Bitcoin price has once again climbed above $52,300, neutralizing the impact of negative macroeconomic data. While it’s unclear if the market has fully corrected, the surge in altcoins is boosting investor confidence. ETH has also reclaimed its position above $2,900.

Cryptocurrency Investment Report

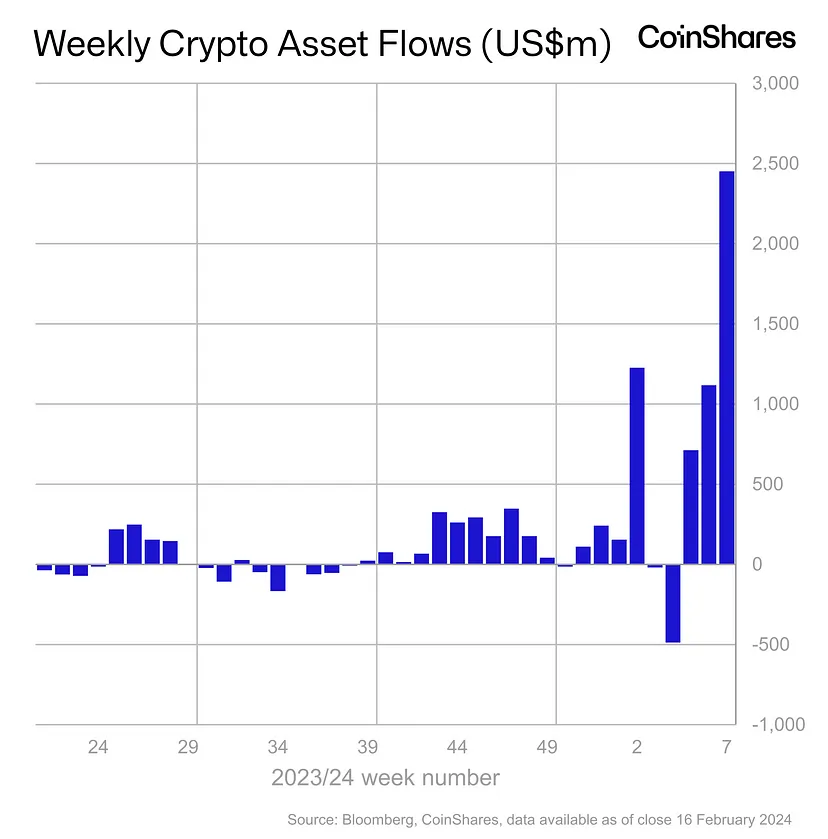

CoinShares weekly report tracks inflows into cryptocurrency investment products. According to the report, there was a net inflow of $2.45 billion last week. The total value of funds has climbed to the level of December 2021. The annual total net inflow has reached $5.2 billion, a promising sign of demand following the nightmare of 2022.

Cryptocurrency funds have reached a reserve size of $67 billion, the highest level since December 2021, setting a new all-time high (ATH). When comparing the average daily net inflow of $450 million over the past five trading days to the total value, the potential appears quite high.

US-based inflows account for 99% of total inflows. Investors in Germany and Switzerland made inflows of $13 million and $1 million respectively. Ethereum saw a total inflow of $21 million, while AVAX, LINK, and MATIC attracted less than $1 million each.

Türkçe

Türkçe Español

Español