Due to the astonishing progress of artificial intelligence and the recent gains associated with NVIDIA, some stocks have been observed to rise in the American stock market. Additionally, there has been a development on the Solana (SOL) network. A meme token with the same ticker as NVIDIA on the SOL network has also seen an increase due to this hype.

What’s Happening on the Solana Side?

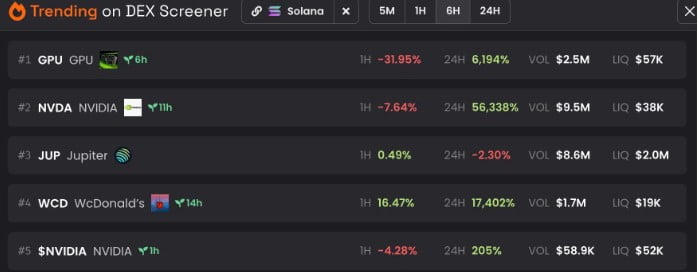

Within just 11 hours, the price of the SOL-based meme token NVDA soared by an alarming rate of 56,000%. The reason for concern about this increase is the extremely low trading volume.

Furthermore, other tokens with the same ticker as the GPU giant NVIDIA have hosted extreme growth within the last 24 hours. It is important to remember that this price increase requires careful attention and may not be sustainable in the long term.

The transient nature of these token price increases could leave many investors in a difficult position and could even lead to a rug-pull once a certain volume is reached.

Despite these assumptions, the Solana network and SOL token could benefit from the increased interest in these smaller tokens. The use of the Solana network for the development and transactions of these tokens could improve overall activity on the network and create significant benefits for the ecosystem.

Current Situation with Solana (SOL)

After testing the support level at $79.20 on January 23, the price of SOL experienced a 31.22% increase. During this period, SOL’s price showed volatile movement.

The resistance level at $117, having been tested several times in the past few months, appeared to have weakened. If SOL challenges this level again, there is a possibility that the token could break through and reach new highs. A decline in the RSI for SOL was observed, and at the time of writing, it was at the 42 level. This could indicate a negative outlook for the price of SOL.

At the same time, some traders and analysts might interpret the situation as a signal that SOL’s price is low or that there is excessive selling pressure, potentially indicating a level for a rebound.