BlackRock is back on stage, and as institutional investors’ interest in cryptocurrencies increases, the price of BTC continues to reach new peaks. This month, Bitcoin has repeatedly hit new highs, climbing to $54,910 in the last 24 hours and pushing its 2024 peak higher. So, what’s the latest on spot Bitcoin ETFs?

Spot Bitcoin ETF

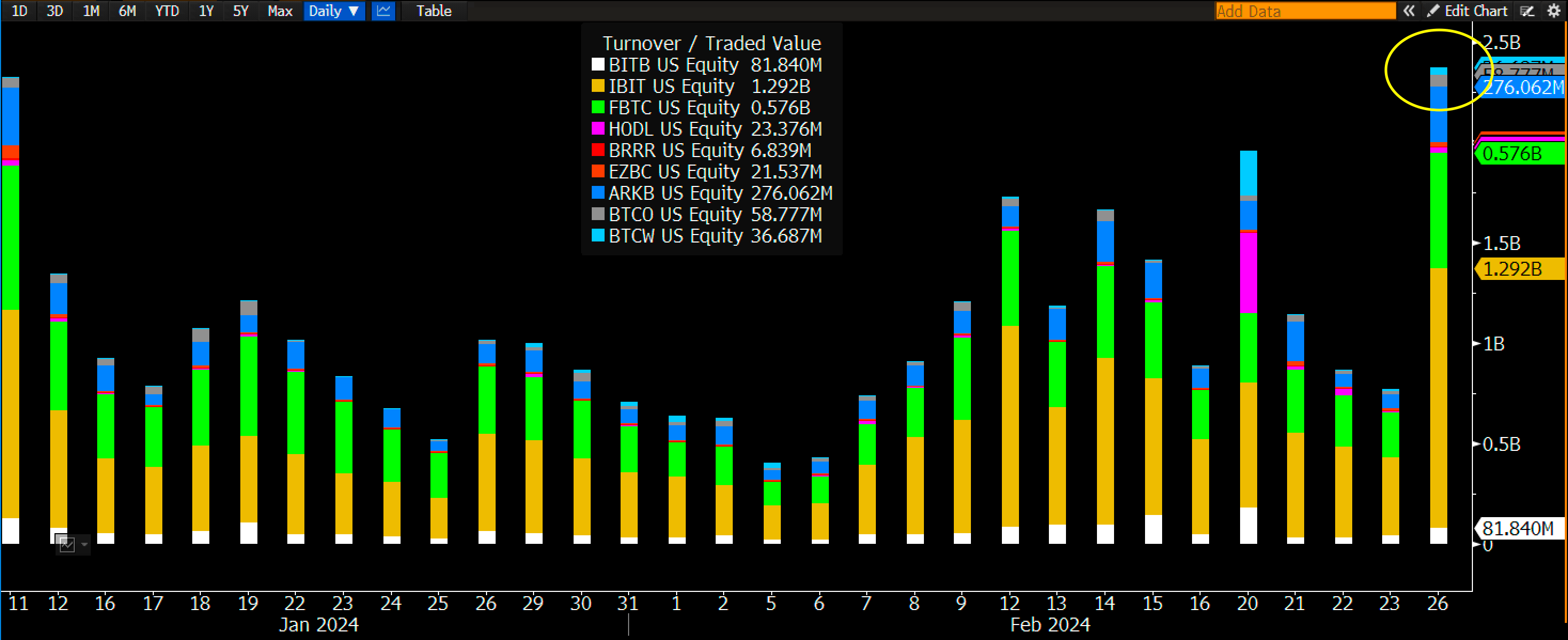

Bloomberg ETF analyst Eric Balchunas recently shared the exciting news of February 26 with his followers. Spot Bitcoin ETFs finally broke the volume record set on January 11, and the price of Bitcoin surged to the $55,000 mark after a long break, fueled by the excitement.

The previous volume record of $2.2 billion was surpassed. Even though the volume data for January 11 and February 26 did not include entries from GBTC, yesterday’s volume came during a period dominated by entries, which could lead to extra positive outcomes.

BlackRock‘s ETF, trading under the ticker IBIT, reached a volume of $1.29 billion on February 26, surpassing its own record by 30%. Fidelity’s FBTC saw over half a billion dollars, reaching $576 million and taking second place.

ARK 21Shares (ARKB) and Bitwise (BITB) saw volumes of $276 million and $81 million, respectively. In terms of reserve size, including GBTC in the list, IBIT and FBTC continue to lead the race. Although they appear competitive in terms of transaction fees, it’s understandable that other issuers don’t have enough ready customers to compete with these two major asset management firms.

Crypto Market Rally

While Balchunas said that the volume excitement for the first day of the week was reasonable, he emphasized that there was no definite explanation. This week we will see significant developments on the macro front, and it wouldn’t be surprising if the anxiety of the coming days is reflected in the price. Bloomberg ETF analyst James Seyffart mentioned that February 26 was the second-largest trading day recorded, with $3.2 billion, including flows from Grayscale’s Bitcoin ETF.

BlackRock’s ETF volume was among the most talked-about topics in the last 24 hours. Balchunas mentioned that IBIT reached the 11th spot in terms of volume among all ETFs.

“A crazy number for a novice ETF (especially one with ten competitors). A billion dollars a day is a significant volume, sufficient for (even large) institutional valuation.”

Türkçe

Türkçe Español

Español