Google search data indicates that individual investors have not yet taken a position on the Bitcoin front. The price of Bitcoin has been on the rise for the past few months, climbing from below $20,000 in June 2023 to over $50,000. The primary reason for this is the approval of spot Bitcoin ETF applications in the United States, yet individual investors are still not present in the market.

Individual Investors’ Interest in Bitcoin

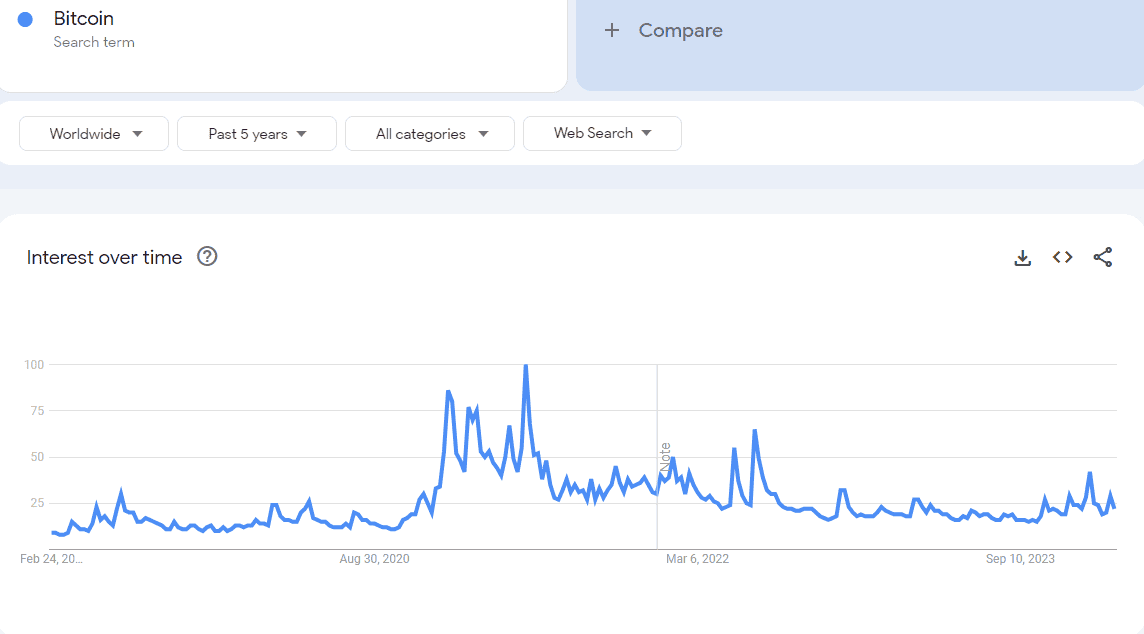

Google Trends data reflects the typical behavior of individual investors. This is due to people still tending to search more for investment options. The cryptocurrency market is perhaps most notable for these kinds of sentiment shifts.

Such a cycle was last seen in 2021 when prices exploded and the crowd of individual investors was everywhere. During this period, analysts predicting Bitcoin prices would rise to $100,000 in the following months stood out on Twitter, but Bitcoin lost value and individual investor interest waned.

Bitcoin began to recover in June 2023 when BlackRock applied to launch a spot Bitcoin ETF fund. Considering the company’s significant success rate in the ETF space, institutions began to show more interest in Bitcoin, igniting a significant spark in the market. This change created excitement and was followed by a price increase. Bitcoin rose from below $20,000 in June 2023 to over $40,000 at the beginning of January. Subsequently, approvals came for 11 spot Bitcoin ETF products.

What to Expect on the Bitcoin Front?

While large investors and institutions are taking steps towards Bitcoin with significant purchases, reports frequently emerge of smaller asset owners liquidating their holdings. Google Trends data shows a similar situation; worldwide queries for Bitcoin are far from the 2017 boom, the 2021 bull run, and even the 2022 industry crash.

Apart from a brief spike related to the ETF approvals in mid-January, searches barely surpassed the 2019 bear market and the 2020 Covid-induced correction. This indicates that, although the price of Bitcoin has more than doubled since last June, individual investors have not fully arrived yet. However, considering Bitcoin’s price performance after each of the previous events, the upcoming halving event could change all that.

Therefore, it could be interesting to follow whether individual investors will be behind another run-up to a new all-time high for Bitcoin in the coming months.

Türkçe

Türkçe Español

Español