Bitcoin’s (BTC) price is consolidating around $52,000, while Bitcoin miners persist in their selling frenzy. What impact might the miners’ sales have on the leading cryptocurrency?

Bitcoin Miners’ Selling Transactions

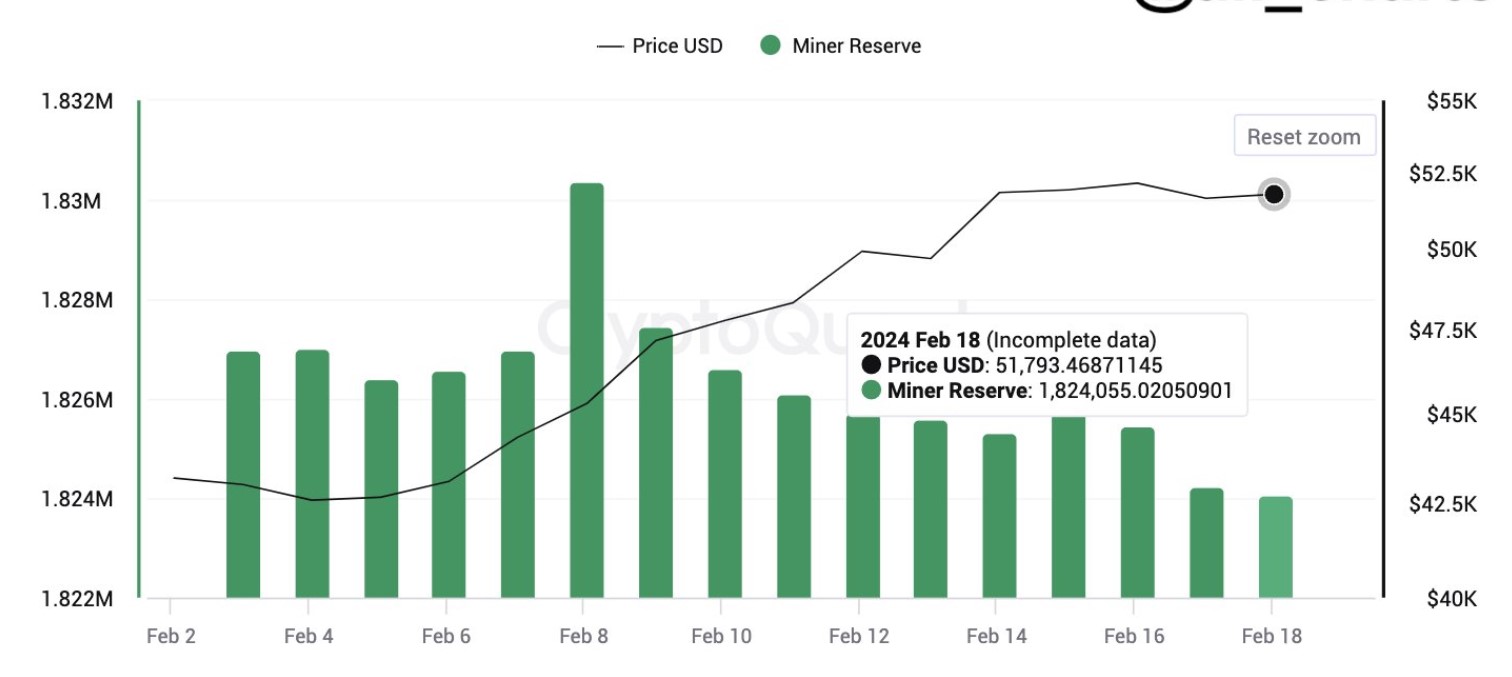

Cryptocurrency analytics platform CryptoQuant’s data may suggest that in the last ten days, Bitcoin miners have taken advantage of the recent price increase. In less than two weeks, the BTC price has risen from about $45,000 to its current price of $51,904.95, following a 2.21% increase in the last 24 hours. The decreasing miner reserve could indicate that these entities are releasing their assets into the market.

Approximately 6,329 Bitcoins were sold from the miners’ reserve between February 8, when it was at its highest for the month, and February 18. The value of the sold tokens exceeds $300 million based on the current market value of the cryptocurrency. Moreover, this selling trend has been ongoing for a while, and the reserve is gradually being depleted. In January, miners liquidated an estimated 10,600 BTC units valued at $455.8 million. This move was labeled as a dynamic market response to a sudden drop in the BTC hashrate at that time, which affected miner profitability.

Miner Reserves

Later in February, the Bitcoin miner’s reserve experienced two days of intense selling. Approximately $600 million worth of Bitcoin was sold, revealing that the reserve had dropped to its lowest level since July 2021. These miners may be selling their holdings to balance mining bills, but such moves appear unhealthy to market analysts.

BTC miners’ ongoing sales could likely trigger a drop in the token’s price, as investors may feel uneasy about what these network validators think about Bitcoin. However, the Bitcoin price could continue its current positive momentum due to a variety of factors, including the impact of a spot Bitcoin ETF and the upcoming halving event. Many market analysts and experts are already quite optimistic about how high the Bitcoin price could reach before and even after the halving event.

Türkçe

Türkçe Español

Español