The United States cryptocurrency exchange Coinbase has firmly backed Grayscale’s application to convert its Ethereum Trust into a product traded on the spot Ethereum exchange, with one of their main arguments being that Ethereum is not viewed as a security. On February 22, Coinbase’s Chief Legal Officer Paul Grewal shared a 27-page letter summarizing the legal, technical, and economic reasons why the Securities and Exchange Commission (SEC) should approve an Ethereum-based ETF fund.

Coinbase’s Striking Statements

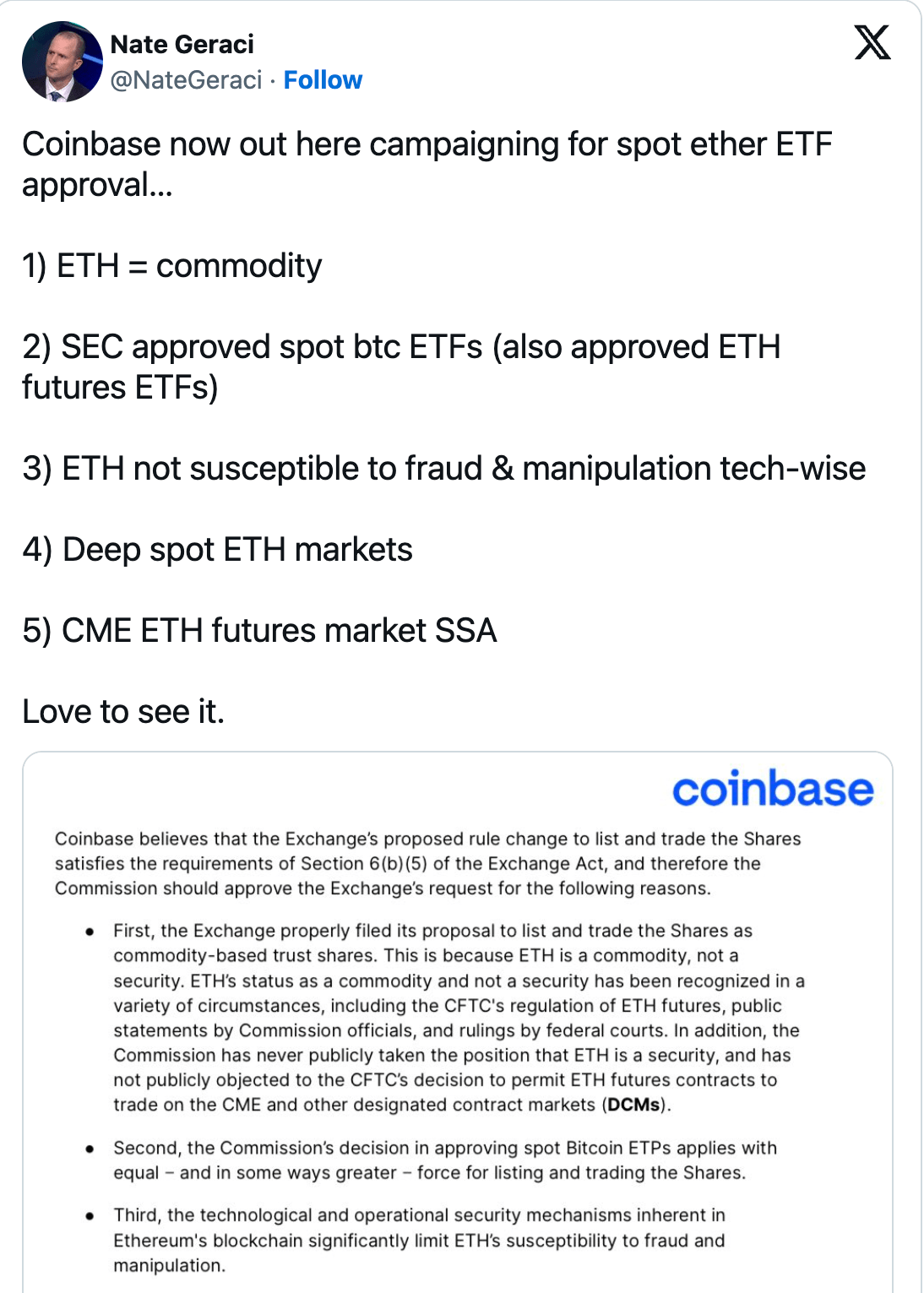

Coinbase made a total of five main arguments, but the most striking was the claim that Ethereum is appropriately classified as a commodity rather than a security, as evidenced by the Commodity Futures Trading Commission’s (CFTC) approval of Ethereum futures, statements by SEC officials, and court rulings. Moreover, the SEC did not object to the CFTC’s assessment of Ethereum as a commodity:

“Our letter states something that anyone paying even the slightest attention to the matter knows: Ethereum is not a security. In fact, before and after the merger, the SEC, CFTC, and the market have treated Ethereum as a commodity, not a security.”

The second argument of the letter states that the SEC’s approval of spot Bitcoin ETF applications, while not stronger, is equally valid for an Ethereum ETF fund. Market data showing the widespread ownership and trading activity of Ethereum, high liquidity, and tight trading spreads were argued to be indicators of an efficient and mature market.

Details on the Ethereum ETF

Ethereum futures ETF funds are similar to spot Ethereum-based funds, so it would be arbitrary for the SEC to approve one but not the other, considering the tight correlations. The firm also argued that the technological and operational security mechanisms inherent in the Ethereum blockchain ecosystem significantly limit the susceptibility of Ethereum to fraud and manipulation.

Additionally, the asset’s market depth, transaction tightness, and price correlation across spot markets were shown as indicators of a market resistant to fraud and manipulation. Lastly, Coinbase mentioned that it has sophisticated market surveillance to monitor transactions on its platforms and an agreement with the Chicago Mercantile Exchange (CME).

The letter was presented in response to a proposed rule change by NYSE Arca to list and trade shares of the Grayscale Ethereum Trust (ETHE) as an Ethereum ETF. The SEC is soliciting public feedback on the proposed rule changes before making a decision.

Türkçe

Türkçe Español

Español