Liquid re-staking protocols, also known as re-stake protocols, have shown a strong signal of growing interest among Ethereum (ETH) investors as the total value locked (TVL) in these assets has surpassed $3.5 billion. Last month, protocols such as Etherfi, Renzo, Kelp, and Puffer saw a significant increase in deposits, largely due to users maintaining access to their funds through these platforms by leveraging EigenLayer.

Intense Interest in Liquid Re-Staking Protocols

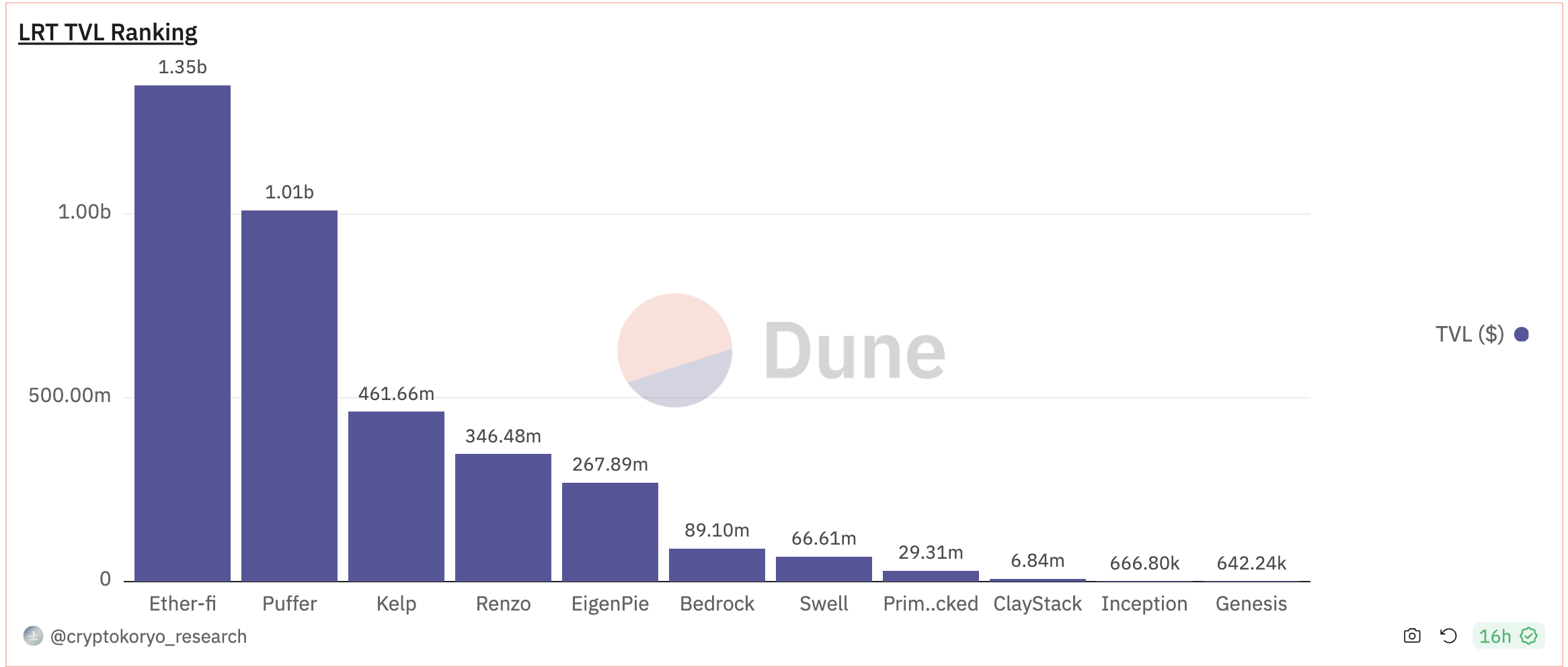

According to data compiled by Dune Analytics, among liquid re-staking protocols, Etherfi leads in TVL with an impressive $1.3 billion. Following Etherfi are Kelp with over $460 million and Renzo with $346 million in TVL. Puffer, the latest entrant to the liquid re-staking world, saw a rapid increase in its TVL, surpassing the billion-dollar mark shortly after its launch.

While larger protocols dominate the space, smaller players such as Bedrock, Swell, Prime, and ClayStack have also contributed to the overall increase in TVL, drawing millions of dollars collectively to the ecosystem. This diversity indicates a growing interest and participation in liquid re-staking protocols across the Ethereum network.

Liquid re-staking enhances the economic security of the network by allowing token holders to stake their assets on EigenLayer. Unlike traditional liquid staking methods, which involve staking assets through a service provider, liquid re-staking enables users to contribute directly to the security of third-party networks while maintaining liquidity.

EigenLayer Shines as a Key Player

The significant role of EigenLayer in increasing these protocols’ TVL cannot be overlooked. The platform has facilitated the deposit and withdrawal of various liquid staking tokens, leading to significant growth in TVL across the ecosystem. Currently, EigenLayer’s TVL impressively exceeds $7 billion, positioning it as one of the leading players in the Ethereum ecosystem.

Despite a temporary pause in the re-initiation of deposit transactions through liquid re-staking tokens on EigenLayer, re-staking protocols continue to accept ETH deposits and re-stake on behalf of users. This ongoing commitment ensures a seamless experience for users and underscores the protocols’ determination to maintain liquidity and security.

Furthermore, users participating in the re-staking process on EigenLayer earn rewards in the form of points, potentially increasing their chances of receiving protocol tokens. With the allure of potential AirDrops and additional rewards from both EigenLayer and the protocols themselves, users are increasingly investing in re-staking protocols, strengthening the ecosystem’s growth trajectory.

Türkçe

Türkçe Español

Español