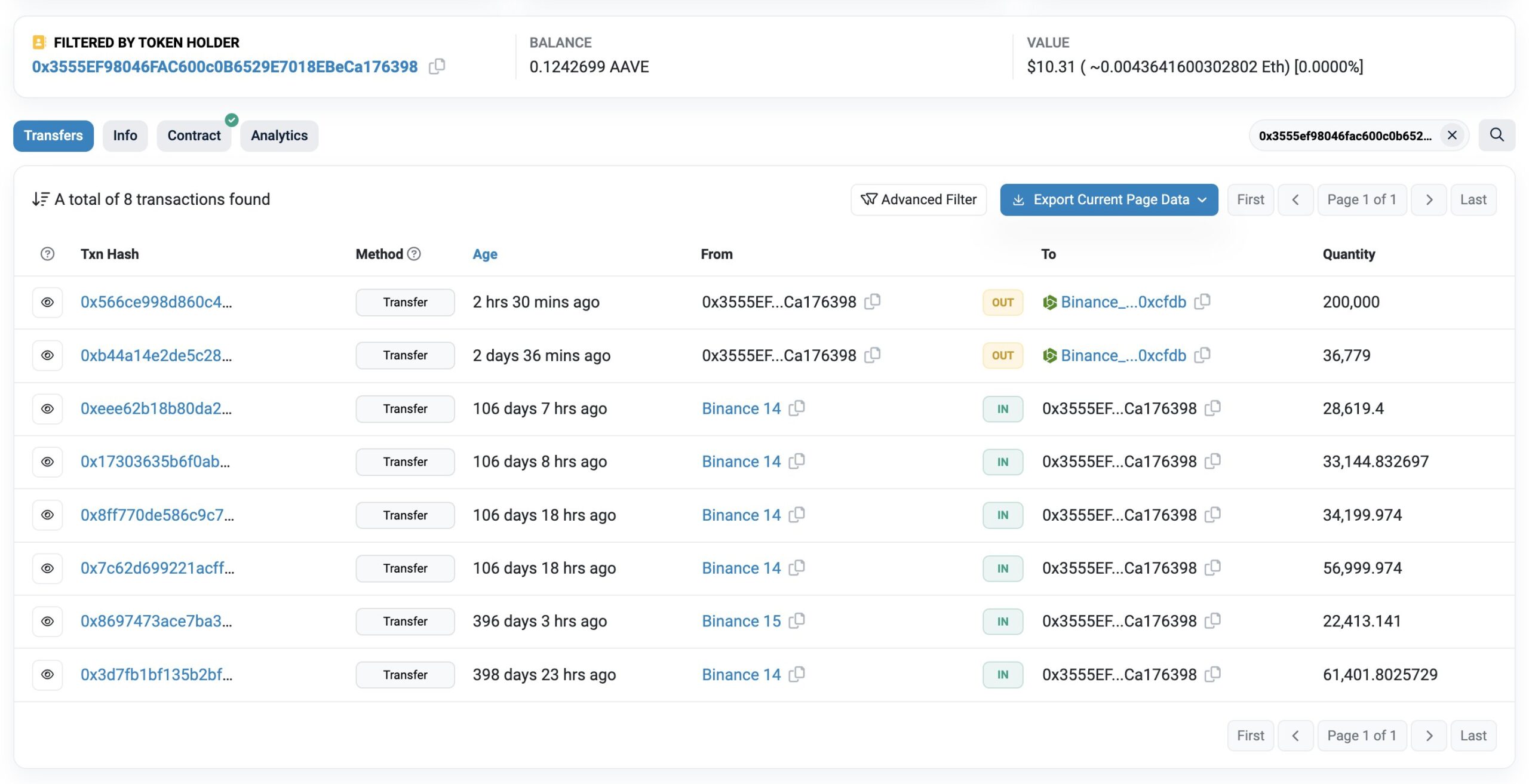

A whale who had been accumulating an average of 23.6779 AAVE at a price of $74.4 from Binance between January and October 2023, transferred 200,000 AAVE to Binance 2 hours ago. The transfer, worth $16.7 million, has started to raise questions within the cryptocurrency community. With the latest transfer, all of the 23.6779 AAVE that was bought at an average price of $74.4 from Binance between January and October 2023 has been moved to Binance within the last two days. If the whale decides to sell, the potential profit from the AAVE investment will be approximately $2.23 million, indicating a significant increase of 12%.

Breakdown of the Whale’s AAVE Investment Performance

The whale’s investment strategy at the beginning of 2023 included buying ETH, COMP, AAVE, and UNI. Accordingly, these moves have yielded varying results over the year. The details are as follows:

- ETH: Between January and March 2023, 10,425 ETH were purchased at $1,520, spending a total of $15.84 million. Shortly after, these ETH were sold at $1,709, resulting in a profit of $1.97 million.

- COMP: Between January and March 2023, $3.5 million worth of COMP was purchased at $40.24, totaling 86,976 COMP. This cryptocurrency was sold between July and August 2023 at $57.8, yielding a profit of $1.25 million.

- AAVE: Between January and October 2023, 23.6779 AAVE were purchased at $74.4, amounting to $17.62 million. Later, this cryptocurrency was sold in February 2024 at $83.8, resulting in a profit of $2.23 million.

- UNI: In March 2023, 920,000 UNI were purchased at $6.63, totaling $6.1 million. However, these assets have not yet been transferred or sold. If sold now, a loss of $350,000 is expected.

By diversifying their investment portfolio with these leading cryptocurrencies, the whale has demonstrated a sophisticated approach to capitalize on market fluctuations and maximize returns.

Navigating Market Dynamics

The recent transfer of 200,000 AAVE to Binance underscores the whale’s strategic maneuvers in the crypto market. Such decisive actions not only optimize portfolio performance but also reflect a sharp understanding of market dynamics.

As the market continues to evolve, savvy investors like this whale stay alert to emerging trends, leveraging strategic growth opportunities. This whale, executing each transaction meticulously, appears to have capitalized on timely opportunities in the volatile crypto environment to enhance profitability.

Türkçe

Türkçe Español

Español