As this article was being prepared, the price of BTC was struggling to turn its last daily candle from red to green. If the price can increase by another $1000 and maintain it until the daily close, it could find the support it has been waiting for to reach new highs. But what about the altcoins? What do the predictions indicate for AVAX and SOL Coin?

How Much Will Solana (SOL) Be Worth?

Crypto investors with sufficient experience are focusing on Ethereum layer2 solutions and other alternatives. However, Solana has been attracting more attention lately with its simpler use and airdrops. Phantom user data clearly reflects the excitement around Solana. The latest report stated:

“In January, the monthly active user count reached 3.4 million, a 220% increase from 1 million a year ago. Wallet downloads in the same period went from 167,000 to 941,000, an increase of nearly 500%.”

Approximately 750-800 thousand new investors turned to the Solana network in just one year. Reaching 3.4 million active users is a dream for many networks with massive market values today. Solana could continue to be a hotspot for investors with lower income levels in the future.

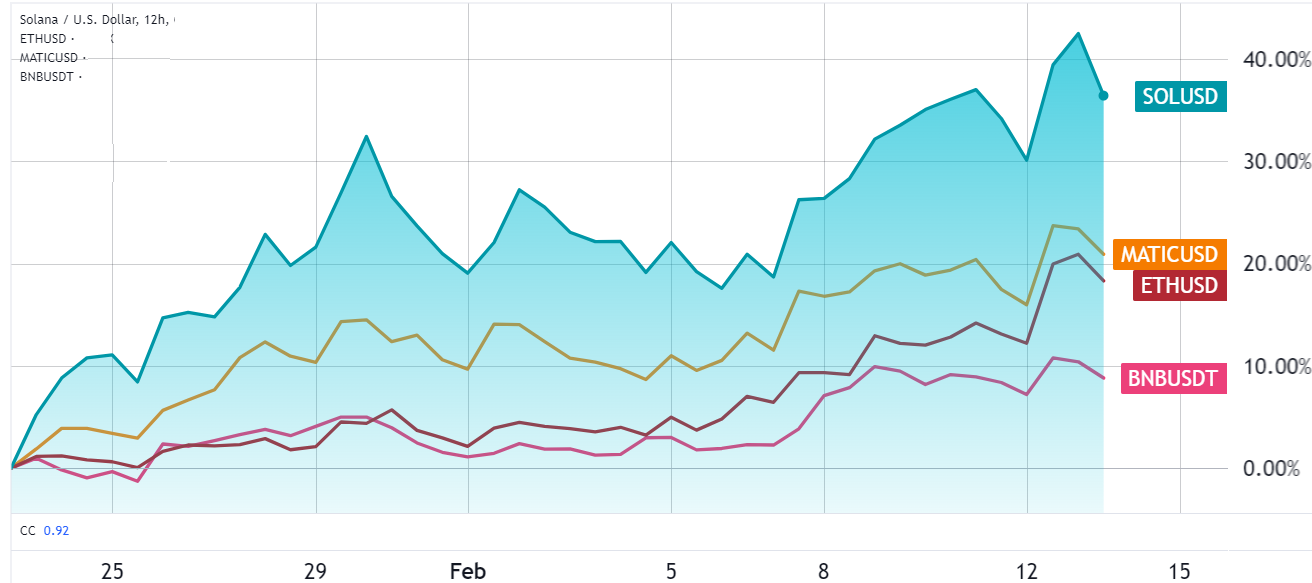

The price of SOL Coin has been highly affected by BTC’s rises for a long time, while seeing less damage during declines. If the price can maintain stability above $110, targets of $120 and $126 can be aimed for. Beyond that, the increasingly vocalized target of $150-158 is also present.

Avalanche (AVAX) Predictions

As BTC returned to $49,500 at the time of writing, the price of AVAX was also at the $40 threshold. For further increases, converting $42 into support is essential. If successful, we could see a swift recovery to the $50 resistance level in the middle of the parallel channel.

In the opposite scenario, closures below $38 could lead to a drop to $32 and $27.5. In a long-term bullish scenario, targets of $68.2 and $92, followed by $104, are identified. We will see the reversal of the major drop in April 2022 with closures above $68.2. However, the price has not yet moved far from the devastating days of the bear market.

Türkçe

Türkçe Español

Español