Bitcoin‘s (BTC) price experienced double-digit increases over the past week, reaching up to $53,000 on February 16 before falling back to around $52,000. Analysts suggest that the recent rally could primarily be driven by institutional investors, as individual investor participation seems to be waning.

Bitcoin’s Rise Attributed to Institutional Interest

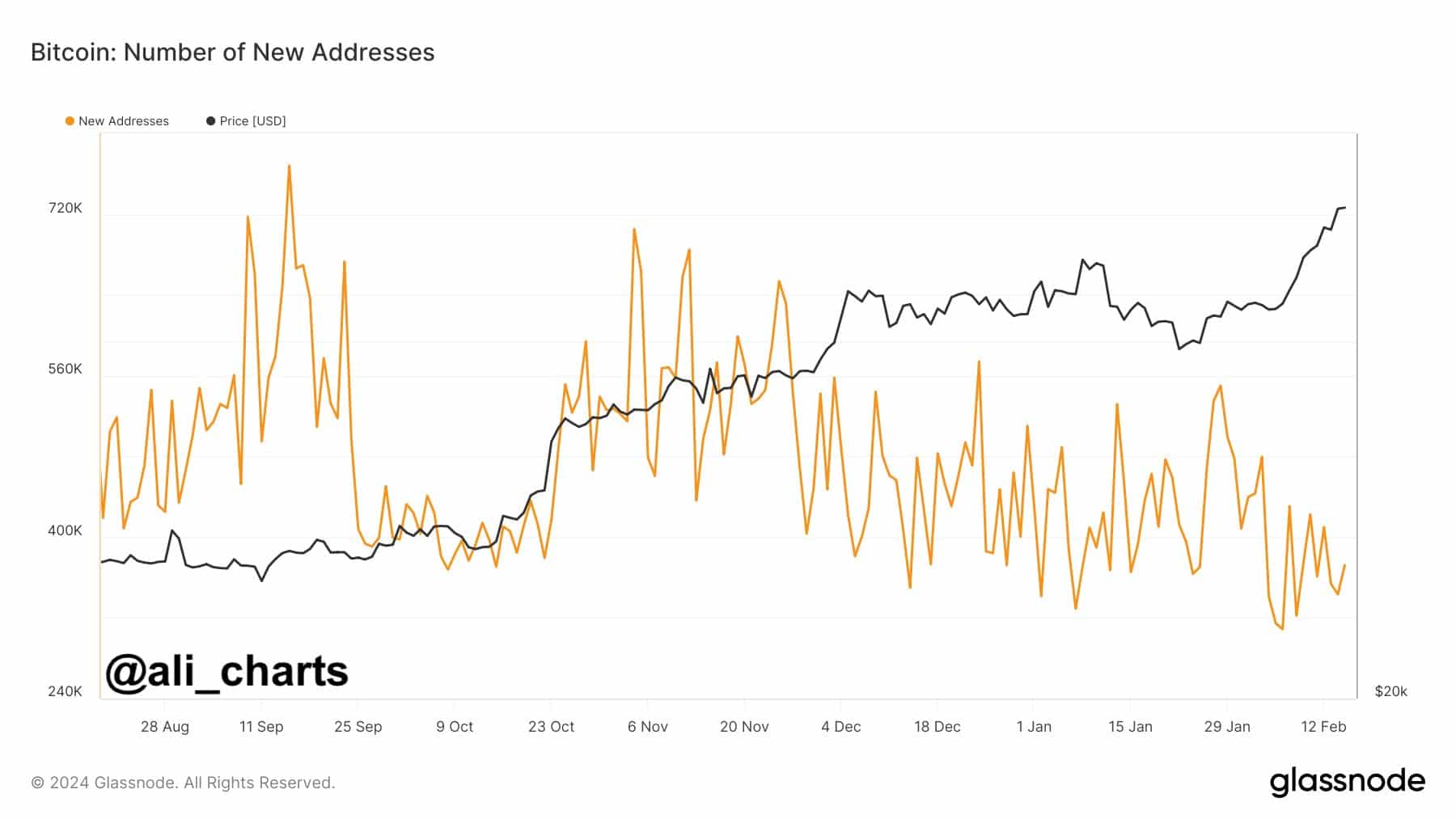

Crypto analyst Ali Martinez pointed out a significant correlation between the rising price of Bitcoin and the decrease in the creation of new Bitcoin wallet addresses daily. This trend indicates a decline in individual participation during the ongoing Bitcoin fluctuations and a predominance of institutional demand.

Martinez’s observation sheds light on the changing dynamics of Bitcoin adoption and highlights the increasing influence of institutional players in the cryptocurrency market. This shift is particularly evident with significant inflows into spot Bitcoin exchange-traded funds (ETFs).

The analyst also reported that Bitcoin whales have accumulated about 100,000 Bitcoins worth approximately $5 billion. This accumulation confirms strong institutional interest in Bitcoin amidst the recent price surge.

Anticipated Supply Shortage Has Not Yet Materialized

Despite expectations of a supply shortage with the increasing demand for spot Bitcoin ETFs in the US, liquidity in the cryptocurrency market has shown growth since the launch of these ETFs. Figures from Bitcoin advocates like MicroStrategy’s Chairman Michael Saylor and Gemini co-founder Cameron Winklevoss indicate that the demand from these newly launched ETFs has significantly exceeded the miners’ BTC production, contributing to Bitcoin’s latest rally. However, current market data still reveals a high amount of Bitcoin in circulation. According to Michael Safai, founding partner of quantitative trading firm Dexterity Capital, liquidity continues to lean towards the demand side, indicating an excess of available BTC for sale.

Another significant development in the cryptocurrency market is the new court ruling allowing Genesis to liquidate its GBTC assets. This decision could create additional selling pressure as companies use their shares and settle their debts. Moreover, miners’ selling activities are partially increasing due to the upcoming Bitcoin code update known as the Bitcoin block reward halving.

When all these factors are combined, a complex landscape emerges for Bitcoin investors; while institutional demand boosts price momentum, potential selling pressure from various sources in the market becomes apparent.

Türkçe

Türkçe Español

Español