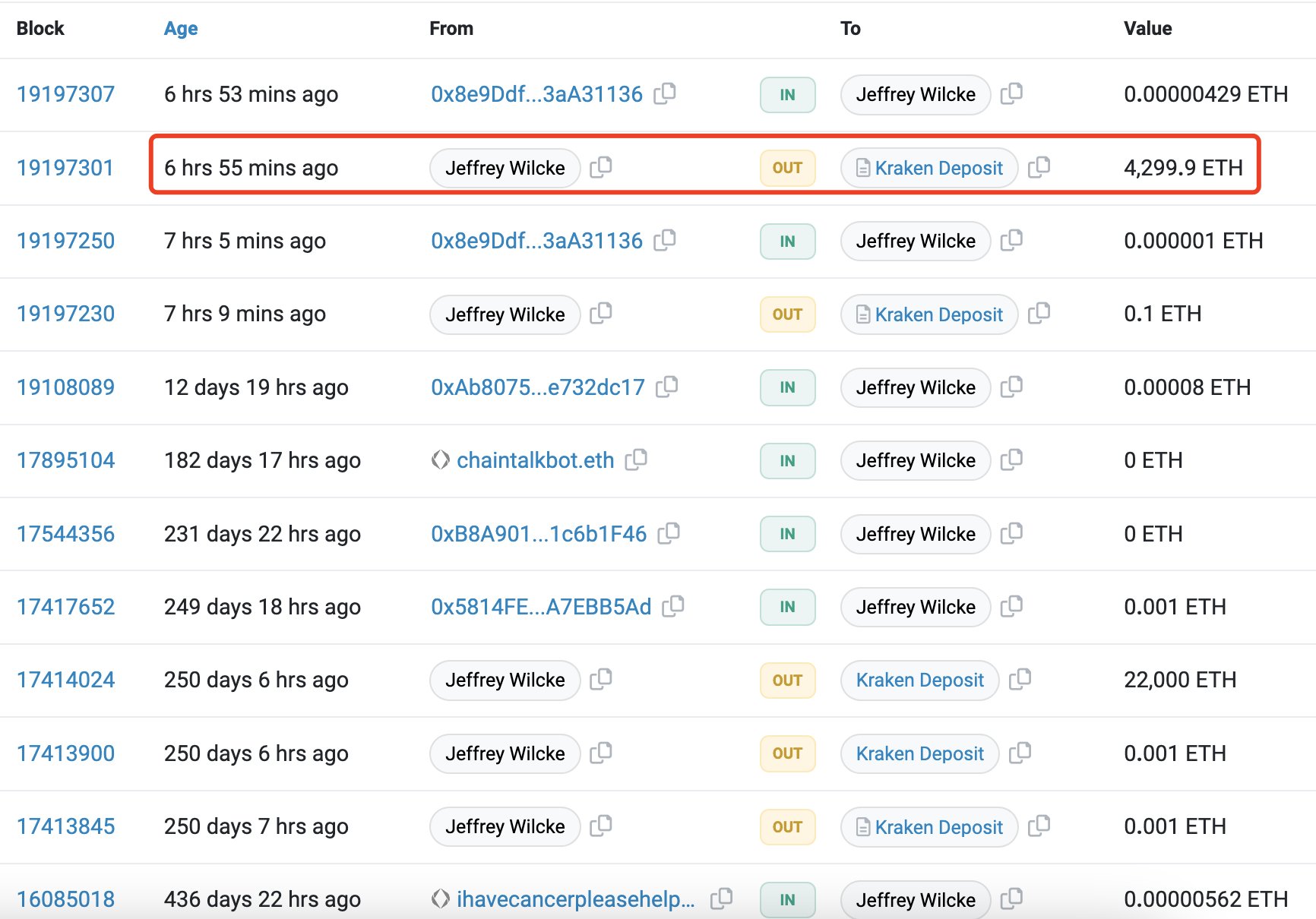

Ethereum‘s co-founder Jeffrey Wilcke has caused a stir within the cryptocurrency community by depositing an equivalent of 10.7 million dollars, or 4,300 ETH, into Kraken just seven hours ago. This transaction is significant on its own but also hints at potential market movements and strategic maneuvers in the crypto space.

Analyzing Jeffrey Wilcke’s Ethereum Investment

The decision by Jeffrey Wilcke to deposit such a substantial amount of Ethereum into Kraken has sparked curiosity and speculation among investors and analysts. Given Ethereum’s status as one of the leading cryptocurrencies, any major move involving a founding partner is bound to attract attention.

Moreover, the timing of the deposit adds another layer of intrigue. The transaction suggests a new decision or strategic move by Wilcke seven hours ago. Analysts will undoubtedly scrutinize this timing to discern any patterns or correlations with broader market trends.

Additionally, the choice of Kraken as the deposit destination is noteworthy. Known as a secure and reliable exchange platform, Kraken is favored by many institutional and high-net-worth traders. Wilcke’s preference for Kraken could indicate his confidence in the platform’s stability and liquidity.

Implications for the Ethereum Market

Wilcke’s deposit of 4,300 ETH into Kraken raises questions about his perspective on the Ethereum market. Although inherently speculative, such a significant move by a founding partner can suggest various possibilities.

Wilcke might be diversifying his crypto assets, spreading risk across different assets or platforms. The deposit could also be part of a larger trading strategy that takes advantage of short-term price movements or arbitrage opportunities.

Alternatively, Wilcke’s action could reflect a long-term investment approach, indicating his confidence in Ethereum’s future growth prospects.

In any case, the Ethereum community is likely to closely monitor the impact of Wilcke’s deposited funds on market dynamics. Price fluctuations, trading volumes, and investor sentiment could all be influenced by such a significant move from a key figure in the Ethereum ecosystem.

Türkçe

Türkçe Español

Español