Bitcoin price today continued its upward momentum, approaching the $53,000 level after reaching an intraday high of $52,820. Throughout the week, Bitcoin gained 14.5% in value, and over the year 2024, it has increased by 22%. Consistent spot BTC ETF inflows, the upcoming halving event, and on-chain data are the primary factors behind the recent rally.

Why Is Bitcoin Rising?

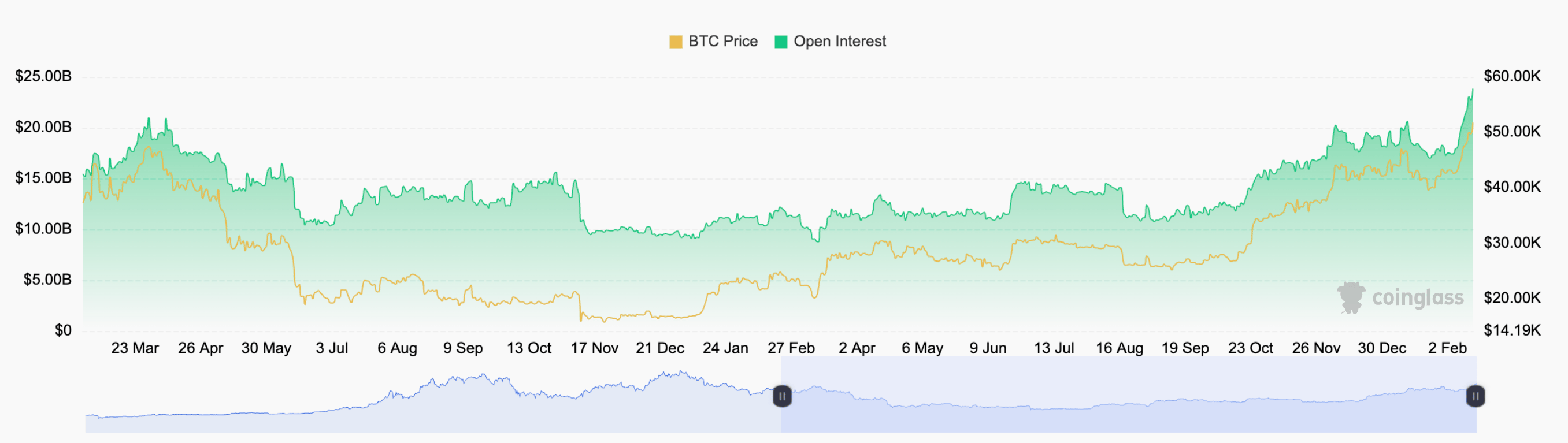

Data from blockchain analytics firm Coinglass indicates that the open interest in the futures market is at $23.85 billion, which is close to the record level of $24 billion reached in mid-November 2021 when Bitcoin soared above $69,000 to its all-time high.

Bitcoin’s open interest has increased by 102% since mid-October, coinciding with Bitcoin’s 93% gain during the same period. The rapid increase in open positions matches Bitcoin’s sharp rise from $45,000 to $69,000 in 2021.

The rise in open positions indicates a renewed interest in Bitcoin among investors, reflecting a continuous influx of new money into the Bitcoin market, particularly due to positive entries into new spot Bitcoin exchange-traded funds (ETFs).

Noteworthy Developments

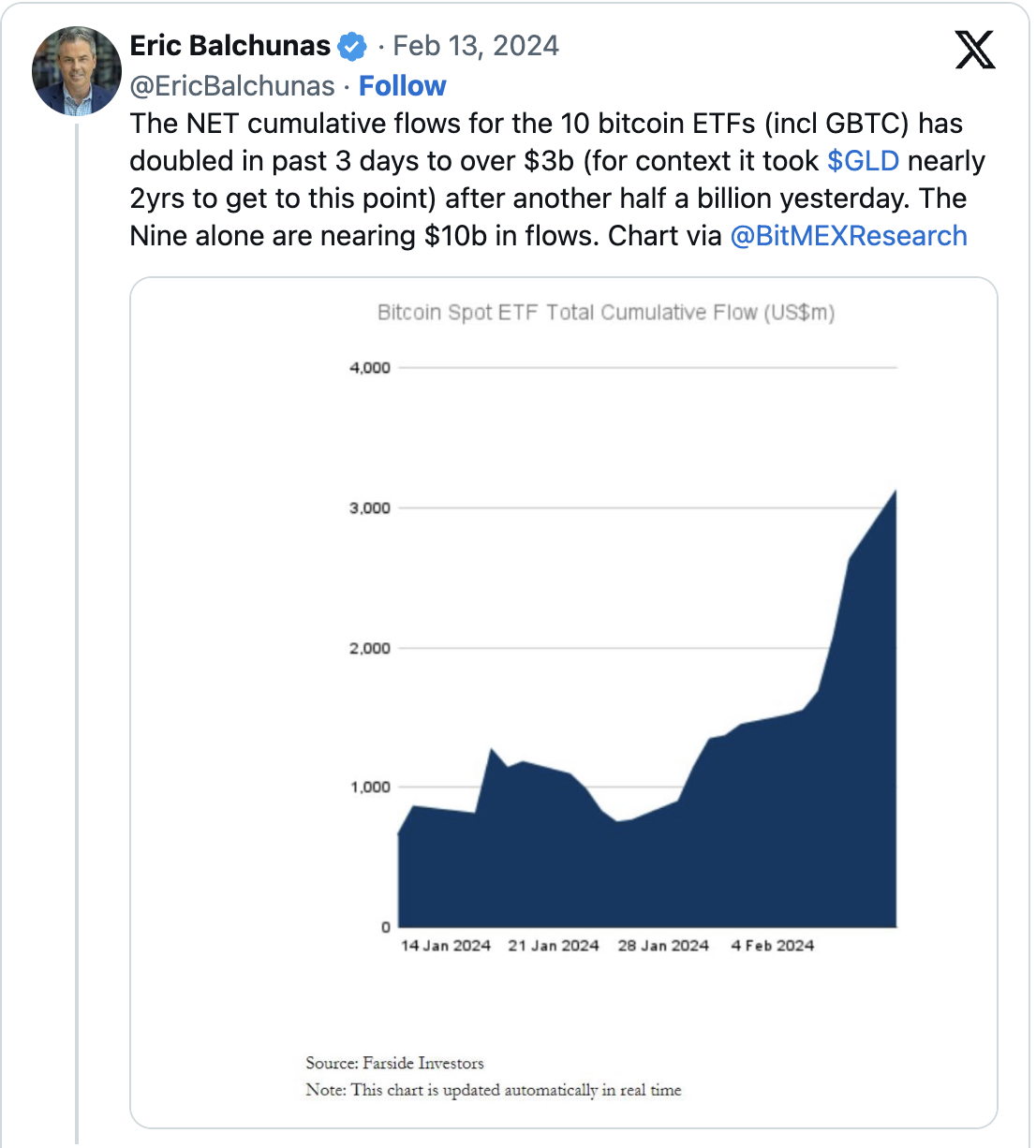

Another factor strengthening Bitcoin’s upward trend is the steady capital inflow into spot Bitcoin ETF funds. Spot Bitcoin ETFs are currently seeing over $3 billion in net inflows, outperforming the initial performance of Gold ETF funds after their launch 20 years ago. According to Bloomberg Intelligence analyst Eric Balchunas, it took $GLD approximately two years to reach the same milestone.

It should be noted that about half of these inflows occurred in the last six days alone, averaging $450 million per day. On February 14th, Grayscale’s Bitcoin ETF fund IBIT broke its own weekly volume record with $760 million in weekly inflows.

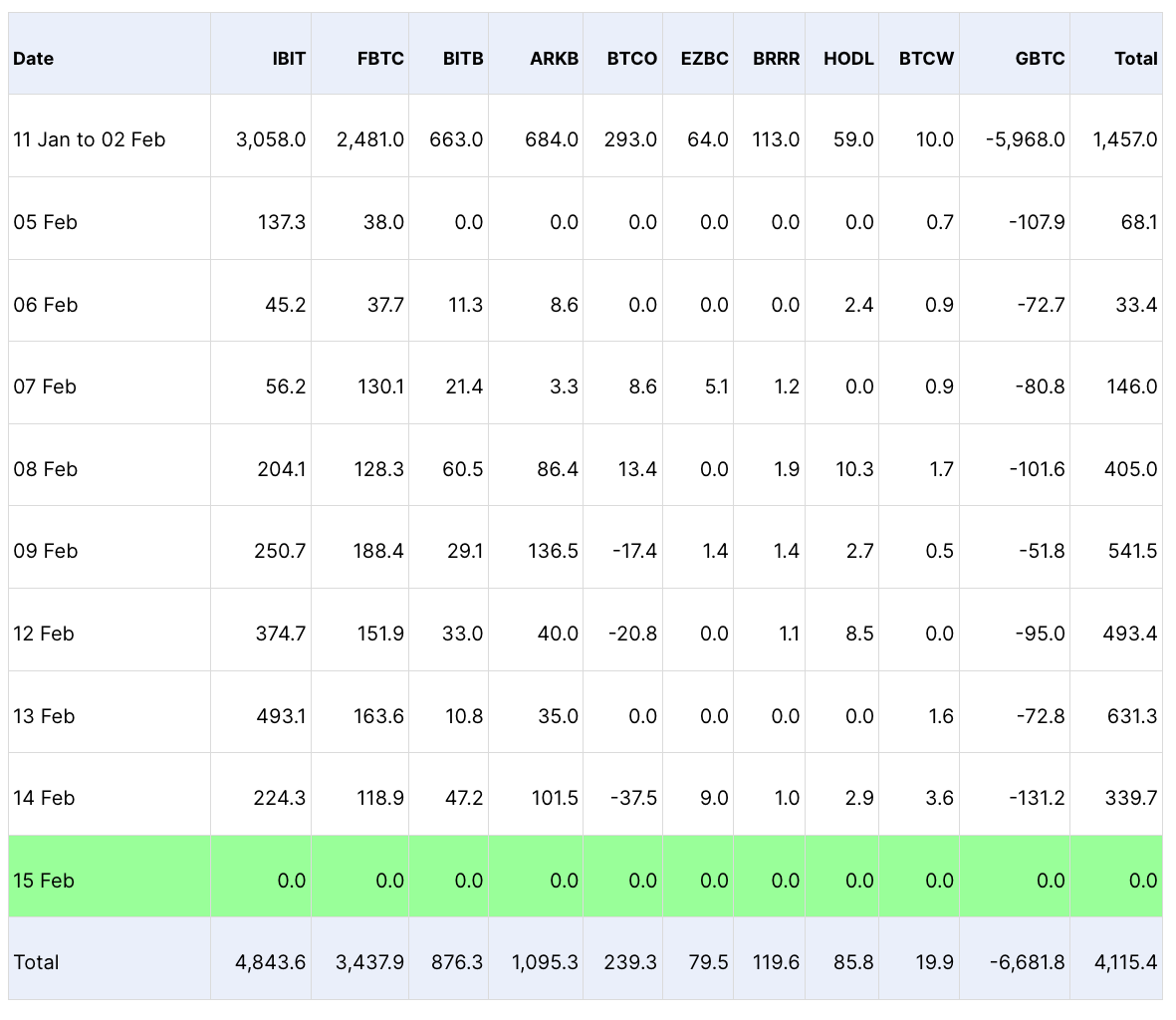

Data from Farside Investors shows that nine new spot Bitcoin ETF funds have accumulated approximately 1.09 billion dollars worth of a total of 10,795 Bitcoins, with BlackRock’s IBIT leading with a total of 4,843 Bitcoins valued at 251 million dollars. LinkPool CEO Jonny Huxtable commented on the matter:

“The inflows we’re seeing into spot Bitcoin ETF funds and the broader interest, especially with only 58 days left until the Bitcoin halving event, signal a very significant moment in global markets. The increasing interest reflected in 11 Bitcoin ETF products underscores the growing institutional and retail adoption of blockchain technology in global financial markets.”

The upcoming Bitcoin halving event, which is expected to halve the rewards given to miners, is also anticipated to play a significant role in further increasing investors’ interest in Bitcoin. Historically, the halving event has occurred before Bitcoin reached new record levels in the months following the event.