Popular investor and analyst Rekt Capital states that Bitcoin halving events tend to offer investors a final bargain purchase opportunity at the start of macro uptrends. Rekt Capital analyzed Bitcoin price retracements seen around both the 2016 and 2020 halving events in one of their latest YouTube posts.

What to Expect During the Halving Process?

The first of these events reached 40% of the local peak just before the halving event, while the 2020 halving process saw a 19% correction. Rekt Capital commented on the matter:

“But let’s say the pre-halving peak is coming quite soon. A 19% retracement, essentially mimicking the 2020 retracement around the halving event, would take us to the $42,000 level, which is roughly the top of the recent reaccumulation range we’ve emerged from.”

The video also highlighted the idea of a deeper dip with $37,000 and $31,000 as significant base levels based on historical halving behavior. Venturefounder, a contributor to the blockchain analysis platform CryptoQuant, evaluates the possibility of a significant drop in Bitcoin price. According to the analyst, the 50-day moving average serves as a historical reference point:

“Since Bitcoin’s bottom cycle in 2023, every time Bitcoin has risen above 12% of its 50-day moving average, a correction has occurred. Each correction ended below 8-11% of the 50-day moving average.”

The 50-day trend line is currently at the $45,700 level, and Venturefounder added that this level is the dollar cost averaging (DCA) price for investors in spot Bitcoin exchange-traded funds (ETFs) launched last month. However, they acknowledged that the trend line is rising and approaching the spot price, so it could potentially lose its significance if the market continues to move sideways.

Noteworthy Data on the Bitcoin Front

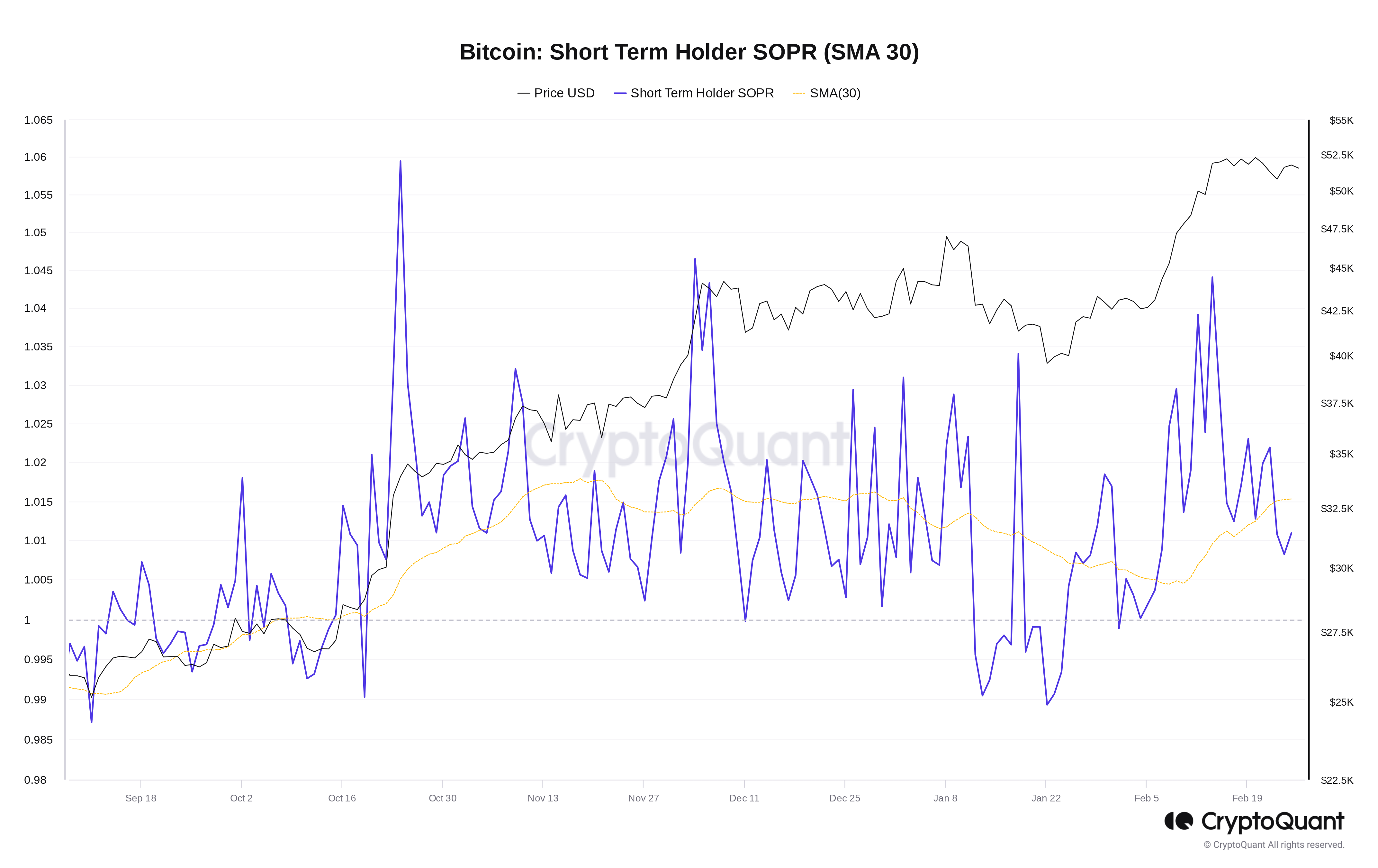

Short-term asset holders (STHs) provide another reason to believe that the Bitcoin price could go down. CryptoQuant contributor CryptoOnChain issued a warning about potential profit-taking in one of the Quicktake market updates on February 25.

Analyzing the Short-Term Holder Profit Ratio (SOPR) data, CryptoOnChain concluded that conditions for the dispersal of speculators in the market could soon be right. The SOPR measures how much short-term investors, who have held Bitcoin for 155 days or less, are in profit compared to their purchase prices.

The data’s 30-day moving average reaching local peaks coincided with retracements in Bitcoin prices. CryptoOnChain now argues that Bitcoin is approaching the sell zone for short-term investors and stated:

“Examination of the technical chart also confirms this. Bitcoin is located in the area below the technical chart resistance. It seems Bitcoin could fall to the $48,000 region.”