Bitcoin‘s (BTC) price increase has led many investors to believe that a correction might be imminent. However, new data could indicate that BTC’s upward trend may continue. This situation could be related to increasing BTC volumes.

Daily Trading Volumes in BTC

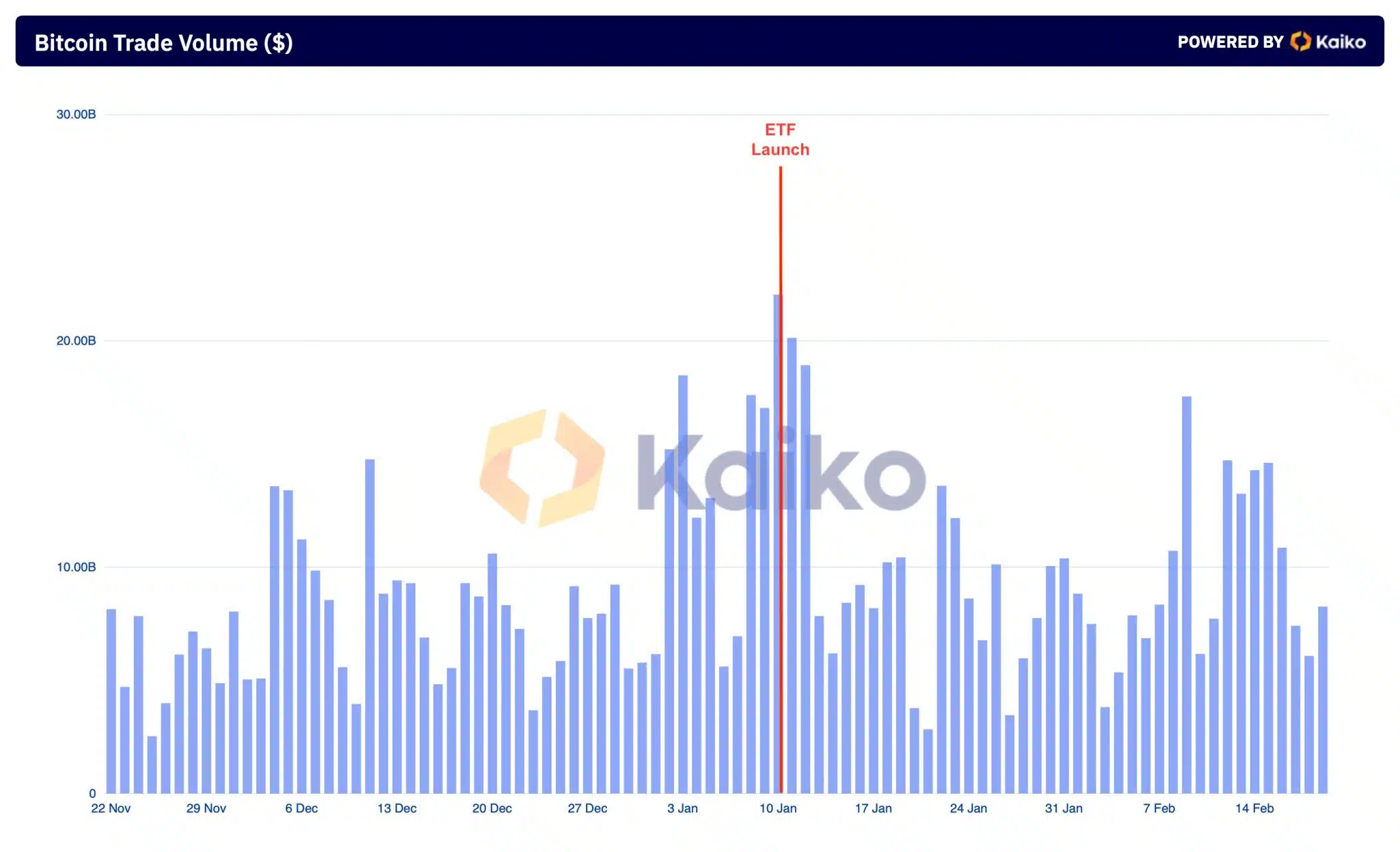

According to the data obtained, the daily trading volume of BTC was over 10 billion dollars in the second half of February. An increase in BTC’s daily trading volume can often indicate increased market activity and interest. Higher trading volumes can positively affect Bitcoin in various ways. Moreover, increased volume usually points to increased liquidity, which can facilitate investors’ ability to trade without causing significant price volatility. This increased liquidity can attract more institutional investors, contributing to a more stable market.

Furthermore, higher trading volumes are often associated with increased investor confidence and participation. However, the mentioned volumes did not surpass the highest levels reached in 10 months, just before the ETF launch on January 10th. At the time of writing, BTC was trading at $51,739.42, with its price having decreased by 0.35% in the last 24 hours. BTC’s price fluctuated between $50,0683 and $53,054 during this period.

Critical Level in Bitcoin

The cryptocurrency has shown multiple high and low levels but has not formed a larger trend. The resistance level of $53,054 has been tested several times, which could indicate weakening during this period. The Relative Strength Index (RSI) for BTC was at 50.52, suggesting that the momentum around BTC’s price is relatively neutral. If the bullish momentum turns into an increase in the near future, it could raise the likelihood of BTC’s price surpassing the $53,054 level.

For BTC’s price to increase further, there needs to be a rise in interest from both whales and individual investors. According to analyses of Santiment data, the interest of both whales and individual investors seems to have decreased in the last few days. Additionally, recent data shows that Bitcoin holders have generally made a short-term profit. It is not yet known whether these addresses will wait for BTC prices to drop further before they start accumulating again.