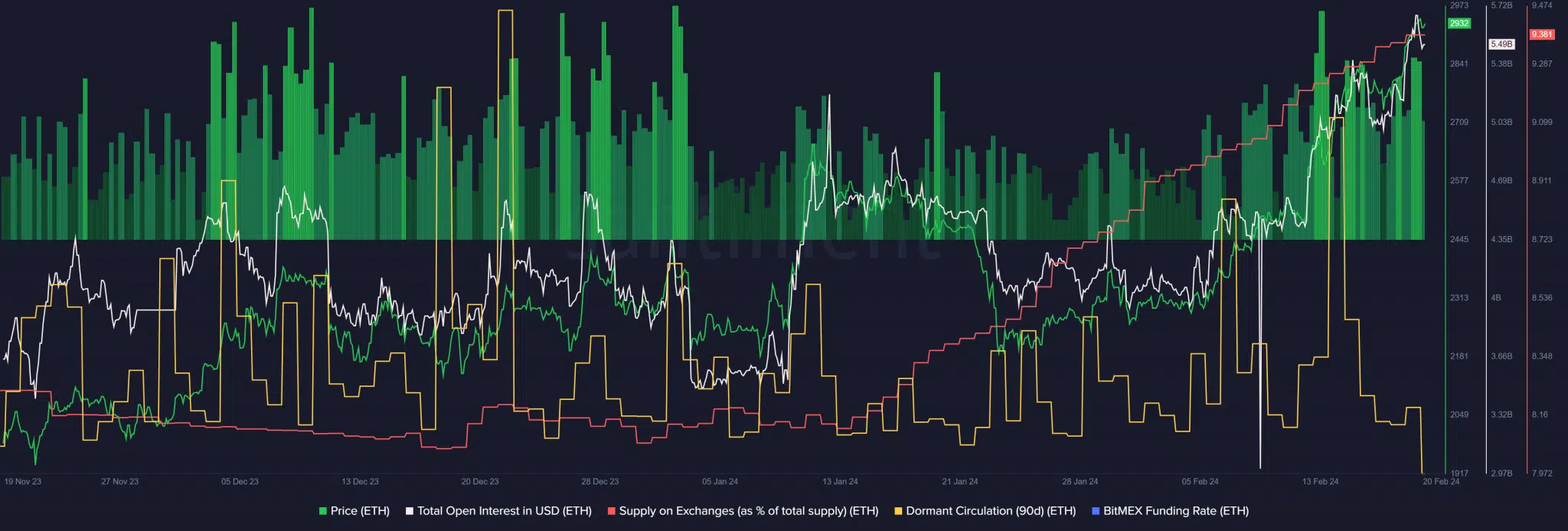

Ethereum (ETH) has overcome the $2,600 resistance level that sellers have defended since the middle of January. The latest uptrend has caused a substantial rise in open interest for Ethereum. Cryptocurrency analytics firm Santiment reported significant increases in open interest (OI) for both Bitcoin (BTC) and Ethereum.

Santiment Reports on Ethereum’s Activity

Open interest for ETH last reached $5.4 billion in March 2022. A recent analytical report also highlighted the bullish trend behind Ethereum on the 12-hour chart. The report mentioned that a pullback towards the $2,600 range could present a buying opportunity. The strong increase in open positions in recent weeks is not the only indicator signaling a bullish sentiment behind the altcoin.

ETH’s funding rate has also been consistently positive. This suggests that long positions have been dominant for a significant part of the past three months. However, an increasing supply metric on exchanges could indicate that selling pressure may start to rise, potentially reversing gains made in recent weeks. The aforementioned price trend has surpassed the $2,600 level and has been on an uptrend since October.

Current Data on Ethereum

In addition, open interest has been steadily increasing over the past two months, reinforcing the idea of strong market confidence. However, the supply distribution chart shows that addresses holding any amount of Ethereum between 0 to 10 million have been selling off in the last three months. The whale category saw an increase at the beginning of January, but this trend quickly reversed.

This suggests that ETH holders have been gradually selling off some of their assets in recent months. Addresses holding 10 million or more ETH are also on the rise, which could explain why the mentioned metric is slowly decreasing in percentage terms. Moreover, according to experts, other on-chain metrics continue to indicate bullish conditions.

Türkçe

Türkçe Español

Español