Crypto currencies’ rapid world often dominates conversations with the allure of quick wealth. However, experienced investors know the importance of being patient and strategic timing very well. While many are eager to take advantage of Bitcoin‘s potential, maintaining a balanced perspective and analyzing fundamental data trends has become very important.

Early Indicators in the Bitcoin Market

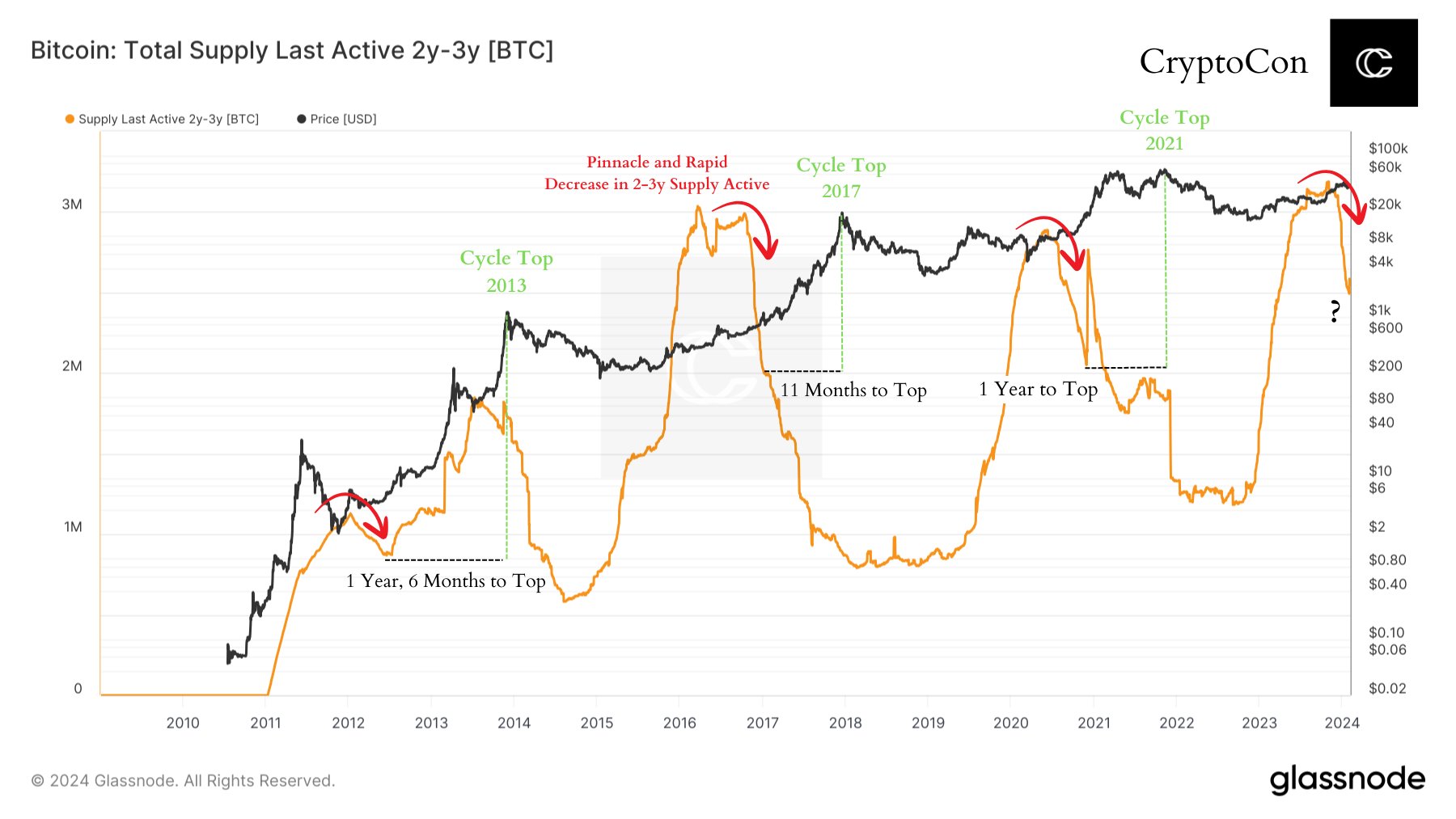

Bitcoin market’s early indicators are presenting intriguing insights that challenge conventional wisdom. One such observation revolves around the activity of coins held for 2-3 years. In the initial stages of each cycle, there is a noticeable increase in the number of active coins from this time frame.

According to CryptoCon, this increase, which is often exponential, paints a picture of rising investor confidence and long-term commitment to crypto currency. However, the subsequent process is equally important. As the cycle progresses, typically after half of the process has passed, there is a sharp decline in the number of coins held for 2-3 years.

What Does This Decline Mean?

This decline can be a harbinger of a significant turning point in the Bitcoin market, namely the peak of the cycle. According to the analyst, historically, this peak occurs approximately 1 to 1.5 years after the first increase of long-term assets. This represents a crucial moment when a significant decrease in activity follows the data peaks.

According to the analyst, the implications of these data are profound. Could this model possibly be indicating that the peak of the cycle is near, maybe by the end of this year? While cycle timing models offer different views, exploring alternative perspectives is becoming very important for navigating the complexities of the crypto world.

Optimism and Market Realities

As an analyst, CryptoCon continues to focus on understanding the nuances of Bitcoin‘s behavior and market dynamics. While the desire for quick gains continues, approaching investment decisions with a mix of pragmatism and foresight is mandatory.

In conclusion, while the pursuit of wealth in the crypto world is undeniable, adhering to data-driven analysis and informed decision-making processes is of vital importance. Investors can gain valuable insights into the direction of Bitcoin and potential future outcomes by examining trends such as the activity of long-term coin assets.

While navigating the ever-evolving environment of digital assets, it is necessary to adopt a holistic approach that balances optimism with a rational assessment of market realities.

Türkçe

Türkçe Español

Español