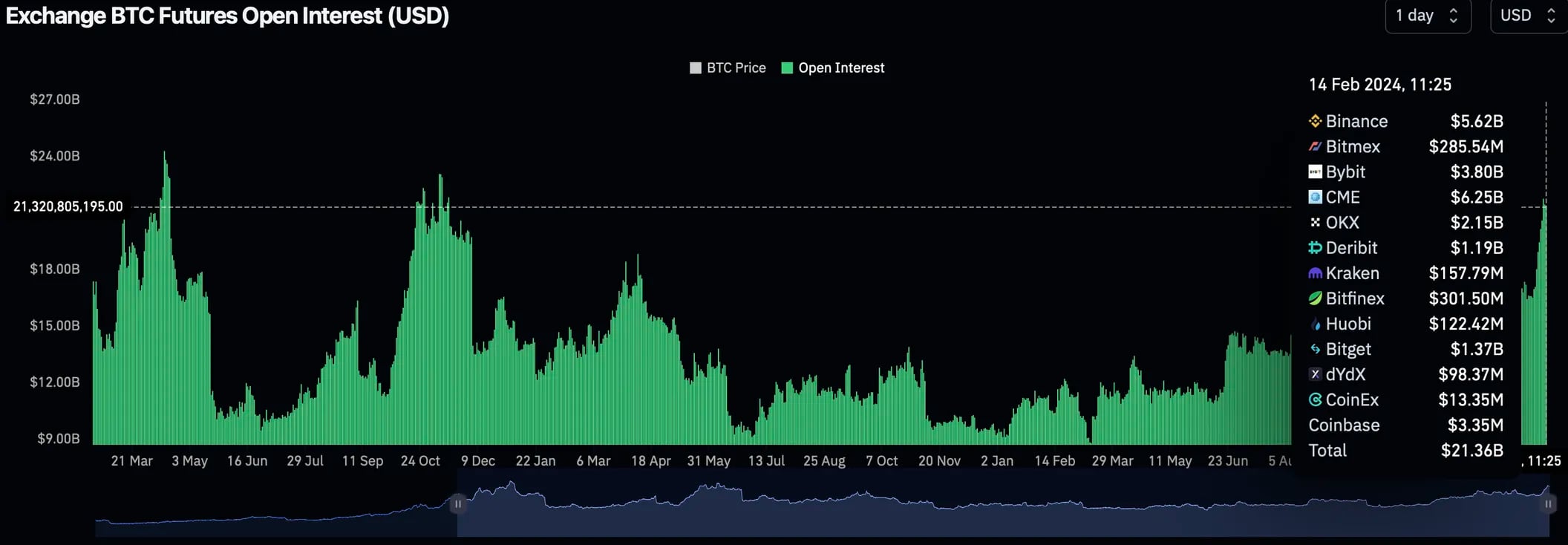

Bitcoin futures and perpetual contracts denominated in US dollars have surpassed $21 billion, reaching a significant milestone not seen since November 2021. Despite this increase in open interest, the overall leverage in the market continues to be relatively low, suggesting a lower likelihood of price volatility due to sudden liquidations.

Conceptual Open Interest in US Dollars Reaches Highest Level in Last 26 Months

According to CoinGlass, the conceptual open interest represented in US dollars for active Bitcoin futures contracts has climbed to $21.3 billion, the highest level in the past 26 months. As per the latest data, open interest in both perpetual and standard futures contracts has exceeded $21 billion, while Bitcoin is trading at $49,570 in the spot market. This increase in open interest reflects a 22% rise since the beginning of the year, approaching the record level of $24 billion observed in mid-November 2021 when Bitcoin was trading above $65,000.

The increased interest in leveraged products like futures, combined with the recent price surge, indicates an influx of new capital on the bullish side, confirming the ongoing upward trend. Bitcoin has experienced a 28% increase in just over three weeks, particularly influenced by strong inflows into newly launched spot ETFs in the US.

Leverage Accumulation Remains Far from Extreme

While it is known that leverage can amplify both profits and losses, the current low overall leverage in the market indicates a reduced likelihood of sudden liquidations leading to a price crash. Liquidations, which involve the forced closure of bullish long or bearish short positions due to margin shortages, are known to cause market fluctuations.

Although Bitcoin’s estimated leverage ratio has risen slightly from 0.18 to 0.20, according to CryptoQuant‘s data, it continues to remain well below the levels seen last August. CoinGlass also reports that the open position in BTC-denominated futures contracts is significantly below the peak of 660,000 reached in October 2022, currently standing at 430,500 contracts.

Noelle Acheson, the author of the popular Crypto is Macro Now newsletter, commented on the current moderate nature of leverage accumulation in the BTC futures market, stating, “Leverage accumulation is still relatively low… It’s climbing quickly, but not yet at frothy levels.”

Türkçe

Türkçe Español

Español