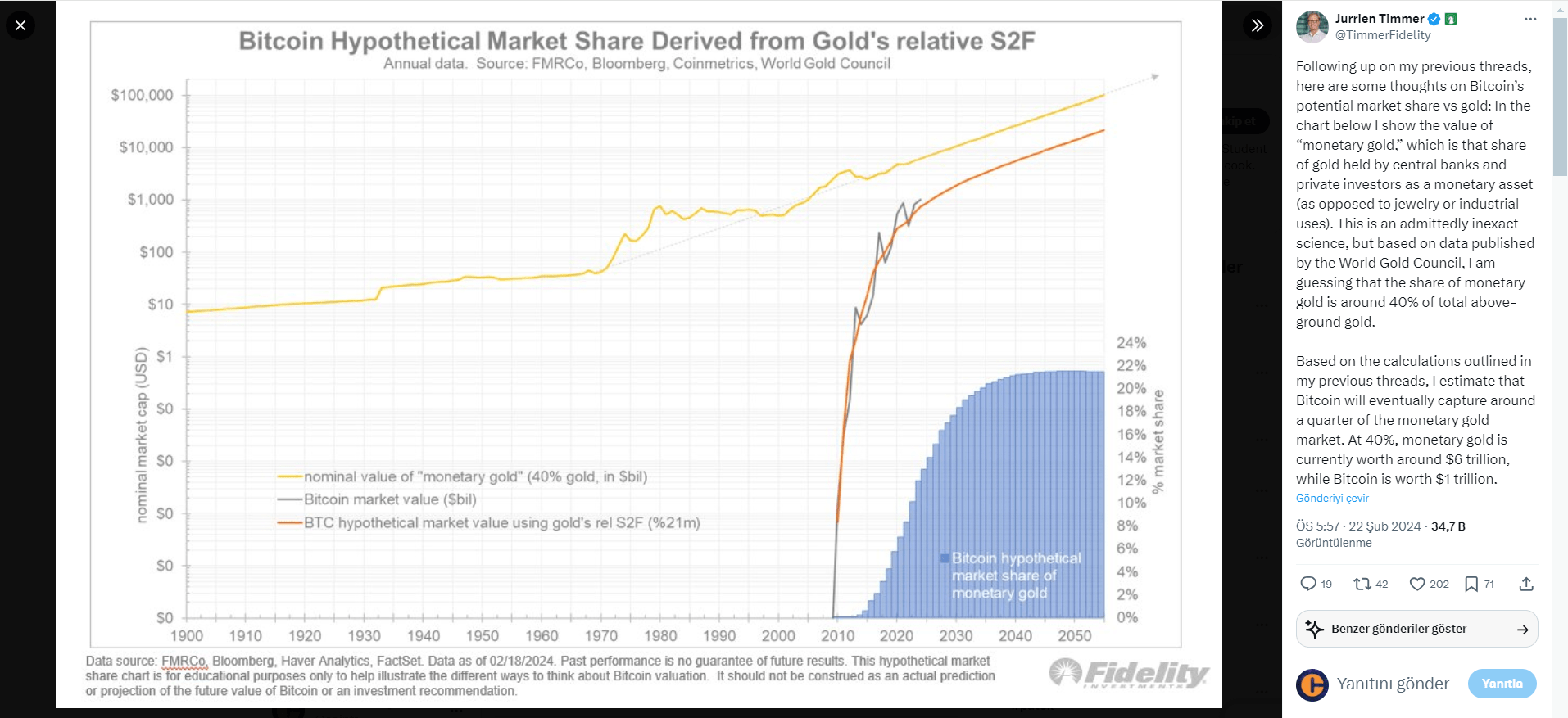

Today, Fidelity’s Global Macro Director Jurrien Timmer made a prediction about the Bitcoin price. The forecast is made by comparing the monetary value of the Bitcoin and gold markets. According to Timmer, Bitcoin has the potential to reach a market value equivalent to a quarter of the global gold market. Timmer’s estimate suggests that Bitcoin could achieve a market value of $6 trillion.

Bitcoin Price Has 6x Potential

Timmer’s striking approach is based on the premise that Bitcoin will strengthen its position as a store of value and be increasingly accepted as digital gold. This parallels the portion of gold used for monetary purposes with Bitcoin. It is mentioned that the monetary portion of gold reserves used by central banks and private investors, excluding industrial or jewelry use, amounts to approximately $6 trillion. Timmer emphasizes this quarter of the $6 trillion figure.

According to Timmer’s forecast, Bitcoin will capture a significant portion of this vast monetary gold market. As a result, it will increase its current market value, which exceeds $1 trillion.

Strengths and Weaknesses in Timmer’s Approach

The strong points in Timmer’s analysis highlight the natural attributes of the cryptocurrency Bitcoin, such as its scarce supply making it valuable and its increasing acceptance as a hedge against inflation and currency devaluation, aligning with the monetary role of gold. Additionally, Bitcoin’s digital and decentralized nature positions it as a modern alternative, becoming popular especially among tech-savvy and younger investors.

However, there are some weaknesses and uncertainties in this forecast. The cryptocurrency market is highly volatile, subject to regulatory changes, technological advancements, and the evolving environment of digital assets. Moreover, the market dynamics of Bitcoin, including competition with other cryptocurrencies and Blockchain projects, are quite distinct. All these factors contribute to the uncertainty of Bitcoin reaching the market value proposed by Timmer.

On the other hand, the comparison with gold does not fully account for the intrinsic dynamics of the cryptocurrency market and overlooks the possibility of Bitcoin being replaced by another digital asset or technology.

Türkçe

Türkçe Español

Español