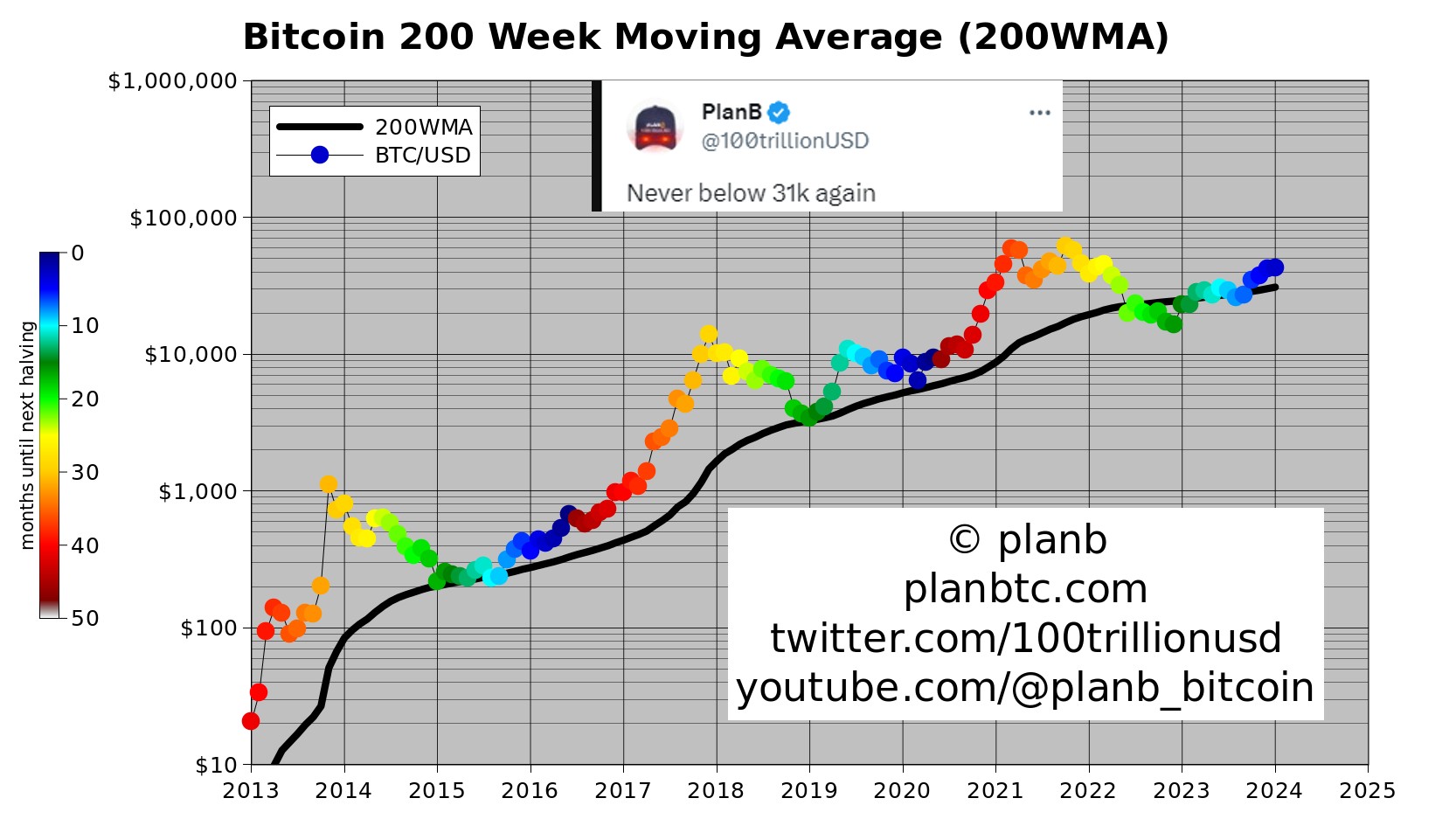

In the ever-evolving world of cryptocurrency, Bitcoin stands as a leading pioneer, setting trends and challenging conventions. Amid recent market turbulence, Bitcoin’s resilience has once again come to the forefront, showing notable stability above the $31,000 level. Legendary analyst PlanB has underscored a new bottom line for Bitcoin’s price.

New Bottom Levels for Bitcoin Prices

Cryptocurrency enthusiasts and analysts closely monitor Bitcoin’s price movements in light of historical patterns and market sentiment. Despite occasional fluctuations, Bitcoin has established a tough support level around $31,000, demonstrating a consistent ability to recover from downturns. This stability is not merely coincidental; it is based on fundamental factors that bolster Bitcoin’s value proposition.

One of the main catalysts supporting Bitcoin’s resilience is the increased institutional adoption witnessed in recent years. Major financial institutions, hedge funds, and corporations have recognized Bitcoin as a legitimate asset class and have allocated significant resources and capital to the cryptocurrency market. This institutional support provides a strong foundation of trust, mitigating downside risks and reinforcing Bitcoin’s status as a long-term investment vehicle.

Market Dynamics and Supply Mechanics

Additionally, Bitcoin’s supply dynamics contribute to the price stability above $31,000. Operating on a deflationary model with a fixed supply of 21 million coins, Bitcoin plays a significant role in the valuation of scarcity. The halving events, which occur approximately every four years, further restrict the issuance rate of new Bitcoins, creating upward pressure on prices over time. This natural scarcity, coupled with increasing demand, lays a solid foundation for Bitcoin’s price trajectory.

There may be other reasons for PlanB‘s view of $31,000 as a new bottom level. For instance, regulatory clarity has also played a significant role in stabilizing Bitcoin’s price above the $31,000 threshold.

As governments around the world establish clearer frameworks for cryptocurrency regulations, both institutional investors and retail participants gain confidence in the legitimacy and longevity of the asset class. Moreover, the maturation of cryptocurrency exchanges and trading infrastructure enhances market efficiency and liquidity, reducing volatility and creating a conducive environment for sustainable price levels.

Technological Innovation and Network Resilience

From a technological standpoint, the Blockchain network that underpins Bitcoin continues to evolve, enhancing its scalability, security, and functionality. Innovations like the Lightning Network enable faster and cheaper transactions, further solidifying Bitcoin’s utility as a medium of exchange and store of value. Additionally, the robustness of Bitcoin’s decentralized network provides resilience against external threats, maintaining its integrity and reliability.

In conclusion, the resilience of Bitcoin above the $31,000 level indicated by PlanB signals a paradigm shift in the world of cryptocurrency. Fed by institutional adoption, supply dynamics, regulatory clarity, and technological advancements, Bitcoin has proven itself as a challenging asset class with a lasting value proposition.

Even as short-term fluctuations occur, the broader trajectory points to a future where the $31,000 level serves as a steadfast base, reflecting the maturity and resilience of the world’s leading cryptocurrency.

Türkçe

Türkçe Español

Español