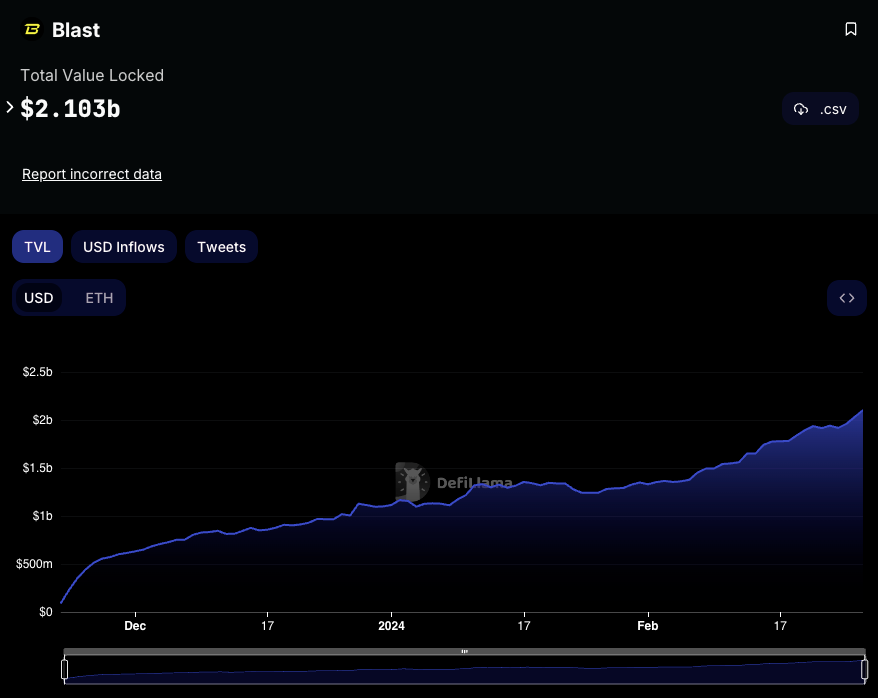

Ethereum Layer-2 network Blast has surpassed a total value locked (TVL) of $2.1 billion just days before its planned mainnet launch at the end of this month. According to data from Blockchain data analytics platform DefiLlama, Blast’s TVL is currently at $2.1 billion, representing an increase of over 2,200% since the bridge protocol was first released on November 22nd.

Interest from Airdrop Hunters Continues

The majority of the locked value comes from hopeful airdrop hunters who are locking their Ethereum assets into the protocol in anticipation of a future airdrop event for Blast tokens, which the protocol team mentioned would happen in May.

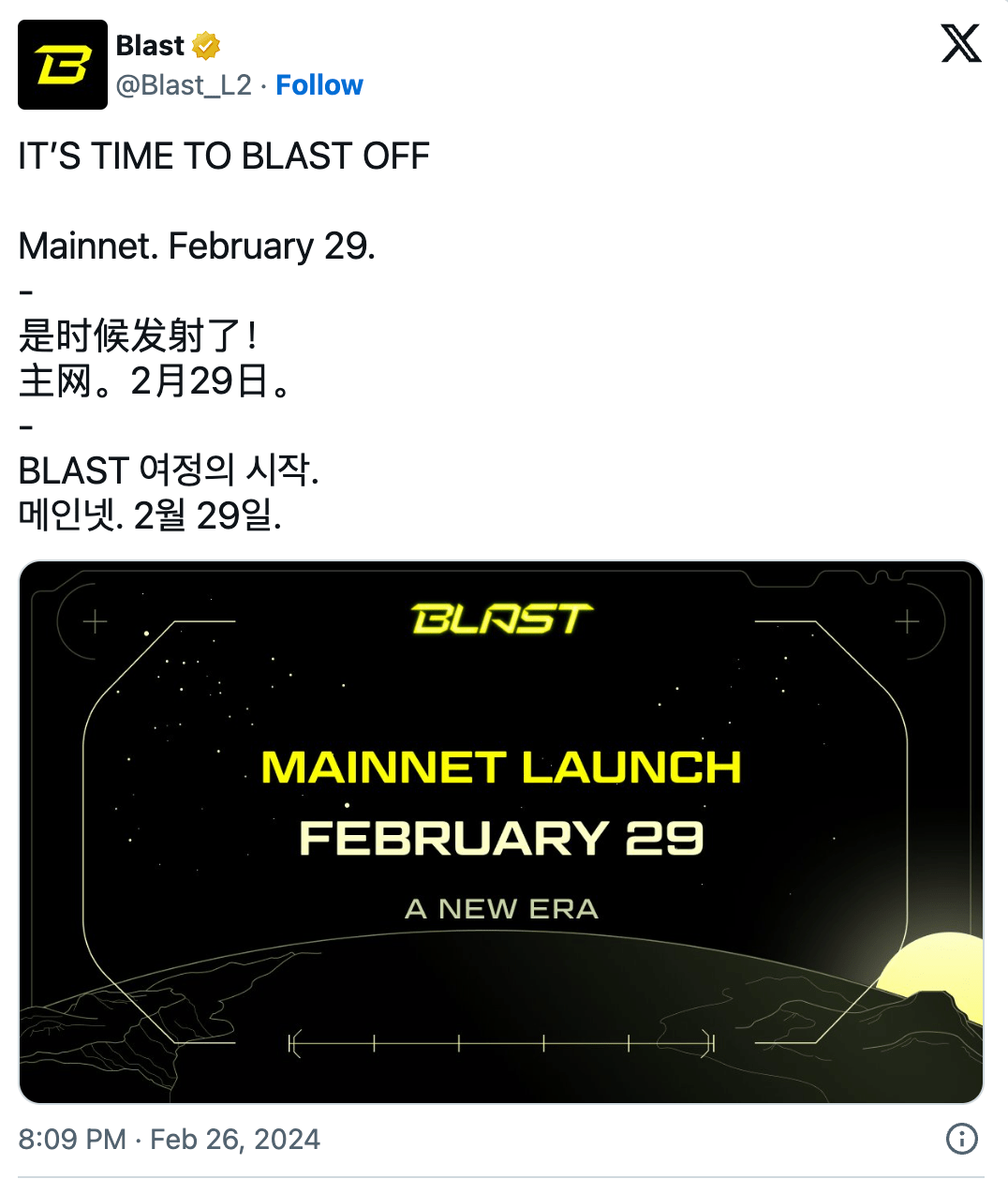

However, discussions about the launch of the Blast protocol have been a hot topic in the crypto community for a long time because once funds are locked on the platform, users will not be able to withdraw these assets until the mainnet launch.

In November, Dan Robinson, the head of research at crypto venture capital firm Paradigm, stated that Blast’s launch crossed lines in both messaging and practice, as the delayed launch could set a bad precedent for future developers.

Concerns Over Blast Continue

Blast protocol once again sparked controversy with allegations of conducting a rug-pull scam in a protocol called Risk on Blast on February 26th. The GambleFi project had collected 420 Ethereum worth $1.35 million for a presale token called RISK, which started on February 22nd and ended the next day.

Since then, the team has moved the funds to the off-exchange crypto exchange ChangeNOW in the form of the stablecoin Dai and continued to delete related social media accounts. The Blast protocol, which was launched in mid-November, stands out as a scaling solution for the Ethereum network and offers native returns in Ethereum and stablecoin to users who deposit their funds into the protocol.

It is noteworthy that Blast’s founder, known by the pseudonym PacMan, Tieshun Roquerre, is also the founder of the NFT platform Blur. Roquerre defended Blast against criticisms of too-good-to-be-true returns in a letter sent to X on November 23rd, claiming that Blast’s returns were generated by Lido and MakerDAO.

Blast closed a $20 million seed round led by Paradigm and Standard Crypto on the days before its launch.