Following the process of spot Bitcoin ETFs, the price of Bitcoin continues to rise, with significant predictions for the upcoming halving event. As the Grayscale team’s latest report indicates, the Bitcoin halving event scheduled for April 2024 is expected to be considerably different from previous events due to increased on-chain activity and positive market updates.

The Relationship Between Halving and Bitcoin

U.S. spot Bitcoin ETF funds received significant investments rapidly, with approximately $1.5 billion in initial net inflows in the first 15 trading days. These inflows, equivalent to the selling pressure after a potential three-month halving event, indicate the potential for mainstream adoption.

Angel investor Anthony Pompliano suggests that Bitcoin’s recent milestone of $50,000 is not the ultimate peak due to Wall Street’s interest. As Bitcoin continues to rise, he argues that individual investors will start selling Bitcoin, which will increase demand from Wall Street funds looking to benefit from the cryptocurrency’s upward trajectory.

The upcoming halving will reduce the rate of new Bitcoin entering the market by cutting rewards from 6.25 Bitcoin to 3.125 Bitcoin. This change could push miners to increase efficiency to maintain profitability. Consequently, developments targeting more energy-efficient and powerful hardware to adapt to reduced rewards in mining equipment can be expected.

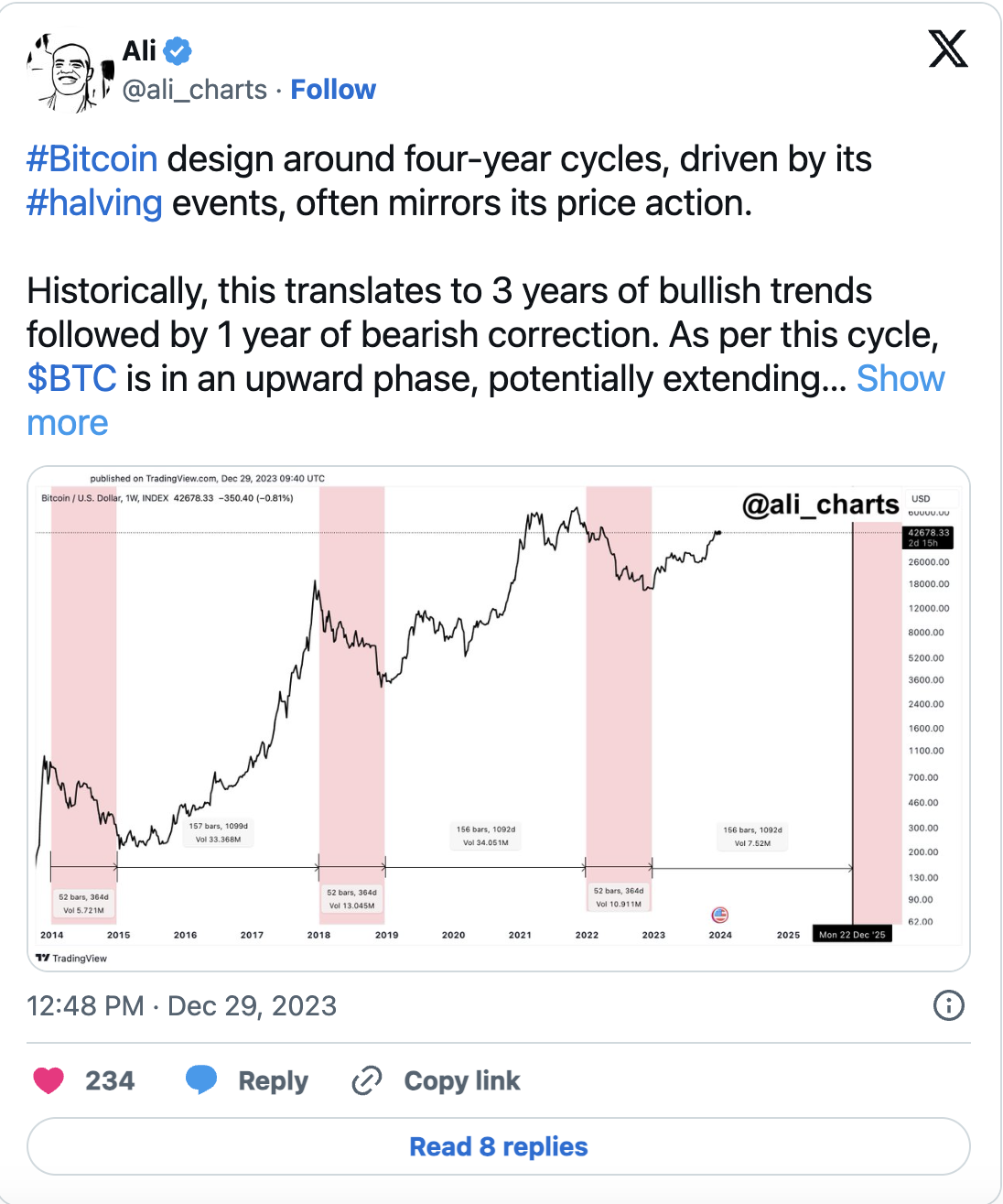

Crypto analyst Ali Martinez recently created optimism within the crypto community with a tweet suggesting that the Bitcoin halving event could trigger a long-term bullish trend for the leading crypto asset.

Optimism Continues Towards the Next Halving

According to a report by Coinbase, the next halving event could potentially enhance Bitcoin’s performance, but it also emphasizes that the limited historical data makes the outcomes somewhat speculative. Historically, with only three halving events and factors such as global liquidity measures affecting previous events, a clear pattern has yet to fully emerge.

Global liquidity appears to have peaked in the near term, and with 9-10 months remaining until the next halving event, the overall impact on Bitcoin’s price behavior remains uncertain for the future.

Crypto analyst Benjamin Cowen stated that the early halving year model for Bitcoin typically reaches the bull market support band, consisting of the 20-week SMA and 21-week EMA, in January or February of the halving year.

Throughout the past year, Bitcoin has shown notable resilience and development, defying bearish market conditions. Despite challenges, it has increased on-chain activities, strengthened its market structure, challenged outdated perceptions with its scarcity, and emerged stronger than ever.

Türkçe

Türkçe Español

Español