Since their emergence, cryptocurrencies have been interpreted as uncertain and volatile within their natural progression. Certain events during this period can more clearly affect the uncertainty and volatility of specific cryptocurrencies. When examining how investors manage their risks, avoiding transactions during periods of extreme uncertainty can guide them to the right decisions. Consequently, we have analyzed three altcoins that may face negative movements in the coming period.

Critical Week for APT, CYBER, and SAND

Generally, token unlocks can increase the circulating supply and significantly impact prices. In this context, investors may consider avoiding transactions involving three cryptocurrency projects next week.

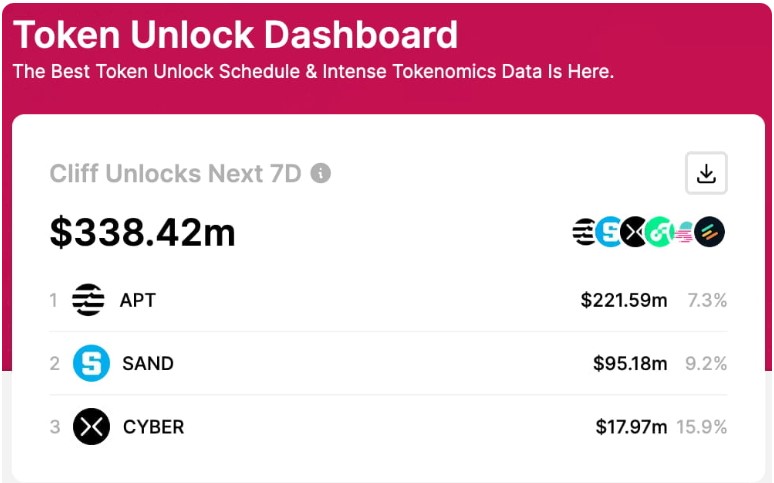

In the coming seven-day period, it has been revealed that a total of $338.42 million worth of tokens will be unlocked across various crypto projects.

According to data provided by Token Unlocks App, particularly Aptos (APT), The Sandbox (SAND), and CyberConnect (CYBER) will unlock 98.9% of their tokens, valued at $334.74 million.

Aptos (APT) Token Unlock

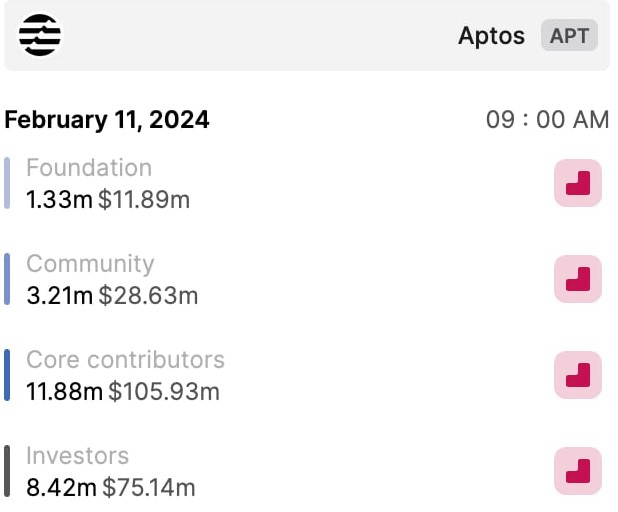

For Aptos, which has been increasingly mentioned in the crypto world, the token unlock scheduled for February 11 will be the largest in dollar terms to date. At the time of writing, it was observed that 24.84 million APTs valued at over $221.59 million would enter circulation.

During this process, the team consisting of investors and Core participants will own liquid assets worth over $180 million. After the unlock, there will be a 7.3% increase in Aptos’s circulating supply.

SAND and CYBER Token Unlocks

Other significant projects to be avoided due to upcoming token unlocks include The Sandbox (SAND) and CyberConnect (CYBER). On the Sandbox side, 205.59 million SAND ($95.18 million), and on the CyberConnect side, 2.36 million CYBER ($17.97 million) will enter the market.

After both unlocks, the circulating supply is expected to increase by 9.2% and 15.9%, respectively. The Sandbox will undergo this process on February 14, while CyberConnect will unlock its tokens on February 13.

While all this is happening, individuals, teams, or institutions that receive the unlocked tokens post-unlock may take this opportunity to introduce the unlocked tokens into the market. This situation could inevitably bring significant selling pressures specific to these cryptocurrency projects. Such pressure can have a major impact on prices and reduce the value of the held altcoins.

On the other hand, price movements resulting from rumors could trigger a short-term upward movement in these tokens’ prices. In this scenario of high speculation and uncertainty, investors may want to be more cautious when buying and selling the three cryptocurrencies mentioned in the news.