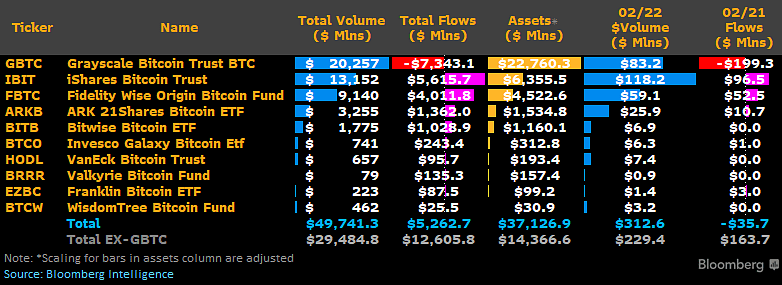

As of February 22, the total spot trading volume for all ten issuers of Bitcoin ETFs is very close to surpassing $50 billion. Data shared by senior ETF analyst James Seyffart from Bloomberg Intelligence reveals that the combined trading volume of Grayscale’s GBTC, BlackRock’s IBIT, Fidelity’s FBTC, and others is currently pegged at $49.7 billion.

Current State of Bitcoin ETFs

The mentioned figure is very close to the $50 billion mark, and if trading volume continues to strengthen, it is likely to reach this number before the end of the day. Grayscale has recorded up to $20 billion in trading volume, yet its total flows still indicate significant outflows. All spot Bitcoin ETFs witnessed a substantial outflow of $88 million as of the date of the data release. IBIT recorded approximately $13.15 billion with $5.6 billion in total flows.

Fidelity’s FBTC registered $9.1 billion in trading volume and $4 billion in total flows. Compared to its impressive rise of over 12% in pre-market trades during its first week, Valkyrie is not seeing as much trading volume as other spot Bitcoin ETF issuers according to current data. Valkyrie recently expanded its BTC custody list to include BitGo to strengthen its position.

Reasons Behind Bitcoin’s Rise

Despite Valkyrie’s trading volume being only $79 million, its total flows ($135 million) are surpassing those of VanEck ($95 million), Franklin Templeton’s EZBC ($87.5 million), and WisdomTree’s BTC (with the lowest volume at $25.5 million). The growth in trading volume of these spot Bitcoin ETFs can be linked to the recent surge in Bitcoin’s price. A few days ago, Bitcoin’s price surpassed the $52,000 mark and is currently positioned at $51,440.50, with a 0.23% increase over the last 24 hours.

Many analysts remain optimistic about BTC experiencing further growth in the coming weeks. Noted cryptocurrency analyst Ali Martinez predicts Bitcoin’s price could rise to $57,000, especially with the growing curiosity among analysts and investors in the global crypto world. Additionally, Max Keizer is optimistic that the Bitcoin price could increase tenfold from its current level, though his prediction may be linked to an impending major correction in the US stock market. The signs of a rise in Bitcoin’s price could serve as a positive catalyst that may further drive FOMO into the spot Bitcoin ETF market in the near term.

Türkçe

Türkçe Español

Español