The leading cryptocurrency experienced a swift decline from the $50,000 threshold to $49,185 as inflation data was released. Despite the price drop following the last-minute shared data, BTC continues to linger around $49,500. On the other hand, long upper wicks in the 15-minute candles suggest that profit-taking could continue to drive negativity for a while.

Why Did Bitcoin Fall?

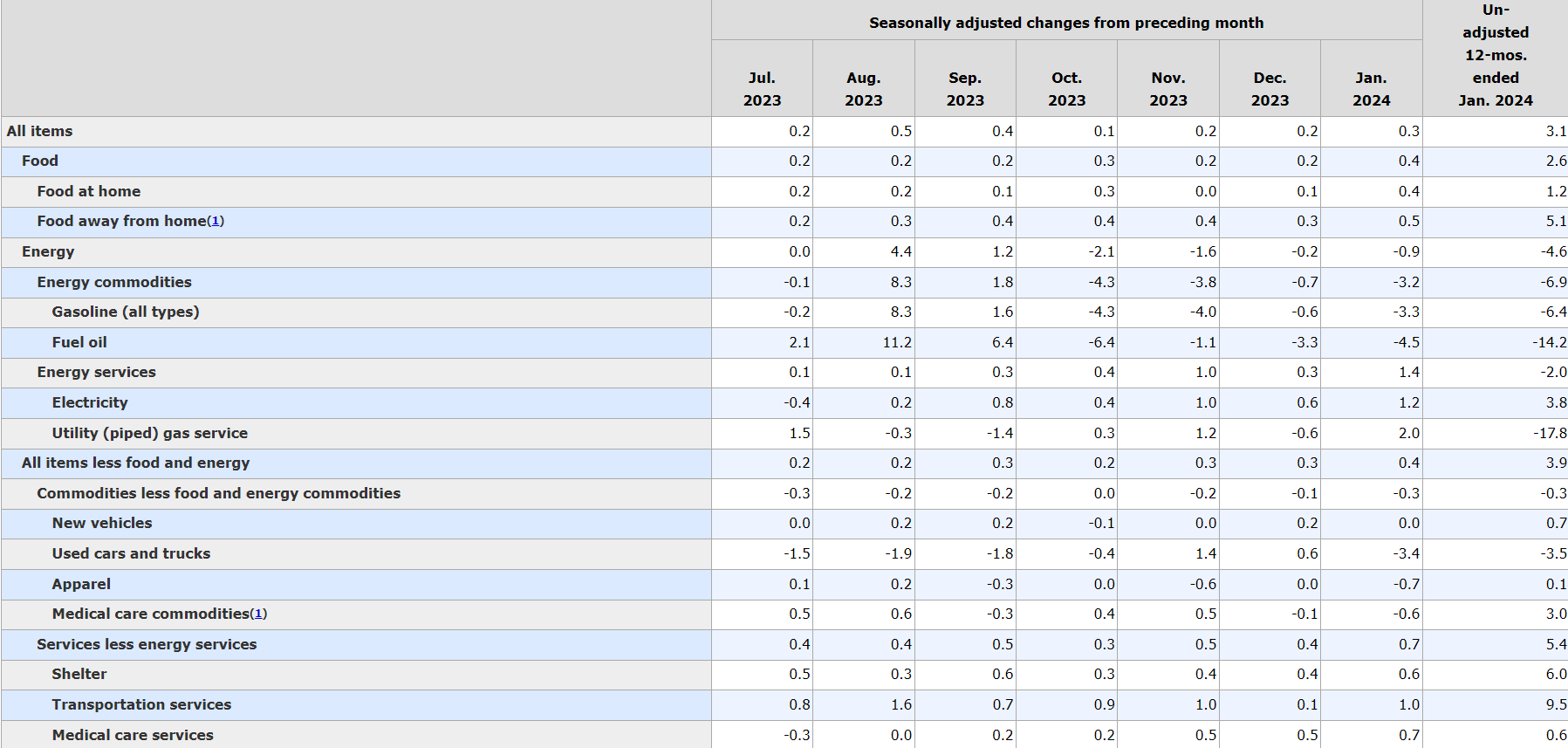

Inflation data showed a decrease compared to the figures in December, yet it came in above expectations again. The primary motivation for investors in risk markets is associated with the continuation of this decline at a similar pace. However, data supporting persistent inflation concerns suggests that the decrease in inflation could halt in the coming months, potentially forcing the Fed to delay interest rate cuts.

The housing index continued to rise in January, increasing by 0.6% and contributing more than double. The decline in energy prices continues to play a significant role in combating inflation. The rise in food prices is starting to attract attention again.

The Fed will likely comment on the need for further data balance and assurance of a downturn, possibly skipping the rate cut in May. This is considerably negative compared to the market a few weeks ago, which expected an 86% rate cut in March.

Bitcoin Price

At the time of writing, at 17:15, the Bitcoin price had fallen to $49,033. Staying above $48,800 would be positive for the coming hours, but the current view suggests the decline could continue. This week we will see statements from Fed members. Tomorrow at this time, Fed’s Goolsbee will speak, followed by Barr and Bostic six hours later.

The Fed members’ approach to inflation in the next 24 hours will be decisive for the market’s performance this week. The rise in altcoins slowed with BTC sales, and daily gains exceeding 5% are approaching neutral territory.

If the downturn continues, the targets of $47,400 and $45,600 remain current. Capo has started warning about deeper bottoms again. However, in a scenario where investors focused on inflation data start to dominate, we could see a new rally supported by ETF entries. Investors should be prepared for liquidity hunting movements in futures trading by setting their stop points well.