Token unlock events frequently lead to abnormal price volatility in altcoins and affect their long-term performance. If moves are not made to trigger greater demand for the new supply, we have seen that it can seriously damage the price. In the upcoming hours and days, there will be many important token unlocks.

The Effect of Token Unlocks

Most altcoins are introduced to the market with a limited circulating supply and often fail to return to their all-time high (ATH) levels from their initial periods. Even if their market values multiply the numbers from the ATH period, they are unable to achieve this. For example, DYDX entered our lives in 2021 with only an 80 million circulating supply and reached a price challenging $27. However, as the supply rapidly increased, the likelihood of seeing double-digit prices significantly diminished.

On the other hand, XRP Coin is one of the most popular examples. If the market value of the altcoin returns to its ATH days, the unit price will correspond to a mere $1.3.

Altcoin Unlock Events

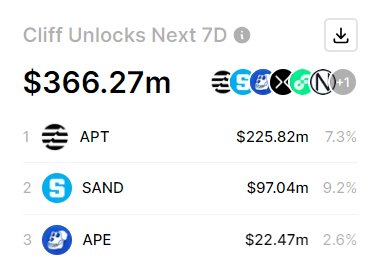

Around 14:00 TSI, Aptos will release 7.32% of its total token supply into the market. According to TokenUnlocks, the amount of APT to be released is worth approximately $224.82 million at the current price. In proportional terms, the largest unlock this week will be by the SAND Token team on Valentine’s Day, February 14th.

The unlock of 9.19% of the SAND Token supply, worth more than $96 million, will enter circulation. This suggests that if we don’t see a big surprise as the unlock date approaches, the price could drop significantly. On February 16th, the cryptocurrency of the Bored Ape ecosystem, ApeCoin, will unlock 2.6% of its total token supply, worth $21.84 million.

One of the biggest unlocks in February will be conducted by the AVAX team, which at the time of writing is priced at $40. On February 21st, supply worth $363.5 million will enter circulation, which is approximately 2.5% of the total supply.

Similarly, we will see an unlock event by the OP Coin team. These unlock events, which increase token inflation, could lead to frustrating outcomes for investors in the coming days and hours. However, the impact can be neutralized, or even cause the price to move in the opposite direction of expectations, with moves like delays in the unlock event, announcements of new projects, or partnerships.